Since the start of the year, commodities have had a great performance. Precious metals, industrial metals, and oil are the ones in focus as they are current market leaders due to structural changes in energy markets and growing demand for gold and silver in portfolios and central bank reserves accompanied by a positive economic outlook for 2024 and 2025.

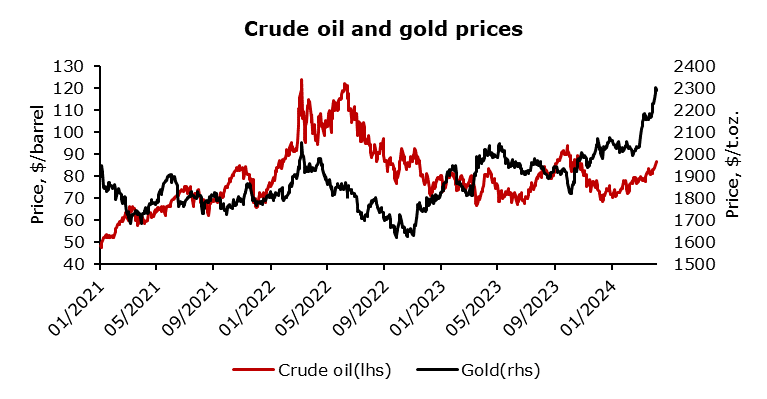

Over the past three months, oil rallied by 21.5%, gold by 10% and copper by 8.2%. Significant price appreciation is fueled by a stable macroeconomic situation without previously expected harsh consequences for the economy caused by tight monetary policy. Currently, recession fears have faded as forward-looking indicators point to a better economic situation in the near future. Recovery may be accompanied by inflation above the target in the US and near-target inflation figures in the Eurozone. Commodity prices reflect the current market expectation of a soft landing with occasional reductions in a number of rate cuts due to a prosperous economy. Additionally, fears of escalation of conflicts in Ukraine and the Middle East propped up prices of oil and precious metals even more as Iran threatened Israel with retaliation. Another significant contribution is the deepening of the crude oil production cuts by Russia on top of already large production cuts by other OPEC members. Precious metals face renewed demand from central banks in combination with long-term underinvestment in production leading to skyrocketing prices. Industrial metals had a great week, copper rose by 4.5%, aluminum by 4.5%, lead by 6.4% and zinc by 8.1%. Most likely due to a more positive manufacturing outlook for the UK and the US.

However, natural gas that is pinned to very low prices due to oversupply as Biden restricted the building of new LNG terminals and extra production due to upscaling of the oil production which results in extra produced gas. Also, corn and wheat are returning to levels seen before the conflict in Ukraine. Although food inflation figures slowed worldwide, cocoa is the only food commodity that went significantly up in the past few months.

Some economists predict that the economy is at a turning point and should improve as of now. If that scenario comes true, commodities should continue their rise even though central bank interest rates remain unchanged or slightly lower than current ones. Hard landing seems far-fetched given the GDP growth in the US and the stable economy in Europe and the UK.

In conclusion, the commodity market has experienced a significant uptrend since the beginning of the year, driven by various factors including stable macroeconomic conditions, geopolitical tensions, and increased demand. While certain commodities such as oil, gold, and industrial metals have surged in value, others like natural gas and agricultural products face challenges such as oversupply and geopolitical shifts. Looking ahead, the market seems poised for continued growth, particularly with a positive economic outlook and ongoing demand dynamics. However, vigilance is required to navigate potential risks such as inflationary pressures and geopolitical uncertainties.