If we could pick one, but just one line describing the trader’s sentiment over the past few weeks, it would definitely by the verse composed by 2016 Nobel prize laureate for literature: „The highway is for gamblers, better use your senses“. The composers given name is Robert Allen Zimmerman, however he adopted the name of Welsh poet Dylan Thomas so he’s much more famous under the alias Bob Dylan. What more can we expect from the financial highway we call the bond market in the coming weeks? Find out in this brief article.

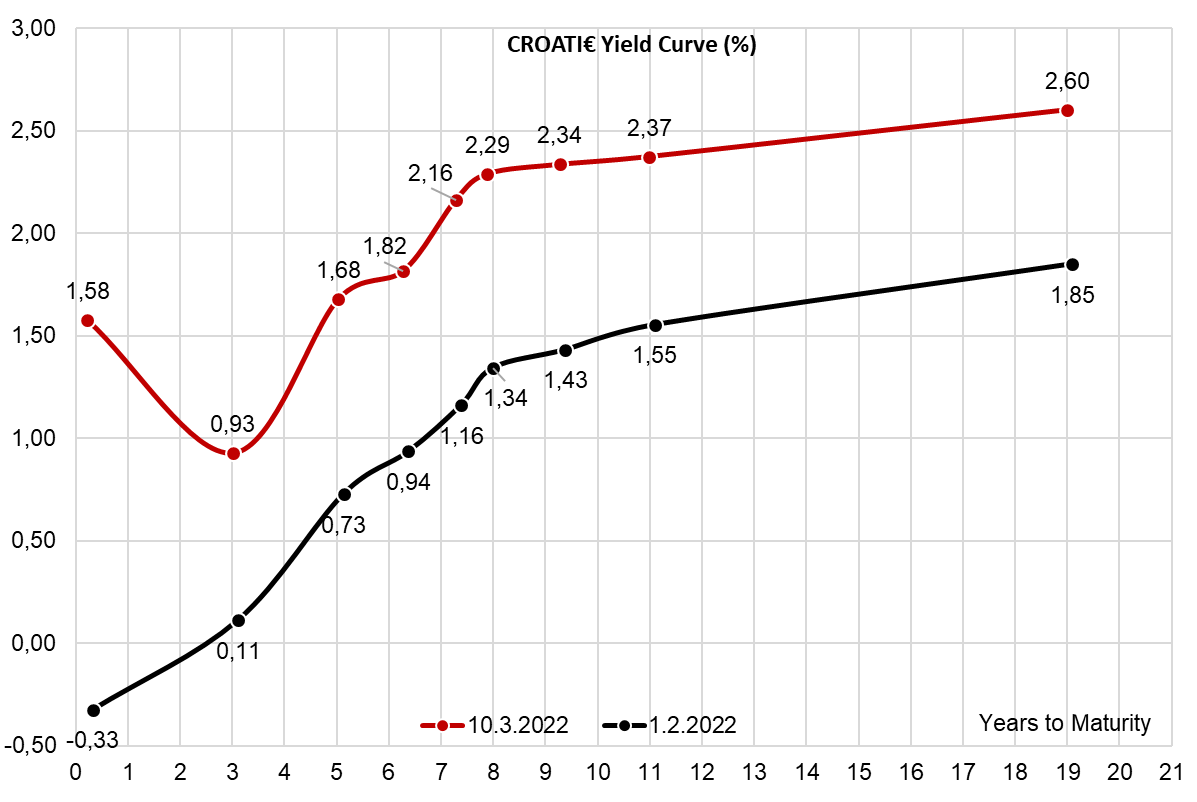

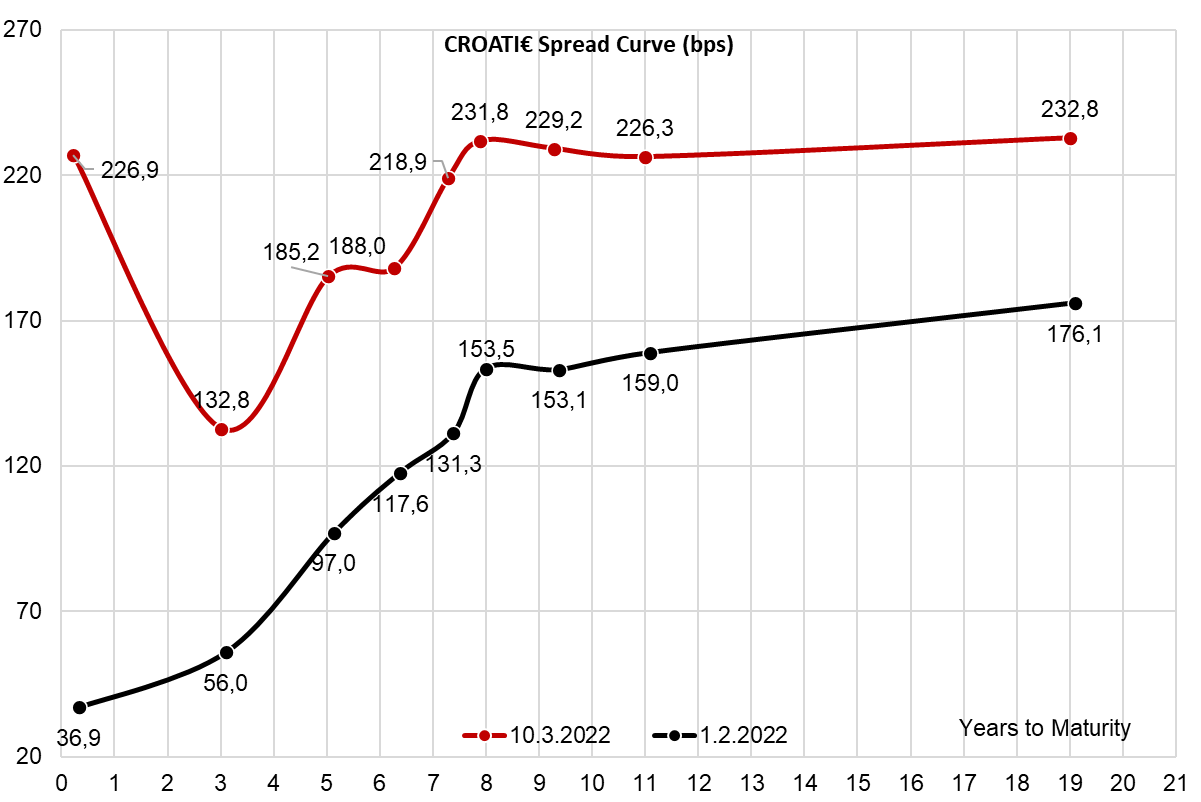

In recent weeks the fixed income market has truly resembled a highway: traders were moving fast and it was quite difficult to turn around and change the direction once you set your mind on taking a particular position. In recent days we have mostly seen offloading (selling) flows on ROMANI belly, however only the most desperate fund managers managed to get execution because the Romanian domestic market was a net seller as well, while Street dealers were left stranded with oversized books and geopolitical events with coin tossing probabilities. CROATI has recently been very well bid, particularly in the long segment, which actually makes sense once you take a look at the second chart submitted below (CROATI€ Spread Curve) and notice that the 7+ year segment is trading in +200bps spread area compared to the German bonds of the equivalent maturity.

What do we expect going forward? From our understanding, Sergei Shoigu masterminded the Russian invasion of Ukraine, but he envisaged a fast fait accompli before Western countries align themselves and impose the hardest sanctions ever on Russia. Shoigu’s plan was shattered in the first 48 hours of the attack when Russian forces failed to swiftly seize the Hostomel airport just outside Kiev. Large Ukrainian cities such as Mariupol and Harkiv have also not been under Russian control and we’re into the second week of invasion, while the Ukrainian air space has been contested and nobody can claim dominance. In this context NATO alliance is pondering how to deliver about two dozen of Polish Mig-29s that are currently grounded in German air base Rammstein. Putin was clear that meddling into affairs could be interpreted as involvement, which could spread the conflict – and to be honest, we don’t believe escalation of this magnitude is possible. Situation on the ground looks as if military conflict is grinding to a standstill, although Russian media reports about significant advances into Ukrainian territory. The deal is, the end to this war is nowhere near sight and sanctions against Russia are really starting to bite: JPM expects a 35% contraction of Russian GDP in second quarter, with 12% YoY FY2022. But there’s more to it than the headline figure. Russian IT experts, mindful of the possibility of introducing general draft if the war doesn’t end up soon, are fleeing the country rapidly and on Monday Georgian economy minister said that as much as 25.000 Russians have arrived in the last couple of days. His Armenian counterpart mentions a 6.000 figure, but please be mindful of the fact that these figures represent reported cross border travels, while the true figure might be even higher.

In the context of war coming to a standstill and Russian economy under external shock that obliterated market capitalizations of bellwethers such as Sberbank and VTB, it’s the right time to ask ourselves what’s going on with diplomatic efforts since in this war obviously everybody is losing. Kuleba and Lavrov, foreign ministers from the two belligerent countries, are supposed to meet today in Turkey, which sounds promising until you remember that their encounter happens on the sidelines of a diplomatic forum and that so far all of the diplomatic efforts came to a halt because of one awkward thing. Nobody, not even the Russian delegation, is really sure which conditions would be acceptable to siloviki from the Kremlin. Ukrainian delegation is ready to decline full NATO membership as long as neighbouring countries would guarantee its territorial integrity. In our view, this might be a red herring since it’s virtually impossible to enforce protection of a country large as Ukraine without some sort of ground presence or air space policing, both of which are unacceptable to the Kremlin.

The unpredictability of Kremlin’s reaction function is what caused the otherwise civilized fixed income markets to become Bob Dylan’s highway for gamblers, but we expect this to change. Today’s ECB’s GC would be closely monitored, with EURIBOR futures market obliterating the probabilities of rate hikes this year. In the light of Perry Mehrling’s book The New Lombard Street we are looking for a potential support for the European bond markets, especially in the context of European Commission activating the fiscal tools it has to speed up the shift to renewables and ramp up investments into defence. More details on that by the end of the week. By the way, if you enjoyed reading Zoltan Pozsar’s brilliant research last few weeks, it might be useful to remember that Perry Mehrling’s insights about the “money view” have often been credited as groundwork for Mr. Pozsar’s insightful views on global money markets. Worth a read!