Since SBITOP’s low (23 March), the index has increased by 23%. However, for the past 4 months the index has been quite stagnant, so if you are now considering investing in Slovenian equity market you might ask yourself a question: Has the train already left the station? Or in other words: Is SBITOP fundamentally undervalued?

If we look at global equity markets since April of this year, we can observe an almost uninterrupted positive sentiment on the equity markets which in turn led to a partial recovery of some major indices. Meanwhile some, like the S&P500, have turned positive on a YTD basis.

The S&P500 has recently (up until early September) witnessed an almost uninterrupted 60% rally from its March lows, mostly led by a strong performance of growth stocks. This resulted in quite stretched valuations with P/E reaching 27.8 on 2 September, surpassing levels from 2002 for the first time to reach the most expensive since 2000. However, the month almost behind us was guided mostly by a negative sentiment on further possible restrictions regarding the Covid-19 pandemic, which translated into a drop in many major indices throughout Europe and the US.

YTD Performance Selected of European Indices

Source: Bloomberg, InterCapital Research

If we turn our attention to the Slovenian equity market, we see a relatively low YTD decrease of SBITOP (-8.7%), which is one of the best (or least bad) performances in the region. Since its low (23 March) the index has increased by 23%, which mostly came on the back of Krka’s very solid share price performance, as it accounts for almost a third of the index weight. However, for the past 4 months the index has been quite stagnant, so if you are now considering investing in Slovenian equity market you might ask yourself a question: Has the train already left the station?

Or in other words: Is SBITOP fundamentally undervalued?

To answer this question, we need to look at the market in more detail. Firstly, according to Bloomberg, SBITOP is currently traded at a (trailing 12m) EV/EBITDA of 4.7, which is by far the lowest multiple of the observed European indices.

EV/EBITDA (trailing 12m) of European Indices

Source: Bloomberg, InterCapital Research

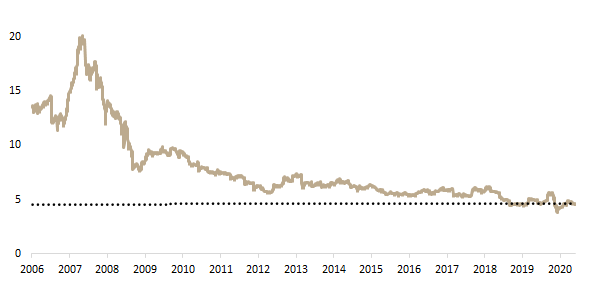

Meanwhile, looking at the historical development of SBITOP’s multiples, one can notice that the index is currently traded at one of the lowest multiples, quite lower than the 10-year median EV/EBITDA of 6.42. Of course, based on solely this information we cannot conclude that SBITOP is cheap. It is also worth adding that the forward multiples for the index is almost definitely higher than the one seen in graph as it is reasonable to expect the majority of index constituents to witness a lower performance in Q3 and Q4.

EV/EBITDA (trailing 12m) of SBITOP Index

Source: Bloomberg, InterCapital Research

In H1 of 2020, the index constituents recorded a decrease in weighted aggregate sales of 4% YoY. At the same time, net profit went down by only 3%, which could mostly be attributed to a sharp decrease in both top line and bottom line of Petrol (the second largest index heavy weight). Such a result was partially offset by a stellar performance of Krka which came on the back of higher demand for healthcare products. But let’s back up for a moment and look at the sectors and companies covered in the SBITOP and how they might bear the times to come.

KRKA

As above stated, Krka, Slovenia’s largest pharmaceutical company, accounts for close to 30% of the index weight. Pharmaceuticals could be seen as relative winners of the crisis as healthcare products continue to be in higher demand. Besides that, Krka operates with a strong balance sheet and negative net debt. Just like Krka, all other Slovenian blue chips are within reasonable levels of indebtedness, with the highest net debt/EBITDA standing at 2.03x. Coming back to Krka, the company has also been returning cash to shareholders both in form of a dividend and continued buyback program which you can read more about here. The solid results (H1 net profit +15% YoY) coupled with the high cash returns seen already in 2020 indicate that Krka has full confidence to generate the projected earnings and cash flows for the following periods.

PETROL

Petrol, as the second largest index heavy weight, has been through a challenging Q2 where the company reported a negative bottom line for the first time since 2010. However, the company is focused on diversification of their business towards higher margin business which are not as cyclical such as: energy and environmental solutions, production of electricity from RES, mobility etc. The company notes that these segments should account for 26% of EBITDA in 2022 compared to 15% in 2019. Since these segments offer a higher margin, implementation of such plan could lead to quite higher profitably of the company. Besides that, last week the Slovenian government announced the liberalization of retail fuel prices which should be beneficial for Petrol. To read more about it click here.

FINANCIALS (TRIGLAV, SAVA RE, NLB)

Next come 3 Slovenian financials which cumulatively account for another 30% of the index weight. 22% of that are Slovenian insurers Triglav and Sava Re, which have so far managed the Covid-19 pandemic very well as in H1, both companies noted a solid increase of all insurance segments. Although we expect to see a decrease in GWPs for both companies by the end of the year coming from the non-life segment (primarily on the back of the motor business), we see Triglav benefiting from higher pricing of health insurance premiums which account for roughly 15% of their GWPs. On the other hand, we see Sava Re benefiting from a solid performance of their reinsurance segment, which has globally benefited by a growing momentum of price rises following two consecutive years of significant catastrophe losses.

Regarding both Triglav’s and Sava Re’s portfolio, the latter is a conservative one, as fixed income financial investments account for the vast majority of the total portfolio. Besides that, the financial markets have significantly recovered since March lows, so it is reasonable to expect a mild impact on their returns. Taking everything above stated into account, we see both companies recording still a high ROE in 2020. We recently published a blog on this topic which you can read here.

NLB Group’ share price was the most hit of all companies, and the bank is currently traded at a P/B of 0.41, one of the lowest multiples of banks in the region. Although banks are definitely going through tough times, we see NLB as well-capitalized to bear the Covid-19 crisis. As of H1 2020, the Group approved EUR 1.694bn for moratorium, which represents 15.6% of the total gross book. When observing performing loans by industry and sectors, one can observe a limited exposure to sectors which are considered as sensitive. To be specific, Accommodation, Manufacturing (related to car industry only) and Transport represent 9.32% or EUR 0.34bn of corporate exposure. For 2020 we expect to see a sharp decrease in net profit on the back of higher impairments and provisions for credit risk. Although a dividend payment in 2020 is almost certainly unlikely, we still see NLB as an attractive dividend payer in the future.

SLOVENIA IS A DIVIDEND PLAY

Most Slovenian blue chips could be characterized as mature companies, which to some extent explains the lower multiple of the index. This also means that Slovenian companies are dividend payers, offering quite an attractive yield. To be specific, in 2019 SBITOP offered an average dividend yield of 7.5%. Meanwhile this year, despite the pandemic, almost all companies decided to pay quite attractive dividends with an average yield of the paying companies amounting to 6.8%. Financials were the only blue chips not to pay a dividend in 2020, as their regulators issued a recommendation on not paying out any dividends in this year. Despite this, Sava Re announced the intention to submit evidence to regulator of their ability to pay dividend. Therefore, to the extent that the Agency has no reservations regarding such dividend distribution, dividends for 2019 may still be paid out this year.

Dividend Yields of Slovenian Blue Chips (2020)

CONCLUSION

To conclude, one should always be aware of the specificity of the market which, for some, has a complex shareholding structure and bears the problem of relatively low liquidity. Besides that, every equity market, as well as the Slovenian market, currently bears some risk of higher than expected economic fragility which could lead to a drop in equities. However, Slovenia still seems to offer quite an attractive story for the investors, as most companies seem to be bearing the crisis quite well.

Coming back to the question stated above: Is SBITOP fundamentally undervalued? I will let you be the judge of that.