Today, we bring you an overview of the key trends in the European Investment fund industry, based on the latest EFAMA research.

EFAMA (European Fund and Asset Management Association), publishes detailed factbooks on the investment fund industry. Its latest 2023 Fact Book contains a plethora of information regarding the industry’s history, trends, opportunities, and challenges. The entire fact book is available here, while in this blog post, we bring you the key trends regarding the industry.

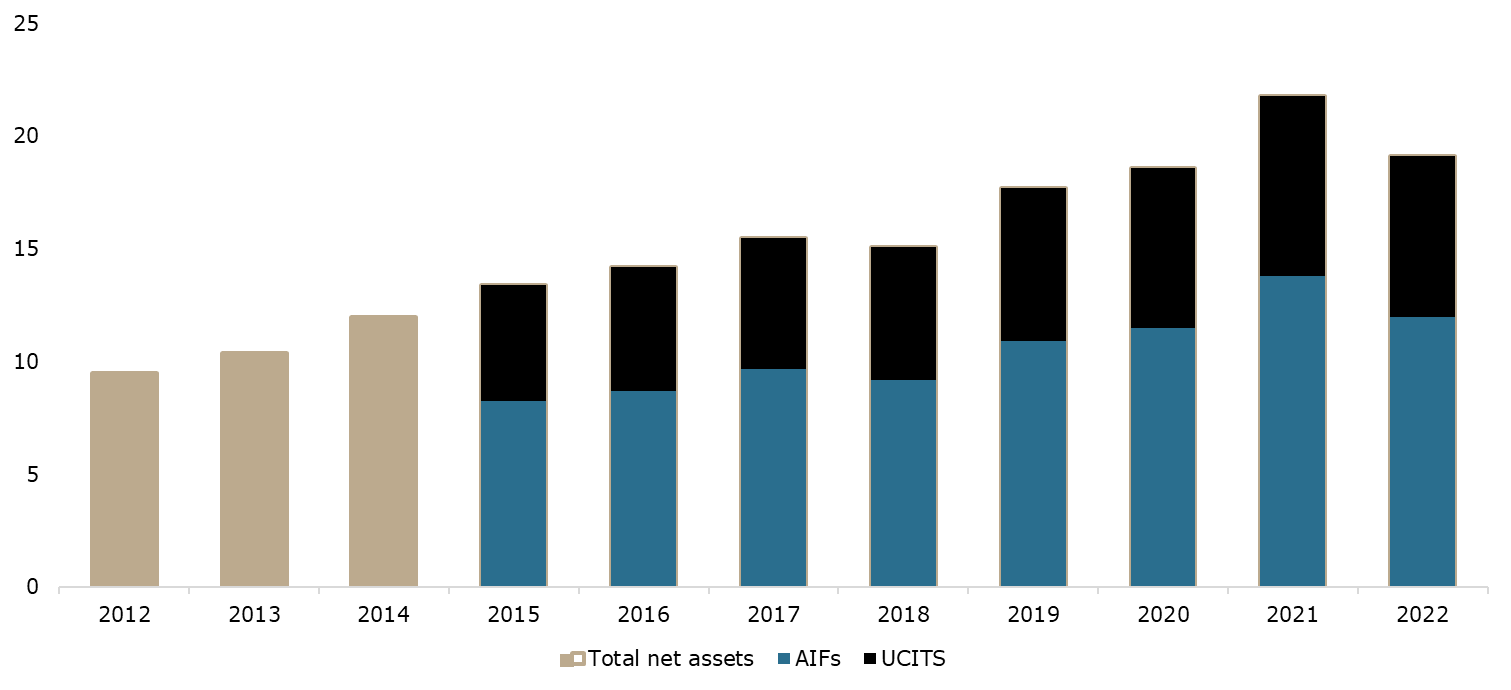

Net assets of European investment funds (2012 – 2022, EURtn)

Source: EFAMA, InterCapital Research

At the end of 2022, the total net assets of European investment funds amounted to EUR 19.1tn, a decrease of 12% YoY, but an increase of over 2x compared to 2012. Of this, UCITS funds held EUR 7.1tn, while AIFs held EUR 12tn. Furthermore, on a YoY basis, the net assets of UCITS funds declined by 13.4%, while net AIF assets declined by 11%. As such, 2022 proved to be quite a difficult year for the investment funds, with net outflows amounting to a decline of 1.2% for UCITS, and 1.3% for AIFs, respectively, while the remaining (12.2% for UCITS, 9.7% for AIFs) came as a result of the stock market decline.

Net sales of European UCITS and AIFs (2013 – 2022, EURbn)

Source: EFAMA, InterCapital Research

Even though the net outflows didn’t contribute as much to the overall decrease as did the net asset value decline, its decrease is still significant. This is due to the fact that an increase in net inflows is expected YoY, and to be fair, until 2022, this has for the most part been the case. In particular, the net outflows from UCITS funds came from equity and particularly bond funds. The decline in equity funds came as a result of poor stock market performance, while bond funds recorded the worst results in the last 10 years, primarily due to the sharp increase in interest rates which negatively affected the valuation of outstanding debt securities and the overall attractiveness of bond funds.

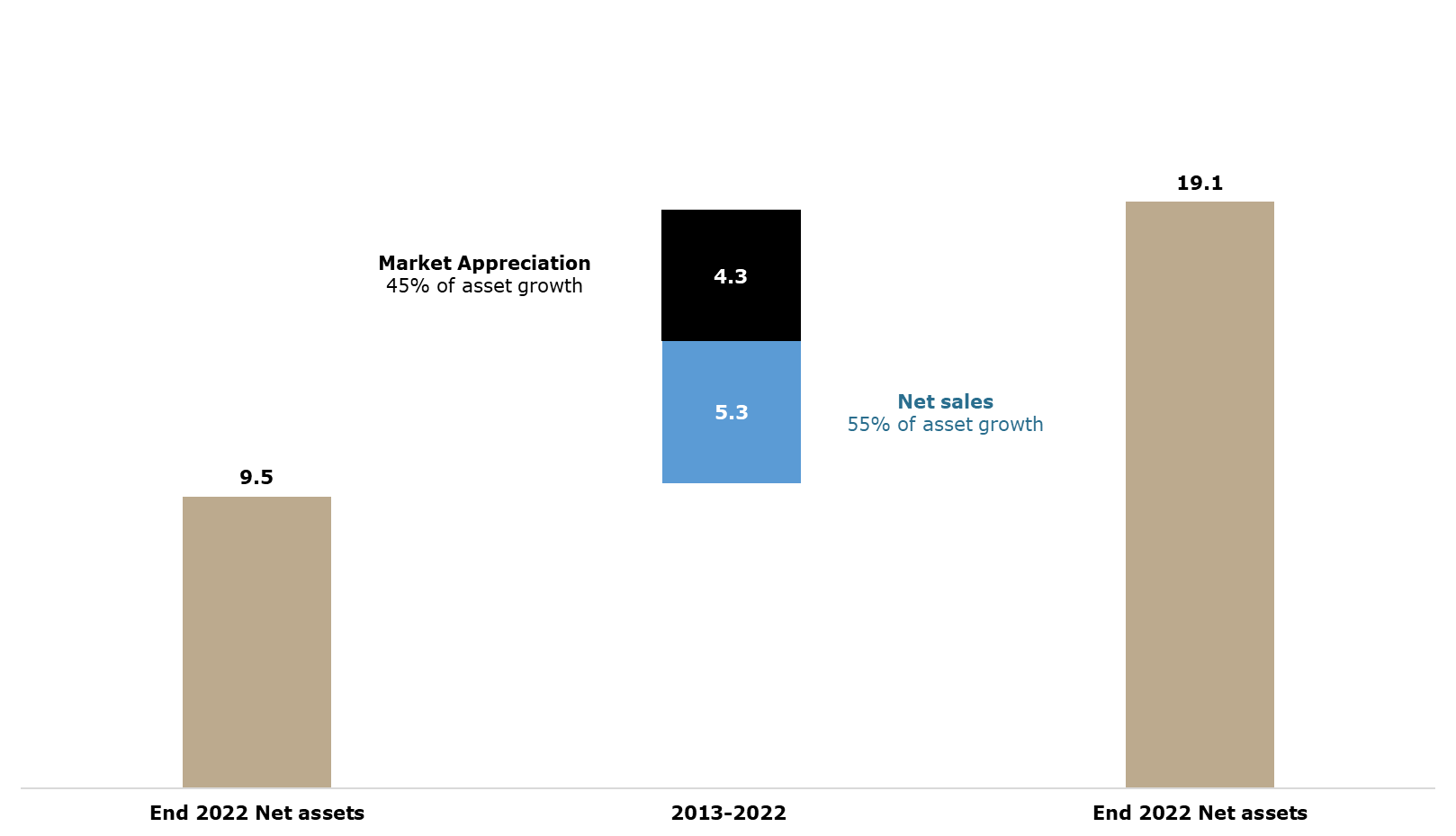

Growth in UCITS and AIF net assets (2022 vs. 2012, EURtn)

Source: EFAMA, InterCapital Research

On the other hand, AIFs recorded outflows mainly due to Dutch pension funds moving away from AIFs. How does Croatia compare to all of this? For Croatia, the story of the decline is even higher, with the NAV of the UCITS funds declining by 24.4% YoY at the end of 2022, and according to the latest data, in April 2023, the decline amounted to 14.9% YoY. Of course, there wasn’t much to be done in terms of the UCITS or AIFs in 2022, as the decline in market value was recorded across almost all the stock exchanges in the world, due to the war in Ukraine, high inflation rates, and recession fears, among others.

Long-term trends in the European fund industry

UCITS – market share by fund size (2012 – 2022, % of total net assets)

Source: EFAMA, InterCapital Research

One of the main long-term trends in the industry is the fact that large funds are becoming more and more important in the sector. The main reason for this is the fact that there are many small UCITS funds in Europe, funds that cannot take advantage of economies of scale to cover their cost. In fact, at the end of 2022, there were app. 12.5k UCITS funds with less than EUR 100m of assets under management. Despite this, these funds accounted for only 4% of the total assets, with their market share falling. On the other hand, the share of funds with more than EUR 1bn in net assets is increasing.

Average ongoing charges of UCITS (2018 – 2022, % of total net assets)

Source: EFAMA, InterCapital Research

One positive development is the continuation of the average cost decline. From 2018 until 2022, the average cost of equity of UCITS funds declined by 0.14 p.p. and amounted to 0.87%. On the other hand, the average cost of bond UCITS declined by 0.13 p.p. to 0.58%. The trend is expected to continue, as increased transparency on fees and competition between fund managers in general, but also between active and passive funds in particular will continue.

UCITS equity funds – regional breakdown (% of the total net assets)

Source: EFAMA, InterCapital Research

On the other hand, one trend that has been quite negative is the decline in the share of European stocks in the overall assets of the investment funds. In 2012, 51% of the total equity UCITS net assets were held in European stocks, while only 35% are held today. This came as a result of growing demand for US stocks, as the US is seen as an attractive investment opportunity for both domestic and international investors, due to the strength of the US economy and the fact that the US is home to many successful companies, particularly in the tech sector. As such, the share of US stocks in the total net assets increased from 19% in 2012 to 42% in 2022.

Investment fund ownership in the EU by sector (2012 – 2022, EURtn)

Source: EFAMA, InterCapital Research

Lastly, insurers and pension funds are the largest fund investors in the EU, with EUR 4.2tn of net assets of UCITS and AIFs held by them at the end of 2022. This represents an increase of 83% compared to 2012. Following them we have households, at EUR 3.2tn, an 88% increase compared to 2012, and long-term funds, with EUR 3tn, a doubling since 2012. Given their size and expected growth, this dynamic is expected to continue.

For anyone who has been in the investment, and especially fund business for long, these numbers and trends do not come as a surprise. In Croatia in particular, we can see a lot of these trends already playing out; pension funds are the largest investors, the investment is made into domestic but also international assets; costs have been falling, especially with the improvement in financial transparency and introduction of new passive funds (ETFs); and the market dynamics concerning asset value decline and outflows from funds are also present. As such, we can see that in the majority of cases, Croatia follows trends that are set on the European, and global stage, so changes and developments seen there can also be expected in Croatia.