Yesterday’s US CPI print giveth what last week’s ADP/NFP taketh? So it seems. What do we make of yesterday’s CPI reading and the discrepancy between financial markets’ expectations and DOTS anticipation? Find out in this brief research piece.

Yesterday’s US CPI inflation expectations were pretty low thanks to gasoline base effects, however, even those low expectations were broken to the downside, catching the financial markets by surprise. Bloomberg consensus estimate was +0.30% MoM for the headline figure and +0.30% MoM for the core figure, both figures ending some 10bps below expectations. To be more precise, core inflation increased by +0.158% MoM, the softest reading since early 2021. We note that used cars, the category that demonstrated the biggest drift upwards in recent years, have reversed course and are now drifting lower at a -0.50% MoM pace. This is probably just a beginning of a larger pullback since wholesale prices are down by 10% and it’s quite likely that used cars’ prices have plenty of runway down. Shelter prices continued to slow down and are currently at +0.46% MoM (rent) and + 0.45% MoM (OER), but regarding the trend, it’s firmly to the downside.

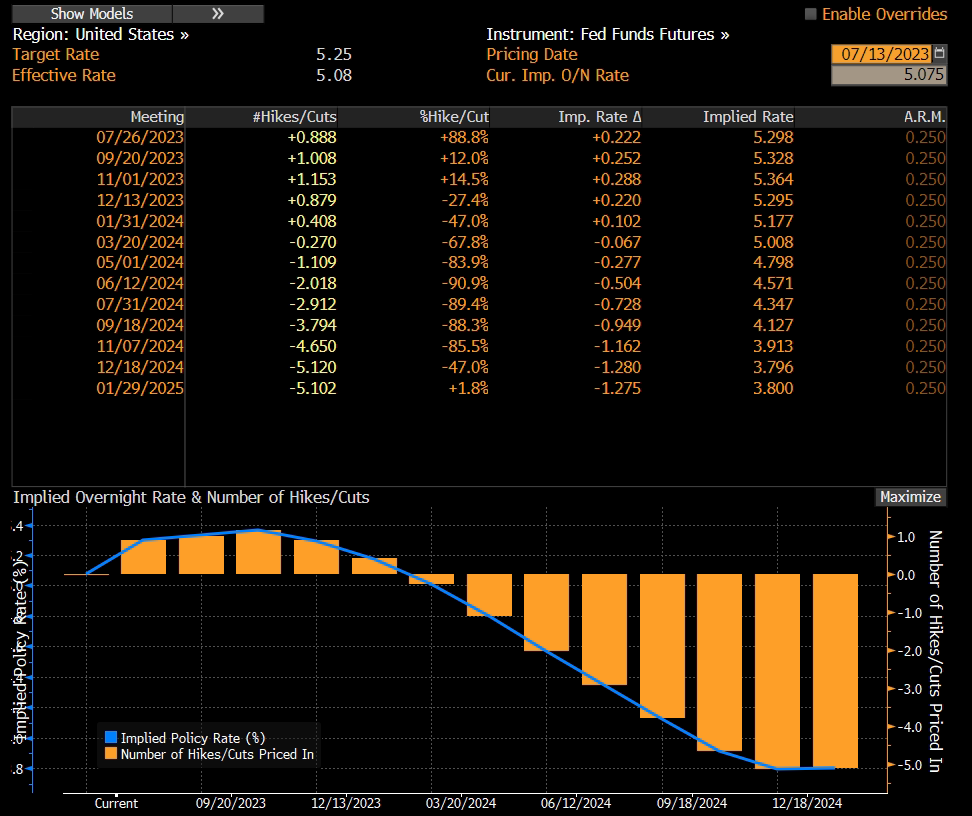

So how have fixed-income markets reacted to this US CPI print below the consensus estimate? Well, it was clear the print will be weak. And it couldn’t have been clearer that since US gasoline prices fell from 370.24 USD/bbl (July 12th, 2022 20-day moving average) to about 258.00 USD/bbl (yesterday’s 20-day moving average), or by -31.0% in relative terms, the headline figure would dip down, but since the core is still elevated historically this would not be sufficient to declare victory over inflation. In other words, without core inflation getting below +3.0% YoY or +4.0% YoY, it’s nearly impossible to get the headline CPI figure to the neighborhood of 2.0% YoY. But try explaining that to financial markets. WIRP US demonstrates that SOFR futures now see peak FED fund rates just 25bps above the current level, meaning that once again we have a disagreement between SOFR futures (i.e. financial markets) and FOMC consensus compressed in the most recent DOTS report. Since we have no more hard data before July 26th FOMC meeting, it’s going to be quite interesting to monitor the statement delivered after the decision. It’s possible more members turned dovish, albeit wordings have so far emphasized that the real issue concerning FOMC members is either not hiking too high, or cutting rates too soon.

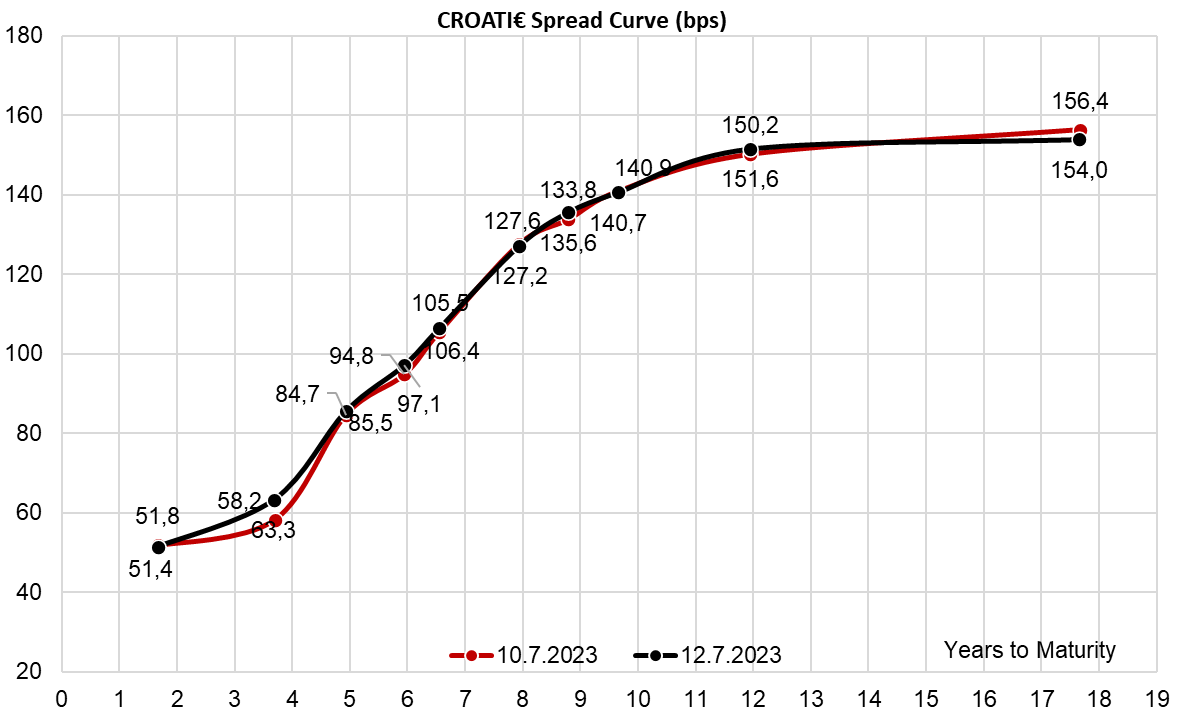

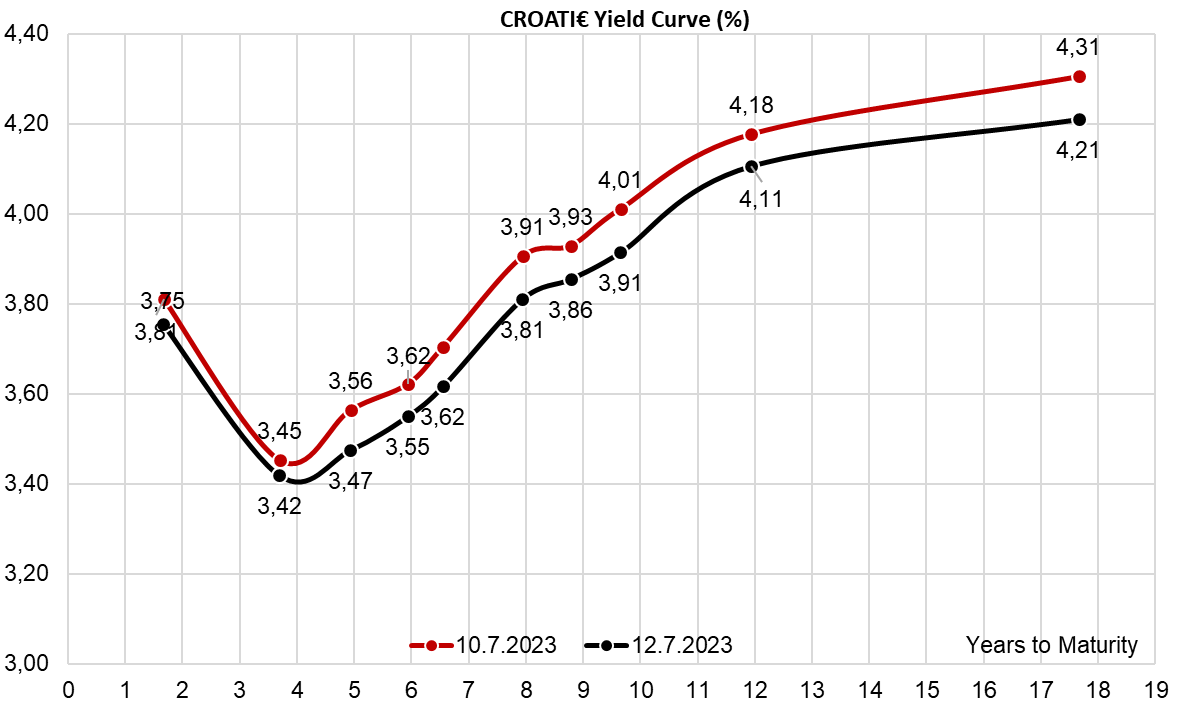

What exactly does all this mean for Croatian international bonds? Regarding CROATI 4 06/14/2035€, we see the market at 99.20/99.70 in 1mmx1mm (4.09% YTM/4.03% YTM, B+151bps/B+145.6bps). Take a look at the spread to Germany – if you think that’s tight, you haven’t been around for a few days. The spreads have actually widened for a couple of basis points and even B+145.6bps on the offer doesn’t look too bad, at least if you consider where the paper was trading for the last few days. We are seeing selling interest on CROATI 3 03/11/2025€ at 99.00 (3.50% YTM, B+77.7bps), CROATI 3 03/20/2027€ at 99.00 (3.29% YTM, B+53bps – you can see the reason why Street is selling it) and last but not least – CROATI 1.5 06/17/2031€ at 85.00 (3.72% YTM, B+126.3bps). The spreads appear to be ultra-tight, but then again there is some room to improve prices, albeit rising Bund futures reduces the bargaining power of buyers. If you’re underinvested, don’t waste any time!