Although she’s taken office merely five months ago, Christine Lagarde has done a fabulous job in steering European financial markets through one of the most troubling periods in history. Today she will make one more appearance before the press to clarify the stance of the ECB regarding the deteriorating economic conditions and lack of consensus among European governments in relation to fiscal support. What can we expect from today’s ECB? Find out in this brief article.

Yesterday’s FOMC went by in line with expectations regarding FED fund target range and guidance on asset purchase and rates. Nevertheless, something was a bit different yesterday: Chairman Powell shifted focus on the medium term risks the coronavirus poses on the US economy (medium term is equal to the next twelve months). Nevertheless, the Committee is now patient and will not use additional ammunition to fight the economic slowdown unless the economic situation starts to deteriorate all over again. It’s also worth mentioning that as the worst is behind us, the FED gradually moves away from traditional asset purchase towards a more targeted approach including an alphabet soup of acronyms: CPPF (Comercial Paper Funding Facility), MLF (Municipal Lending Facility), MMMFLF (Money Market Mutual Fund Liquidity Facility), MSLP (Main Street Lending Program), PMCCF (Primary Market Corporate Credit Facility), SMCCF (Secondary Market Corporate Credit Facility) to name a few.

The focus of investors today during the European session will clearly be on ECB Governing Council meeting – as usual, the rate decision will be delivered at 13.45 CET, followed by a more interesting Q&A at 14.30 CET.

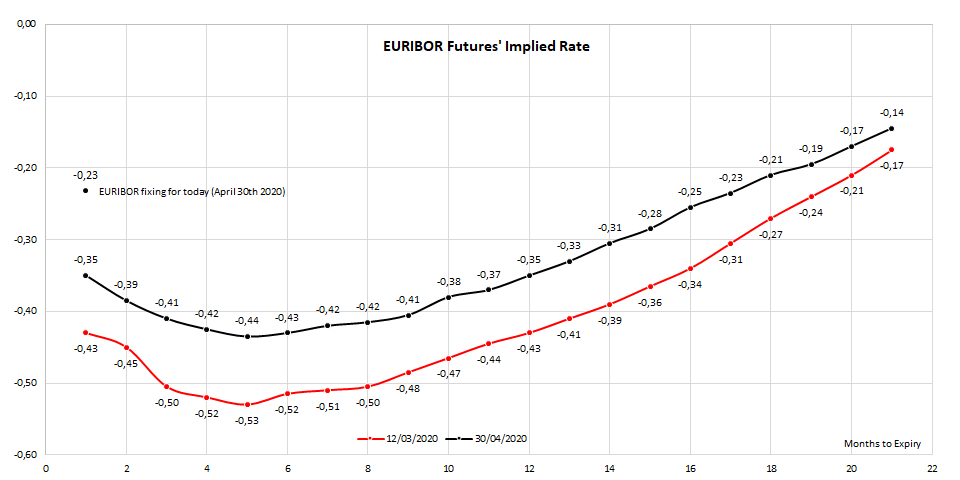

As an ouverture to today’s ECB GC, take a look at the chart submitted above. There is a considerable spread between EURIBOR fixing and the rate implied by the front month futures contract. Notice that the latest EURIBOR fixing stands at -0.232%, while the May futures contract implies a -0.35% rate. Since mid-March EURIBOR rate went much higher as European corporates went to the market to get necessary funding (this claim can be substantiated by the most recent Bank Lending Survey); this move was followed by sovereigns on the bond market a couple of weeks later, adding pressures to the funding costs to go up.

The most recent ECB communication has been highly critical of the inability of European ministers to reach a deal for supranational funding in order to bridge the galloping recession (Mme Lagarde’s exact words were that they did “too little, too late”). Also, ECB reminded of the severity of economic fallout in the block should fiscal support remain weak. In other words, Frankfurt might be putting pressure on the fiscal side to act sooner, than later. Additionally, these messages could also be interpreted in a way that Frankfurt might be ready to pick up the slack if Bruxelles fails to do it.

This is the reason why front month futures are implying a much lower EURIBOR than it is now. Asset managers are hedging themselves against the possible rate cut today (the ERK0 Comdty on BBG contract expires on May 18th, i.e. two days before the following ECB GC meeting). Here’s one more interesting fact: five days ago, front month futures contract was implying a -0.16% EURIBOR rate, while as of this morning this implied rate went all the way down to -0.35%. At the same time the Bund yield went in the same direction, half the magnitude: from -0.40% to about -0.50%. It’s quite likely that high expectations from Mme Lagarde are keeping the rate expectations low and if GC fails to deliver something today, the rates might go higher, pulling long term yields in the same direction.

Is ECB really set do deliver more support today? Well, quite unlikely. This doesn’t mean that ECB wouldn’t deliver more support in the coming months because at this pace the PEPP might run out of space by late summer/early autumn. It’s rather about the timing: ECB already did whatever it took to prevent the periphery spreads from blowing up, while EU ministers are still at the same table trying to hammer out a deal that would satisfy both core and periphery countries’ leaders. Therefor, it’s too early to act right now.