It was a busy week, even if you effectively worked for three days because of the holidays. European sovereigns placed a total of about 27bn EUR of new paper this week, and SPGB 3.55 10/31/2033€ was about half of that sum (13bn EUR). Notice that this figure does not include BTP Valore retail bond because the auction is still open today. In this deluge of sovereign paper, domestic investors are primarily preoccupied with the new CROATI 4 06/14/2035€. What do we make of it? Read out in this brief research piece.

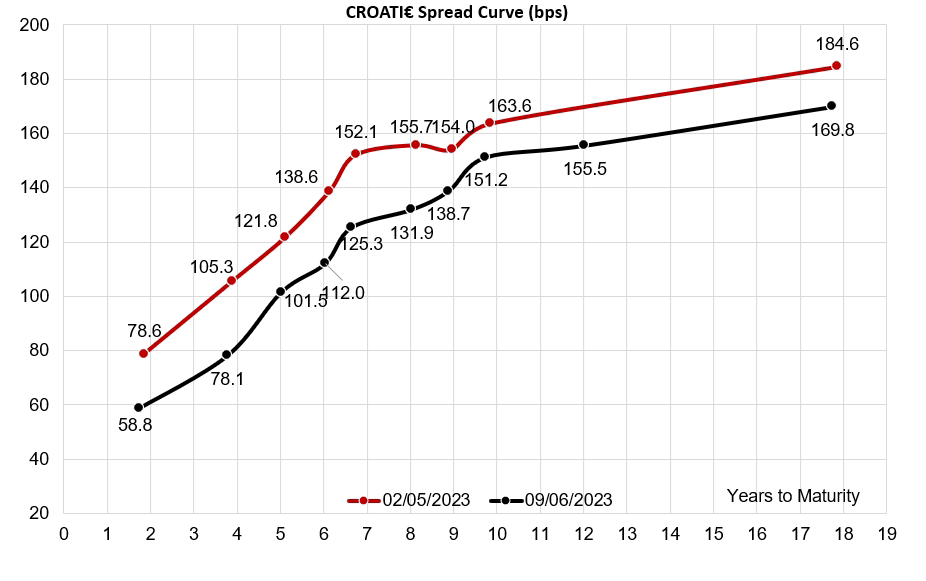

After a long wait that began in early April, Croatia finally tapped the international market with a 1.5bn EUR placement of CROATI 4 06/14/2035€ at 4.047% YTM (99.56 reoffer, MS+105bps, DBR 0 05/15/2035€ + 156.7bps). Early morning IPTs came about MS+135bps, but as morning turned into noon and afternoon the book size grew to about 5.75bn EUR and the leads decided to tighten the spread to about MS+115bps. A few hours later the book size exceeded 7bn EUR and the spread tightened to afore mentioned MS+105bps. It’s debatable whether this offered any NIP at all, but most of the asset managers agreed that it did give them a few extra basis points above the existing curve. However, a few basis points was not what some investors have penciled in and left some of the EM asset managers disappointed, causing them to cut their orders. Final book ended at 6.4bn EUR and the Ministry of Finance later said that it contained 200+ individual interests from the highest quality investors.

The pricing of the paper was a really tricky task according to leads because the country is considered as EM by the existing pool of investors, however, Croatia tries to position itself as a euro area core country. To get a feeling of the market, LITHUN 2.125 10/22/2035€ (Croatian core proxy) was bid at MS+85bps, while POLAND 4.45 02/02/2035€ (Croatian EM proxy) were bid at roughly MS+130bps. So to sum up the pricing process: the leads set up IPTs at levels of Poland and tried to get as close to Lithuania as possible without breaking the orderbook. MS+105bps means 20bps above Lithuania and 25bps below Poland – kind of halfway between the two. Late in the afternoon, we got the feeling that it was a “cheap core and really expensive EM”. We agreed.

Pro-rata allocations were supposed to be 24% of the orders, but there was a strong skew towards the asset managers who got anything in the range of 50%-60% of orders. Later in the afternoon, the paper was traded at -25/-5, meaning that some of the AMs that felt themselves under-allocated had the opportunity to buy more.

Since Thursday was a bank holiday in Croatia, this is where the story gets dark and let’s say a couple of words about the June 08th trading session. The story actually starts on Wednesday afternoon when the Bank of Canada surprised the markets with an emergency rate hike. This was not in the cards since only one in five analysts expected it, but not a totally unexpected move either since the decision followed a similar one delivered by RBA a couple of days earlier. Since all loonie gains were ephemeral, the only reasonable explanation was that the decision recalculated the odds of a US July rate hike, which was true according to the WIRP function (at that time). However, yesterday afternoon initial jobless claims came much stronger than expected (261k vs. 235k consensus) causing the core rates to catch a bid all over again. Personally, we think the reading is fuzzy because continuing claims dropped to 1.757mm (the lowest reading since February), but rates interpreted the reading as bullish for bonds.

Source: Bloomberg

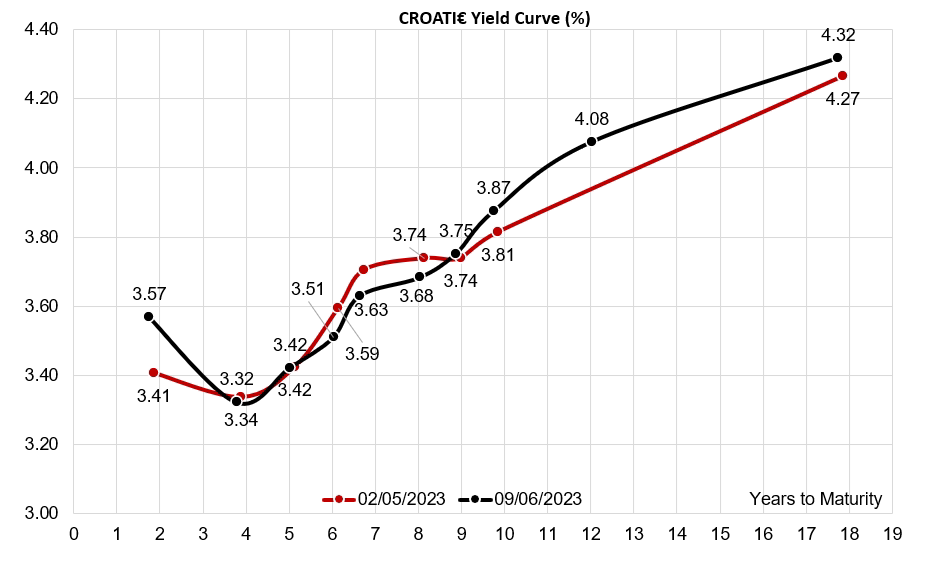

So where does all that leave us this morning? DBR 0 05/15/2035€ is traded at 74.42/74.57 versus 74.65 bis at the time of CROATI 4 06/14/2035€ pricing – in simple English, the benchmark is 23 cents down in terms of price. The first real reading of CROATI 4 06/14/2035€ this morning was 99.20/99.45 in 500k/1.25mm, meaning that it’s down 36 cents compared to the reoffer – however, as one of the traders pointed out, it’s still early morning and this could be caused by slightly wider bid-ask spreads. We believe that the paper should be traded in a quite narrow spread to Germany in the following days because of the potential switching interests coming from some local clients. When you take a look at the yield curve, it makes a lot of sense to switch away from CROATI 2.875 04/22/2032€ at 3.75% YTM (B+138.7bps) to hop into CROATI 4 06/14/2035€ at 4.08% (B+155.5bps), especially if the investors have the balance sheet and the stomach to tolerate duration. Nevertheless, large asset managers are waiting for next week’s central bank meetings – FOMC on June 14th, followed by the ECB on June 15th.

Source: Bloomberg