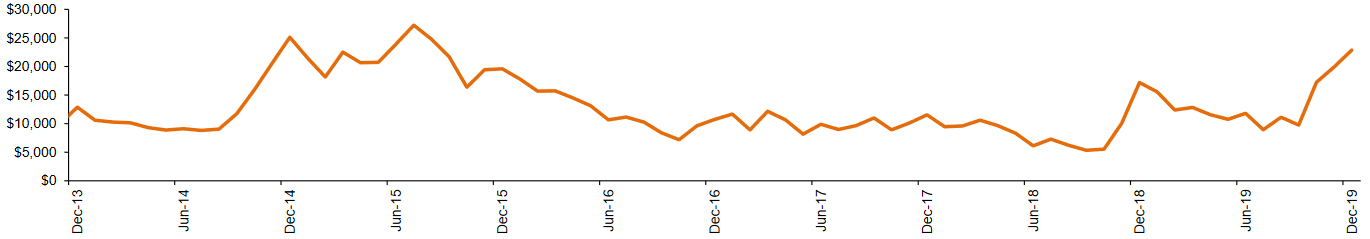

Last year we anticipated that the MR tanker charter rates are likely to increase during the year on the back of changing regulatory requirements and the decreasing number of vessels due to scraping and low orderbooks. Now it is time to look back and see how much did charter rates grow during 2019 and if we can expect additional growth in rates during 2020.

Now things seem to be going in that direction with some additional support by other factors. During 2019 we witnessed an increase in the average daily rates of MR tankers with higher spot TCE rates in every month in 2019 relative to 2018 levels.

MR Avg Earnings (USD/Day): Dec 2013-2019

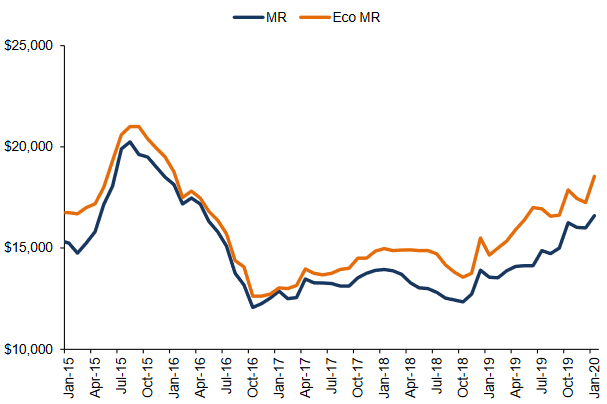

One should also add that one year time charter rates have increased significantly over the last two years and are now approaching 2015 levels.

MR One Year TC Rates (USD/Day)

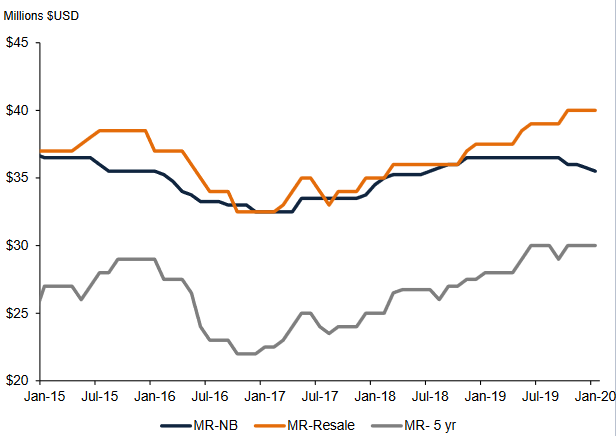

Asset Value

When turning our attention, the value of vessels, increasing spot market and time charter rates continue to drive asset values for vessels on the water. In 2019 resale vessel values have exceeded newbuilding values, reflecting positive future expectations for products market. In addition, uncertainty about future IMO regulations and propulsions systems has constrained some appetite for newbuildings. Considering the record low product tanker orderbook this seems as a backbone for future rate growth.

MR Asset Value

IMO 2020

An important factor to consider in the upcoming period for the product tanker market is the introduction of the IMO 2020. The IMO 2020 is a regulatory requirement set by the International Maritime Organisation which mandates ships to emit less sulphur dioxide by only using fuel oil with less than 0.5% sulphur content (vs 3.5% currently). Note that the regulation was initially introduced back in 2016, however its implementation was postponed.

In order to reduce the sulphur content to the required amount, shipowners will have to decide between:

- Installing a scrubber to enable the vessel to burn HSFO

- Paying the premium to consume compliant fuels with a sulphur content <0.5% (MGO and LSFO Blends)

- Use LNG as bunker fuel

Among the options which are available, the installation of a scrubber is the least expensive one. Moreover, scrubbers’ favour larger vessels that consume more fuel and have trading patterns consisting of more time at sea.

The new regulation is expected to have a positive effect on the tanker market, as one could expect an increase in crude tanker trade due to increased refinery utilization and throughput in order to produce more low-sulphur fuels. Furthermore, it could lead to an increase in clean tanker trade due to the increased production of low-sulphur fuel and the need to deliver these fuels to global bunker markets. Finally, it would lead to a higher floating storage demand for both clean products (building inventories of low-sulphur fuel prior to 2020) and dirty products (a need to store excess fuel oil post-2020).

Record Low Product Tanker Orderbook as a % of Fleet

Orderbooks continued to decrease, therefore one can expect a further reduction in the number of available vessels as current orderbook is at lowest levels since March 2000, measuring 6.8% of existing fleet on water. Note that this is significantly below longer term five and ten year averages of 13.9% and 17%, respectively. Furthermore, only 33 product tankers have been ordered to date this year compared to an average of 133 since 2000, making it the third lowest year for newbuilding orders.

Product Tanker Newbuilding Orders

Danger Signs

However, despite all the positive fundamentals concerning the MR tanker market, one should also highlight some dangers. At the end of 2019 we witnessed how easily it is to disturb some key drivers of oil prices. As a reminder, Saudi Arabia has reduced their product exports since the September 2019 attacks on the country’s oil infrastructure. Meanwhile, warmer weather recorded this winter has reduced seasonally strong winter distillate heating oil demand. Furthermore, although there is still uncertainty about the depth and duration of the coronavirus, but if not resolved quickly could have substantial implications on global economic activity.