OK, so it’s going to be a triple tranche bond auction, and Croatian Ministry of Finance is looking to place a 20Y HRK paper on the market. What do we make of the current market conditions for this paper? Find out in this brief article.

While global financial markets are closely monitoring Democratic primaries to get a glimpse of what might happen on Super Tuesday (March 03rd), Croatian bond market is bracing for Super Thursday (March 05th) when the Croatian Ministry of Finance pays the principal for H203A (5bio HRK) and H203E (1bio EUR). Since the total principal amounts to 12.5bio HRK, the only natural course of action for the government is to role the debt over into new fixed income paper. The market is already buzzing about the possibility of issuing 20-year HRK paper together with a combination of shorter HRK paper (mostly for banks, i.e. ALM departments) and a tap of November’s H34BA (designed for long term investors such as pension funds and insurance companies). Target size is yet to be determined, but glancing at the structure of current holders of H203A and H203E, we can easily guestimate that focus of most of the investors would be on the longest paper (probably designated as H403A on the stock exchange or RHMF-O-403A in the clearing system).

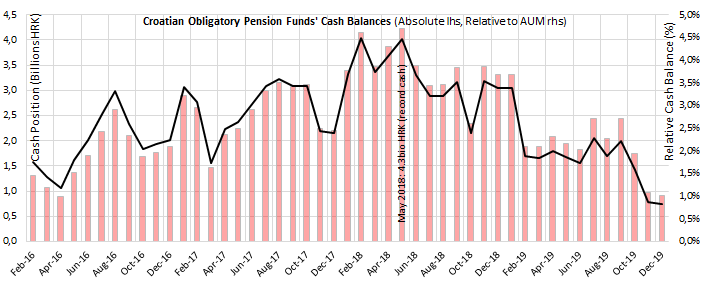

Obligatory pension funds currently hold 3.14bio HRK (62.9% of the notional outstanding) of H203A, as well as 360mio EUR (36% of the notional outstanding) of H203E, at least according to the public data from the central registry. It’s also worth mentioning that these two bonds pay huge coupons (6.75%/6.50%, respectively) since they were issued back in 2010 when interest rates were much higher. Translated in pure cash amounts, the language bond markets are most fluent in, the semi-annual coupon payments would add some 192mio HRK on top of the principal proceeds. Speaking about the cash balance of Croatian obligatory pension funds, it’s worth mentioning that thanks to the November auction (H24BA and H34BA) the cash is thin relatively to historic values (as indicated on the chart below).

A bit of a history lesson: the largest cash balance was recorded at the end of May 2018 when cash balance amounted to 4.3bio HRK (4.47% of AUM); at the end of December pure cash laying on pension funds’ current accounts amounted to merely 921mio HRK (0.82% of AUM).

Should we look worried about that?

Well, not really. As stated before, the obligatory pension funds have huge chunks of the maturing bonds at their disposal to be converted into new, long (and quite likely local currency denominated) paper. Don’t forget that in the last year alone, thanks to rising wages and employment, Croatian obligatory pension funds received some 6.68bio HRK of contribution payments, averaging 556mio HRK per month. Extrapolating this trend into the first two months of the current year would mean that the pension funds’ NAV increased by 1.11bio HRK through contributions alone. Adding all the three figures together (1.11bio HRK of new contributions + 192mio HRK of interest payments + 5.80bio HRK of maturing bonds = 7.1bio HRK) means only one thing: there will be cash to invest.

Reasons for concern might come from insurance companies since some of them are shunning life insurance altogether: it’s a losing business anyway, so why bother with reinvesting the proceeds into lower yielding securities year after year when you don’t make any money on the service anyway? On the other hand, UCITS bond funds might be looking around for a way to extend duration (if they already haven’t) by going long H403A. Yield hunting for them in this rate environment offers only two roads: either you go across the border and into higher yielding paper issued by countries such as Romania and Serbia, or you stay at home and boldly go where no man has gone before, i.e. into 20-year HRK duration.

It’s a bit early to talk about yield-to-maturity on inaugural 20-year maturity, but it’s worth mentioning that the 15Y bond expected to be tapped (EUR-indexed H34BA) currently trades above 99.00, printing 1.75% cap gain compared to reoffer price. On this particular paper clean bid price @ 99.00 yields 1.07% YTM. The yield curve is quite flat on the long end, but since H327A is bid @ 126.00 (1.01% YTM), a rough extrapolation would put the hypothetical 2040 maturity in 1.25%-1.35% range.

It’s quite likely that as the maturity of the existing paper gets closer and closer, new data might emerge about the pending bond auction. In the end, there are two things worth remembering for the pending auction: first of all, by March 11th the Croatian Supreme Court would deliver it’s verdict on the conversion of CHF loans and legality of interest paid on them (the decision might bring about volatility on EURHRK exchange rate); and second, out of the 12.5bio HRK of paper maturing, most of it (7.5bio HRK) is EUR-denominated debt. What will the investors with EUR-denominated H203E do if they want to stay EUR long and they don’t have much assets in the same currency to buy on the domestic market?