Friday’s US NFP was a cold shower for the market hooked up on the FED pivot. So now what ?- it looks like we’re back on square one with markets not knowing what lies behind the corner. We beg to differ because hard economic indicators (namely strong labour market and headline inflation barely coming off the tops) offer a glimpse into the future. But for a complete review, you will have to read our article.

Last week a lot of attention has been focused on Nick Timiraos’ (WSJ) piece on the effect recent rate hikes will have on the real economy. The piece was published before FED/ECB rate decisions (Wednesday and Thursday, respectively) and was dealing with the question of how much time does it take for rate hikes to make their way into the real economy. The very essence of the question is this: is the effect of last year’s rate hikes completely factored into the real economy, or do we still have some runway? Because if rate hikes have already done their bang!, then FED/ECB have more heavy lifting to do and short-term rates would need to go somewhat higher, probably after Jackson Hole in August (they would need some coordination with other global levers of monetary power). On the other hand, if the effect is not factored in and some residual effects could be expected in the coming months, then the most sensible thing for central bankers to do is to wait and not get ahead of themselves. With that in mind, take a look at the one-week change in Bloomberg WIRP US function:

Notice that in the past week, short-term US rate expectations for mid-December went up from 4.476% to 4.809% (+33.3bps), which is the main reason why longer rates went higher in the meantime. Borrowing the framework from Nick Timiraos, we could argue that last week markets were expecting that the lags from monetary policy take longer to come into effect, i.e. enough was done, but needs time to take effect. On the other hand, central bank ambiguity delivered last week was offset by a strong NFP report on Friday (+517k, way above the three-month average of +356k). On a similar line, average hourly earnings grew +4.4% YoY in January, just slightly down from 4.8% YoY in December. Rate hikes are either:

a) not working in the magnitude needed to push inflation closer to the 2.0% target, or

b) need more time to work.

Last week markets were unequivocally choosing b). These days they are thinking that a) might be the correct answer and the 33.3bps higher December rate expected today (as calculated by BBG WIRP function) is an indication of this change of heart.

What do we expect going forward? Both FED and the ECB would deliver the hikes they promised by early spring and then probably wait for signs that wage growth is slowing. The wait will probably extend for a few months until Jackson Hole, but after that chances are the central banks might do just a bit more to curb inflation pressures. Markets are slightly coming to terms with the idea that rate hikes are not a done deal, although we might be at the bottom of the seventh or eighth innings (for our European readers, a baseball game has nine innings).

Ok, so the war against inflation started off with the hope that it would be a Blitzkrieg, but instead turned out to be a prolonged conflict, just like another, more messy war in Eastern Europe.

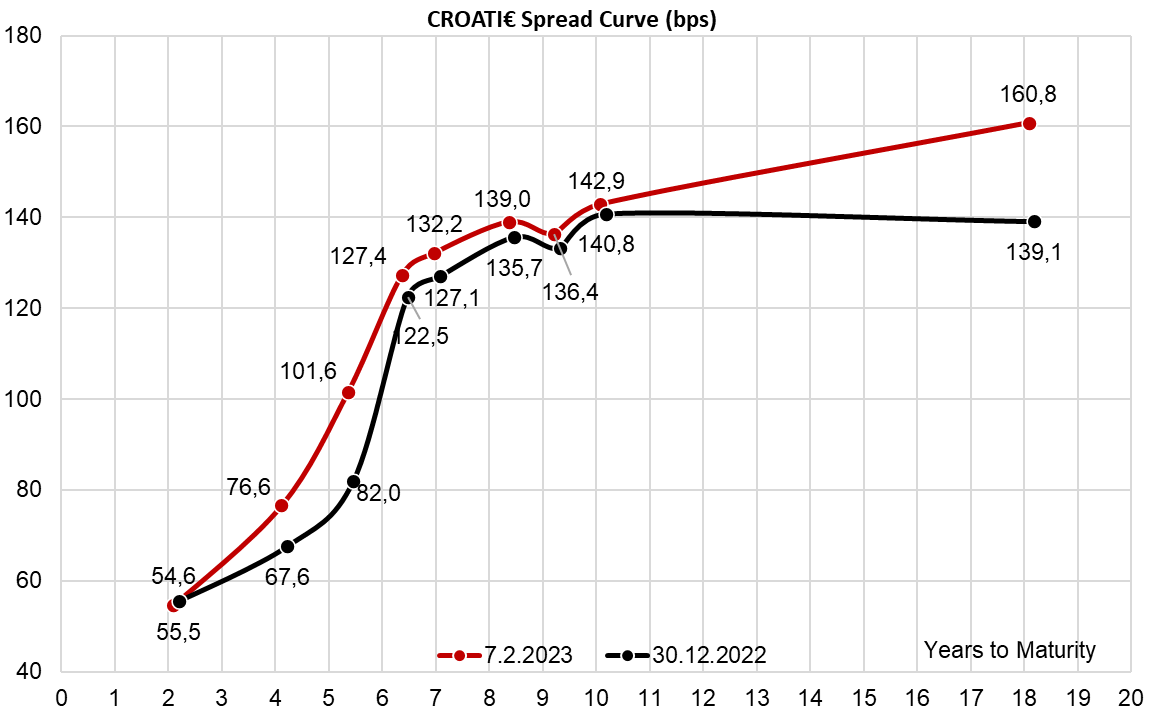

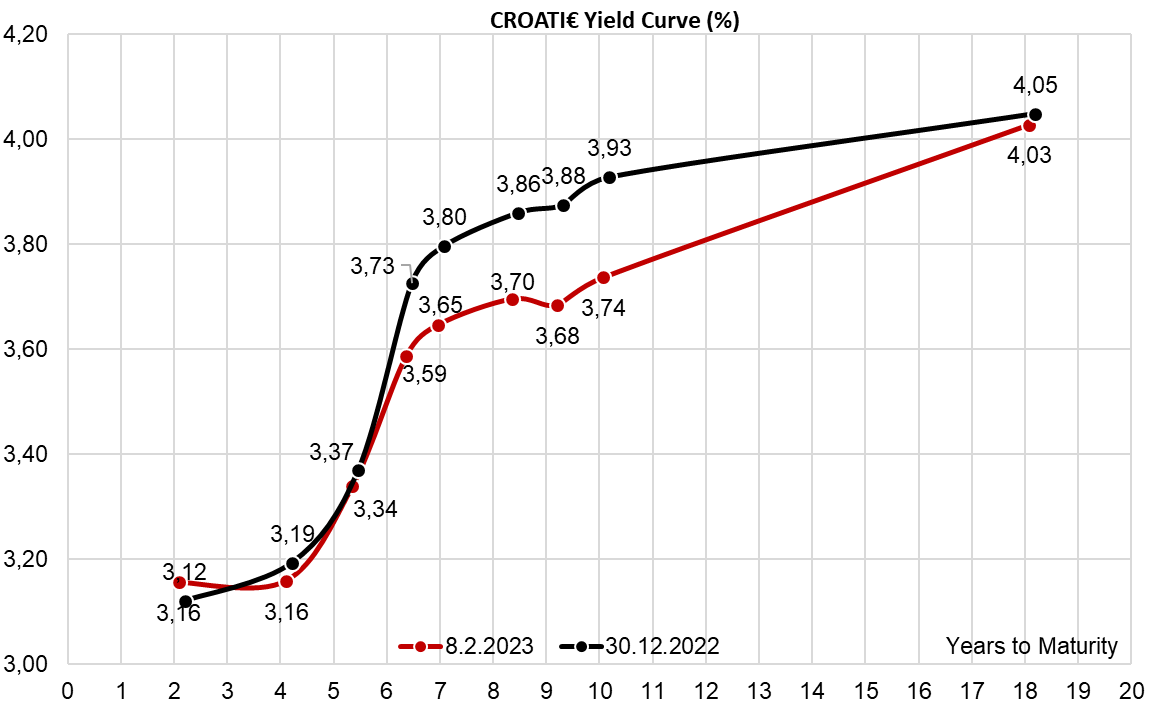

What can we expect going forward? With recent international bond placements from Poland and Macedonia, Croatia is one of the laggards in the CEE region. It’s quite likely that the Ministry of Finance would push for a retail bond, probably by the end of February and after that check the conditions for the international placement. It’s quite likely 1.5bn EUR might be in store, so keep your antennas up for any signal about new international placement. So far, CROATI€ has been trading steady at 120bps-130bps over Germany, a spread so tight that it was detrimental to non-systematic buyers.