In 2020, the product tanker market experienced its most extreme period of volatility in many years. During the first half, MR charter rates rose to record highs, only to plummet to new lows in the second half as the pandemic impacted oil demand and cargo volumes. Since TNG will publish their FY 2020 result in the upcoming week, we decided to take a closer look at where the MR tanker market stands now and what can we expect out of it in the future.

2020 was a volatile year for most industries as the COIVD-19 pandemic turned even well thought out and tested business models upside down. The same goes for the tanker market, as well. While MR tanker rates have experienced a significant boost in Q2 2020 when oil prices plummeted resulting in a surge in demand for MR tanker which were used as floating storages, the situation in the following quarters has changed dramatically. Namely, lower demand for floating storage, coupled with the collapse in European oil demand as a result of the COVID-19 pandemic has reduced the demand for MR tanker.

This can be noticed when observing the movement of the Baltic Clean Tanker Index, which tracks rates transportation rates for petroleum products.

Baltic Exchange Clean Tanker Index

What to expect in the future ?

Well, the first half of 2021 does not look promising as the Covid-19 pandemic remains a worldwide problem. However, a recovery in travel and economic activity, coupled with promising fundamentals which we discus in more detail below indicate that the medium term outlook for tankers remains positive.

Newbuilding Orders

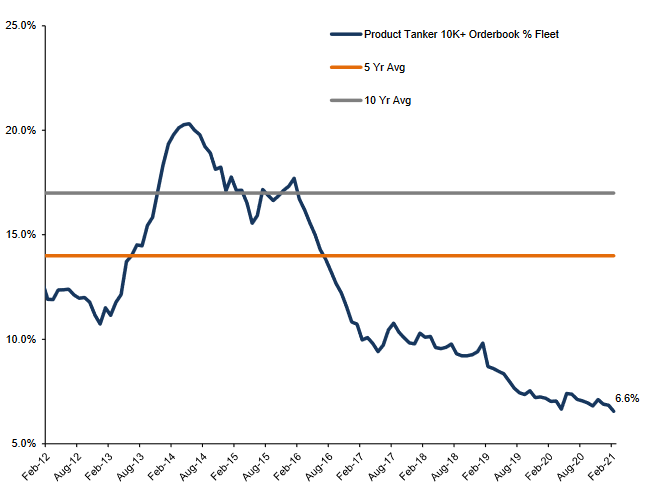

Orderbooks remain low which might lead to a further reduction in the number of available vessels as current orderbook as % of fleet is near historical lows, measuring 6.6% of existing fleet on water. Note that this is significantly below longer term five and ten year averages as visible from the chart below.

Orderbook as % of Fleet

Source: Scorpio Tankers, InterCapital Research

Adding to this the fact that a significant percentage of the fleet is turning 15 years and older marks a positive sign for future rate development. Namely, certain key customers will only employ product tankers that are 15 years old or younger. This limits trading opportunities for older tonnage and creates a two-tiered market where owners consider continuing to carry refined products, switching from products to crude, vessel conversion, storage, and scrapping. There are currently 652 product tanker vessels that are 15 to 19 years old and an additional 957 vessels turning 15 over the next five years. With only 174 product tanker vessels on order and the potential for new environmental regulation the active product tanker fleet could experience a continued reduction in supply.

Fleet Age Profile Today

Furthermore, according to IEA, global oil demand is expected to increase by 8% YoY in 2021, even reaching pre-COVID levels in late 2021. Afterwards a growth of 0.85% per annum is expected until 2030. Meanwhile global refining throughput is also expected to increase by 6% YoY this year, boosting cargo volumes.

Tonne-mile demand should remain supported by the ongoing trend of refinery dislocation as smaller refineries give way to new mega-scale export-oriented refineries. Namely, 1.9m barrels per day of refinery capacity closed in 2020 (in Europe, Americas, Japan, Philippines and Australia) while 5.8m barrels per day of new capacity is coming online between end 2020 and 2024 in Middle East and China, according to Ardmore.

Finally, as we look at the favourable fundamentals which have been in play for several year now, we must not forget the challenges and hardships the ongoing pandemic presents. Thus, we will keep a close eye on the vaccination process and potential loosening of epidemiological measure imposed worldwide.