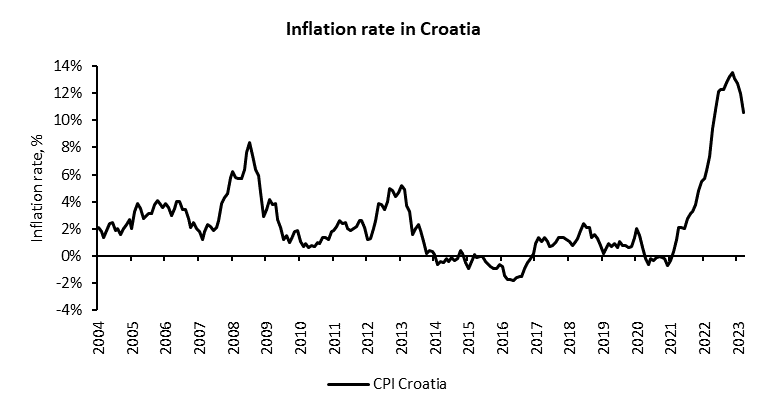

On Friday the 31st of March, the Croatian Bureau of Statistics released inflation data for March. As we expected, the disinflation is continuing as imported inflation scales back after a huge rise last year. Unfortunately, on monthly basis, inflation accelerated to 0.8% in March which is higher compared to January and February. Inflation has certainly peaked, but when we are going to reach a 2% inflation rate is still an ongoing discussion.

Inflation peaked in January at 13.6% and it currently stands at 10.6% YoY as slow annual disinflation is ongoing. Assuming previous inflation rates on a monthly basis remain stable in the following months and if the macroeconomic conditions do not change significantly, lowering the inflation rate on a yearly basis should continue.

Talking about components of the CPI, firstly, food inflation is the most significant contributor to the composite inflation rate. It is currently running at 15.3% YoY and keeps running hot both at home and abroad. Secondly, energy inflation was in the spotlight last year due to the start of the war in Ukraine when oil prices jumped over 100$ per barrel but since then oil prices fell significantly. Namely, energy inflation tumbled from 13.8% in January to 7.5% in March. Thirdly, services inflation is at 8.2% YoY and the impact of monetary policy on it is slow and reduced. Monthly values look much better than yearly values as services inflation dropped significantly since January when it amounted to 1.1% MoM and now it stands at 0.2%.

As it is often implicated that the switch from the local currency to the Euro results in inflation and price spikes, we should consider that the Euro was implemented in Croatia amid the worldwide inflation wave. According to the ECB research from March 7th, Croatia had one of the lowest increases in monthly inflation in February in the Eurozone. Also, their analysis concluded that 65% of products did not change their price after the implementation, 25% decreased in price and only 10% of products increased in price after the implementation of the common currency. Historically, the effect of euro implementation is mild and mostly concentrated in the services sector but is also considered to be a one-time effect. As I previously noted, services inflation was 1.1% MoM in January and 0.2% in March. The higher number in January might be due to the implementation of the Euro, but as noted, the first three months are in line with ECB’s expectations.

I think that the way to 5% inflation should be manifested in the following months. Natural gas and electricity prices plummeted since last year in the wholesale market, which further eased inflation pressures. But the way to 2% might be a bit longer due to the high wage growth in Croatia which amounted to 11.7% in January on yearly basis. That might prolong the return to a 2% inflation rate.

Source: Croatian Bureau of Statistics, InterCapital, ECB