Yesterday’s US CPI surprised investors on the upside with price increase of 4.2% YoY, representing the fastest pace since 2008. Bonds were hit around the globe, but USD yield curve is still below its recent highs. In this brief article we are looking at the recent inflation data and the consequences on yield curves.

US Bureau of Labor Statistics released yesterday much awaited CPI data for April. Investors feared the number with the reason. CPI stood at 4.2% YoY, rising from March’s 2.6%. In terms of MoM performance, prices increased by 0.8%. Core CPI also surprised on the upside, rising by 3.0% YoY versus 2.3% expected and 0.9% MoM which is the largest monthly increase in the last 40 years. All the numbers look quite scary but let us look at some details. With the opening of the service sector, airline fares grew by 10.2% MoM, used cars and trucks’ price increased by 10.0% while accommodation prices were up by 7.6% MoM. On the other side, energy prices declined slightly by 0.1% MoM after rising in the last 10 months straight. Rents increased by ‘only’ 0.2% MoM while food prices were up by 0.4% MoM compared to 0.1% in March. To sum it up, pressure was most witnessed in the sectors that are seeing surge in demand due to the opening of the economy but eventually that trend should ease.

As CPI inflation at 4.2% is not already high enough, other high frequency data point to even higher number in the coming months due to several factors. Service sector in the United States has still a lot to recover while commodity prices are at their multi-year highs with some of the, like lumber, rising so much, they became internet meme. Companies could decrease their margins to stay competitive, but question is for how long. On the other hand, last week NFP shocked markets with only 266k increase versus 1 million expected, and March data was also reviewed lower. Unemployment rate actually increased from 6.0% in March to 6.1% in April vs. 5.8% expected. Market first reaction to the NFP was to buy bonds – US 10y yield breached 1.50% with short sellers covering their positions. However, on the second glance, NFP data revealed something more important, resulting in longer-term bonds ending the day in red. Namely, average hourly earnings increased by 0.3% YoY while they were expected to fall by 0.4% due to the specifically low base in 2020. On top of that, this week we saw number of job openings reaching record high of 8.1m in March compared to 7.5m expected. To sum up, surprisingly low NFP, combined with high JOLTS data and rise of hourly earnings point to the conclusion that labor market could become a drag on the economy and could push prices way higher. Mr. Biden had its say on the matter. POTUS stated that federal unemployment benefits do not discourage workers to come back to work, but employers should pay more decent wages. With most of the fiscal packages now delivered and federal unemployment benefits to last until September, we expect employment to increase in the coming months, but we could still see some shortages on the labor market which could be last nail for the ‘transitory’ rhetoric.

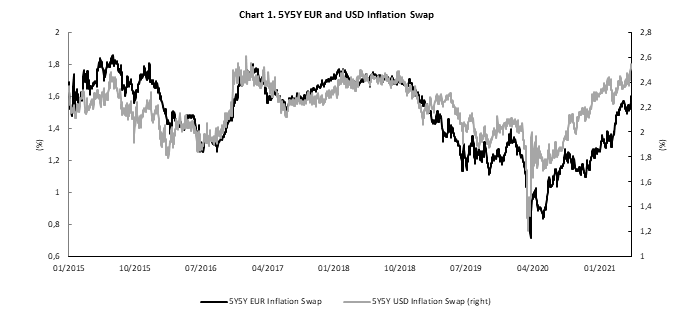

What did markets had to say on these scary numbers? Well, inflation expectations were rising for the last few weeks and once again overjumped 2.50% level. Yesterday of course, bonds were sold and US 10Y jumped by some 5bps reaching 1.70% mark. However, US treasuries are still not testing lows that we saw a month ago when US 10Y yield was above 1.75%. Back then some parts of the puzzle were priced to perfection. Fed is currently more focused on the labor market than on prices. Although it will probably downplay 4.2% price growth as being transitory, it sure will become harder for them to defend their stance in the following meetings.

Source: Bloomberg, InterCapital