“Too risky to deal” is the today’s mantra repeated religiously on the Lombard Street, especially when you ask a Street dealer anything Russia related. To be honest, liquidity is dry on a lot of financial instruments this morning. How did it come to this and what can we expect going forward? Find out in this brief article.

When you came into the office today, you probably noticed that the world looks a bit different than it was earlier, so let’s take it step by step. First of all, we’re entering a fifth consecutive day of full-blown Russian aggression on Ukraine and so far the most visible distress sign is 400k Ukrainian refugees in neighboring countries. So far, Russian army failed in occupying any larger Ukrainian city such as Harkiv or Mariupol, apart from the ones it already had under control (like Donetsk). Russian advances were made on sparsely populated Ukrainian areas but were met with stiff resistance once the more populated areas were reached. During the weekend global financial community was glued to Twitter and Linkedin wallpapers with news about escalating sanctions and countermeasures introduced by a series of Western countries.

So far the most important countermeasures targeting the Russian economy were focused on the Bank of Russia (BoR, i.e. the central bank) and the Russian commercial banks. Let’s go through the details. BoR has about 630bn USD in FX reserves and Credit Suisse analyst Zoltan Pozsar estimates that about 450bn USD are in non-gold financial assets. A more detailed report from BoR’s Foreign Exchange and Gold Asset Management report tells us that about 20% of Russia’s non-gold FX reserves were in USD assets and let’s be clear, these are not US treasury bills. Russia sold off all of its TB holdings back in 2018, so currently, all the USD assets they have are basically FX swaps. These are likely targeted by western sanctions and could be frozen for the time being. On top of that, Pozsar estimates both BoR and Russian private sector (i.e. commercial banks) have deposits in other banks in size of 50bn USD each – these funds are also currently frozen and could not be used. Adding all of this together yields about 200bn USD that are put out of force, which is the bedrock of Mr. Pozsar’s expectation that FED would have to intervene in one way or the other to provide liquidity. Also, pay attention that these are only USD FX reserves and there is a lot more in EUR deposits that would be frozen in a subsequent, but a different set of sanctions introduced by the European Commission.

Norwegian sovereign wealth fund is divesting Russian assets, BP is retreating from Rosneft and just last night news came through the wires that BoR asked Russian market makers not to quote bids on Russian international bonds in order to prevent more cash drain from the central bank. From our understanding, the central bank has been intervening all the way in order to curb FX volatility, albeit the recent 30% plunge in EURRUB might have been a free fall with no intervention from BoR – could be the central bank is saving the last of the ammunition for when it really needs it. At the same time, BoR raised the reference rate to 20% (from 9.5%) in order to make life harder for the short sellers and we’ll just have to see how much effect that really has.

Why is all of this important for us, CEE/SEE fixed income investors? Well, we have listed this chain of events just to see how dire the Russian economic situation really is and that Russian policymakers want the peace agreement really badly. This is what’s going on behind the warmongering rhetoric and it’s no wonder both sides are prepared to enter negotiations on the Ukrainian-Belarussian border, albeit with very low expectations.

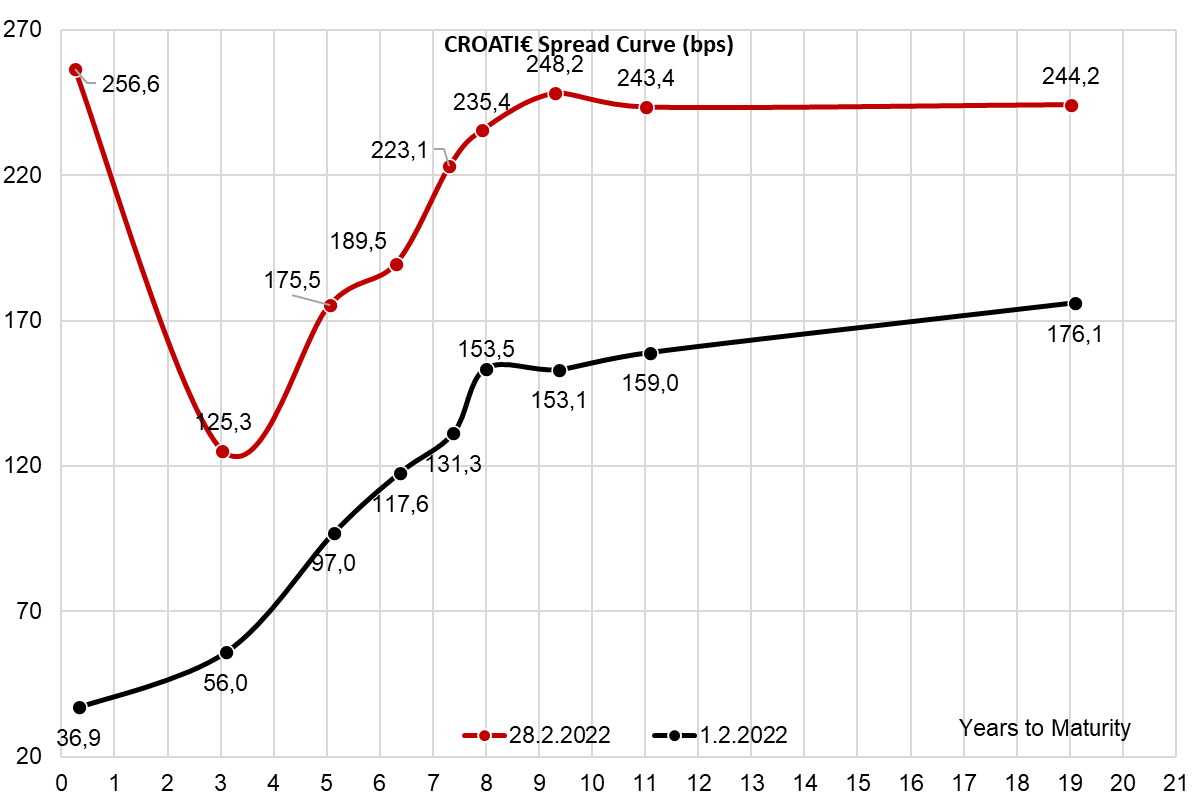

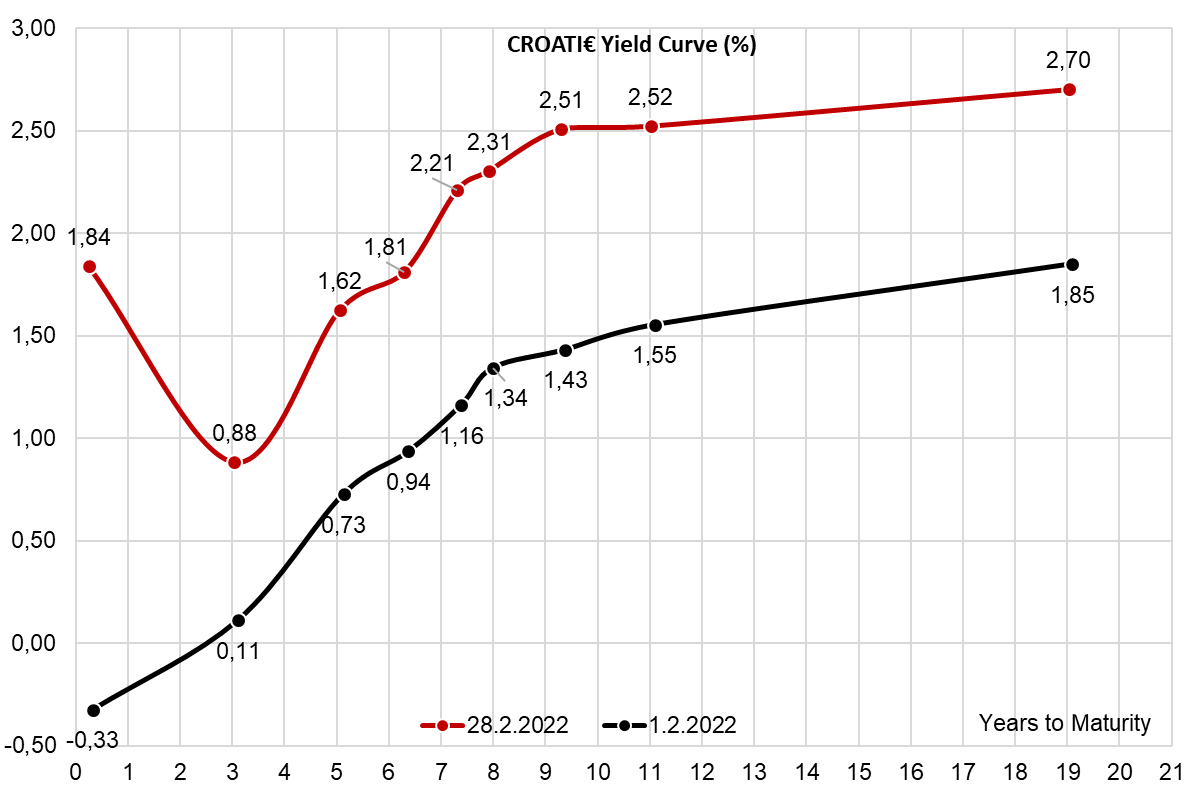

Where does that leave us with Croatian international bonds? Currently, the liquidity is really tight and we don’t see any buyers or sellers at all, obviously because the situation can develop either way. The yield rise/spread widening has been the most pronounced on CROATI 3.875 05/30/2022€, but on the other hand, the paper has a rather short duration and a could of pips in lower price make up a huge difference. We don’t believe you could actually buy a couple of millions of these at 1.84% YTM, meaning that the screen might be a bit misleading. On the other hand, it’s possible to buy plenty of CROATI 3 03/11/2025€ very close to 1.00% and this is exactly where most of the buying flow is concentrated. We have seen some bottom fishing on CROATI 1.5 06/17/2031€ and CROATI 1.125 03/04/2033€, but the sizes were really shy. On Friday afternoon, one false dawn caused a really strong buying spree on Romanian Eurobonds up to 10Y duration and at some point in time, the Street dealers were flat. However, it’s quite clear that in order for that to continue, we need a couple of more good news from the border between Belarus and Ukraine. Fingers crossed that this good news does get to us.