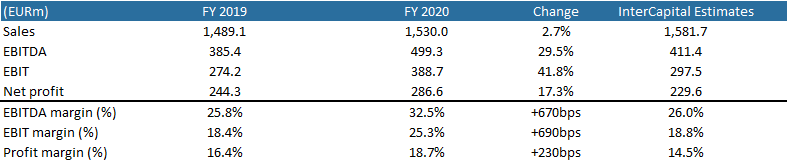

Krka published their preliminary FY 2020 results yesterday, showing a 3% YoY increase in sales, a 30% YoY increase in EBITDA and a net profit of EUR 286.6m (+17% YoY).

In 2020 Krka recorded sales in the amount of EUR 1,530m (+2.7% YoY), representing the company’s best sales result ever. The growth was fuelled not only by growing sales in EUR but also in terms of volume sold.

Krka Key Financials

Source: Krka, InterCapital Research

When breaking down revenue, East Europe remained the largest market, accounting for 33.8% of total sales. Sales in East Europe amounted to EUR 517.2m, representing a 7% YoY increase. The largest individual market, Russia, generated EUR 326.9m in sales, translating to a 5% YoY increase. Meanwhile growth denominated in the Russian rouble totalled 17%.

Region Central Europe, comprising the Visegrad Group and the Baltic states, followed with EUR 341.5m or 22.3% of total Krka Group sales. This represents a 1% YoY growth. Poland, the leading market, generated EUR 163m (+2% YoY) in product sales. Note that sales growth denominated in the złoty reached 5%. Region West Europe recorded EUR 341.1m in sales, almost identical to Region Central Europe. The region also recorded a 1% YoY sales increase. Germany generated the strongest sales amounting to EUR 90.9m (+6% YoY). It was followed by the Scandinavian countries, France, Spain, and Italy. Growth was the highest in Benelux, France, Austria, Italy, Portugal, and Germany. Region South-East Europe posted sales in the amount of EUR 199.4m, representing a 4% YoY increase. Note that this region accounted for 13% of Krka’s total sales. On the flip side Slovenia and Overseas markets were the two regions that recorded a decline in sales. Sales in Slovenia fell by 8% due to lower contribution of health resorts and tourist services, amid measures taken for curbing the COVID-19 pandemic. Meanwhile sales in Overseas markets were down 6% YoY.

EBITDA soared 29.5% YoY, amounting to EUR 499.3m. The sharp increase can be attributed to lower cost of goods sold and lower marketing expenses. Meanwhile EBITDA margin rose to 32.5%, significantly above the strategic target of 24%. However, the Management stated that the current margin is not sustainable in the long run and that a graduate return to the strategic level can be expected in the future.

Although not yet published, Krka’s Management stated that the net financial result can be expected around EUR -50m, mostly due to the negative movement of the Russian ruble.

Finally, net profit amounted to EUR 286.6m, representing a 17.3% YoY increase. Note that this was also the highest net profit in company history.

Turning our attention to investments, CAPEX reached just short of EUR 78m. Krka primarily invested in development capacities, manufacturing upgrades, quality management, and their own production-and-distribution centres across the world. Note that Krka’s CAPEX lagged behind the initially planned EUR 134m due to the COVID-19 pandemic impact on the construction industry.

New Marketing Authorisation

In 2020 Krka obtained marketing authorisations for 20 new medicinal products, including the first one in China. The start of production for the Chinese market is expected in Q1 2021. Meanwhile several other products are currently going through the registration process as well and are expected to receive market authorization in 2021 and 2022. Also note that Krka intends to apply to a local tender offer which will be opened in February, but no specifics regarding the size of the tender were mentioned.

Plan for 2021

According to the Management’s outlook, sales in 2021 are expected at EUR 1,535m and net profit is seen at EUR 265m. Note that the expected net profit surpasses our initial projections made in our analysis. Meanwhile the expected CAPEX amounts to EUR 114m.