In the first half of the year we had a bond tantrum without the taper and central bankers cooled the situation announcing they won’t cut asset purchases before it becomes clear beyond reasonable doubt that economic recovery is under way. US PMIs have peaked in March and have been falling ever since (but are firmly above the 50.0 handle). However, central banks have turned hawkish. What was the trigger and what can we expect in the coming weeks? Find out in this brief research piece.

Last week Oystein Olsen, the Norges Bank governor, decided that it’s the right time to start raising interest rates, making Norway the first advanced economy turning hawkish in order to curb price pressures. Apart from Norway four more countries raised interest rates last week: Brazil, Hungary, Pakistan and Paraguay, and the timing is no coincidence. On Wednesday’s FOMC Jerome Powell delivered the most explicit tapering announcement up to date. By now it’s quite clear that the move would be announced in November and executed before the turn of the year, probably at a rate of 15bn USD cuts per FOMC meeting. This would bring an end to FED’s asset purchase program by the middle of the next year.

But what has caused the recent change in FED’s mindset from “price rises are temporary, let’s focus on the unemployment” to “OK, this is not going away, we need to do something”? What was the trigger? Until at least middle of the year median FOMC voter was sceptical about the persistence of inflation, thinking that it would probably be washed away once the supply bottlenecks are cleared. Chip shortage slowed down car production, shipping costs have risen five-fold since early 2019, LNG demand was already pointing in a way of global natural gas shortage… But all of this was merely reason for concern requiring just monitoring instead of red alert requiring action. In early summer it became apparent that price increases started to feed into wage expectations, which was a tipping point. Fears of inflation started to drive prices higher, the tail was wagging the dog.

At this point in time, Powell and the company figured out it was time to act. And acted they have. Sort of.

The most recent dot plot forecasts about one rate hike in 2022 and three rate hikes in 2023. The dots have mostly been used to push Powell’s hand on ending asset purchases as soon as possible. Also, rate hikes in the future were probably a signal to the market: we have situation under control, we won’t let this get out of hand, so stop expecting ridiculously high inflation rates in the future. We will have to wait and see whether these actions had any impact on average consumer, but the material effect of FED tapering their asset purchases would clearly be felt on the housing market later in 2022.

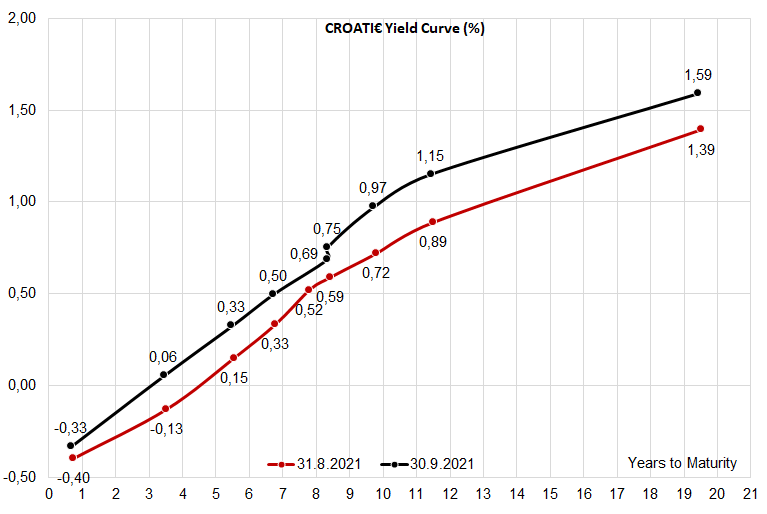

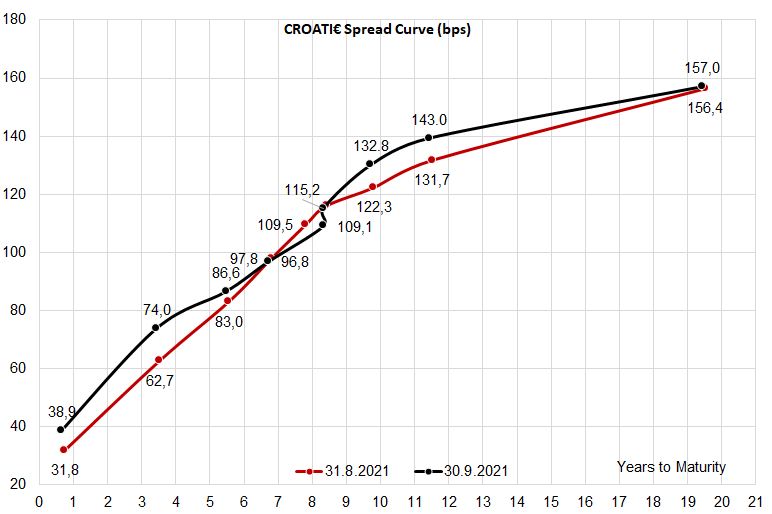

Monetary policy actions in Washington are not the only reason why bond prices fell in recent days. Looking at CROATI€ and taking a bit of the longer view (monthly changes, for instance), it becomes apparent that most of the higher yields came from higher benchmark rates. For instance, yield to maturity on CROATI 1.125 03/04/2033 went from 0.89% (red line) to 1.15% (black line), i.e. up by +26bps, however the spread chart reveals that only about +11bps came from spread widening.

The bond correction has been going for about a month since rising commodity prices (oil and natural gas being the most prominent) spelled higher inflation expectations around the globe. Rising natural gas prices are a different story: just last week Jennifer Granholm, US energy secretary, warned about possible natural gas price manipulations in Europe without explicitly mentioning Gazprom, which accounts for about 40% of European gas supply through long term contracts. Gazprom fulfilled these contracts, but restricted top-up sales and let European storages be depleted. Thanks to warmer temperatures and higher electricity production from wind turbines in the UK, the storages have once again started to note increases, but the shortage is still far from being over. Some analysts point out in the direction of Nordstream 2, which has been completed, but not yet allowed to be used since it’s awaiting a nod from Germany and the European Commission.

Why hasn’t Germany yet put Nordstream 2 in good use? Because it’s a big political decision and it’s still not completely clear in which arrangement would Olaf Scholz (SPD) become the new German chancellor. Nordstream 2 is a contentious issue has been sanctioned by the US government – naturally it takes a guy at the top of German/EU administration to make a decision that conflicts with US interests. We’re waiting for that guy at the top. Meanwhile, before the decision is made, Russian Gazprom might continue to stretch it’s muscles and put a lid on gas supply in order to force the opening of Nordstream 2. That means the pressure on natural gas prices might continue in the coming weeks.