In the past several years every bar conversation inevitably got to the point where somebody would ask: “So what do you think where Croatian yields would be if ECB wasn’t buying so much?” In a matter of three months this question reached dealing desks – today we plan to add some clarity on the context and methods of reliably determining the pricing of a hypothetical CROATI 04/2032€. Find out more in this brief research piece.

On Tuesday afternoon Federal Reserve Board member Lael Brainard rocked the markets with statements about QT being announced as soon as on May FOMC meeting and being much faster than in the previous tightening episodes. It makes sense to put these statements in the context of her pending Senate confirmation for the office of vice chair and it’s of critical importance to communicate now that all instruments at her disposal would be used in order to put a lid on inflation. Brainard’s remarks on QT re-steepened the UST yield curve and brought the 2Y10Y spread back into positive.

More clarity on the trajectory of QT came about on yesterday’s disclosure of March FOMC minutes. There’s a consensus among the members that 95bn USD cap split 60bn–35bn between USTs and mortgage-backed securities would be appropriate and that caps would be introduced “over a period of three months or even longer”. As some analysts put it – this is the fastest balance sheet reduction and it comes right after the pandemic induced fastest balance sheet expansion. What’s more interesting is that “one or more” 50bps hikes would be appropriate at upcoming meetings if inflation fails to slow down. Basically, reading through March FOMC meeting minutes you have a feeling that the Committee would have hiked by 50bps already in March hadn’t Powell locked in a 25bps hike on his Humprey-Hawkins testimony. Powell’s recent remarks have been an attempt to move back to the center of discussion on monetary policy since his outlook on inflation has clearly been marginalized by other FOMC members.

OK, so one huge marginal bond buyer will be out in second half of the year. How is this affecting bond demand? Last week’s EFSF placement indicated a slightly weaker demand for fixed income instruments, at least compared to end-2021. EFSF managed to build a 7bn EU orderbook for it’s 3bn EUR placement of 0.875% September 2028 paper, but fixed income veterans point out that this has been the lowest bid-to-cover since at least 2019. Most of the veterans agreed that even with EFSF curve going up, the supranational still had to give in some 2bps-3bps of premium to sweeten the deal – and this is something we haven’t seen in a while. ECB’s accelerated pace of ending APP certainly had an effect and it’s worth remembering that with the current schedule the Frankfurt-based central bank still plans to purchase 40bn EUR of securities in April, followed by 30bn EUR in May and 20bn EUR in June. Game over for APP from 3Q on.

In a market like this Portugal decided it might be a good time to place a 10Y paper because although borrowing costs are up, it might be a good idea to borrow while the APP is still in place, even with significantly reduced pace of asset purchase. Yesterday the BBB/BBB/Baa2 country sent guidance with IPTs @ MS+36bps and managed to built up an orderbook of 15.5bn EUR for the planned 3.0bn EUR placement (implying a 5.17x bid-to-cover). The orderbook buildup came about with only 1bps of tightening and it’s a fair estimate that the Pyrenean country had to give in at least 11bps of NIP (i.e. new issuance premium) in order to court the investors. NIPs are back en vogue and other issuers should be aware of it. It’s also worth mentioning that Portuguese paper tanked on the grey market, but we’re not quite sure whether it’s because of the lower book quality (too many fast money being attracted to wide NIP) or because benchmark made a move lower. Reoffer price for the new PGB 1.65 07/16/2032€ was set at 99.584 (reoffer yield of 1.694%) and it’s going to be interesting to monitor what happens with the price today since benchmark made a slight retracement overnight right back to the levels at the time of pricing. If PGB 1.65 07/16/2032€ still trades below 99.584, that would certainly indicate low book quality.

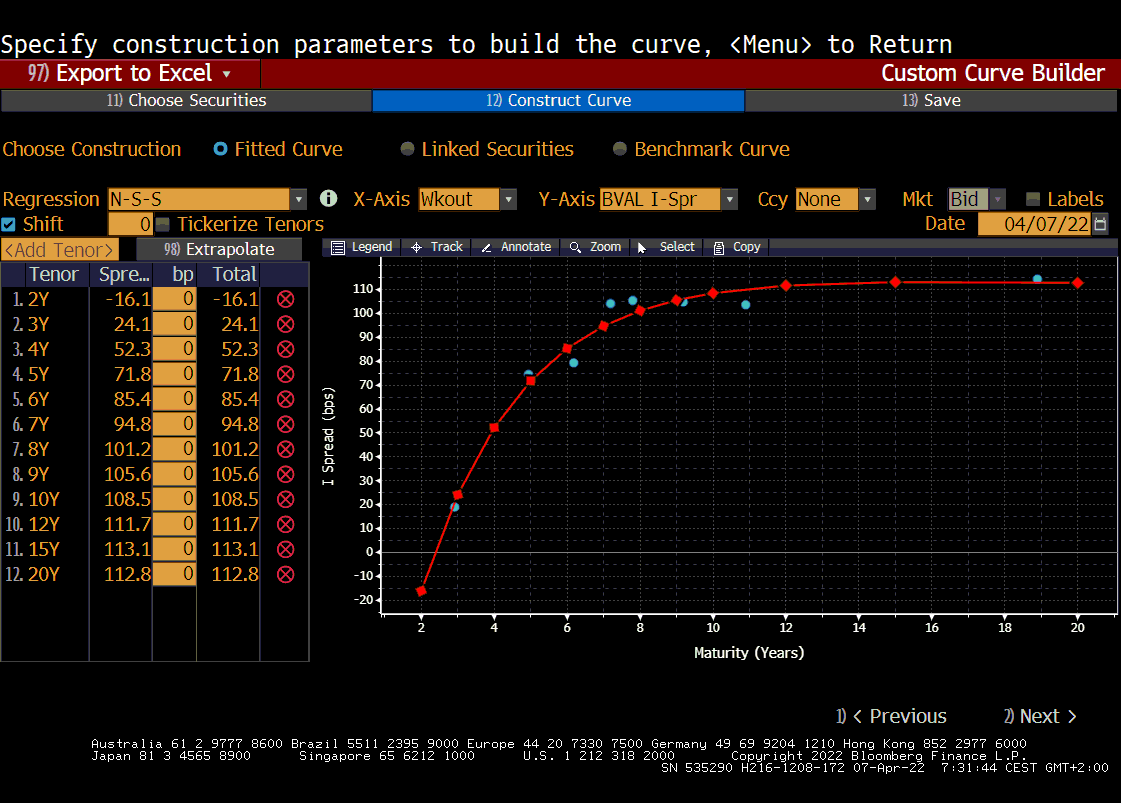

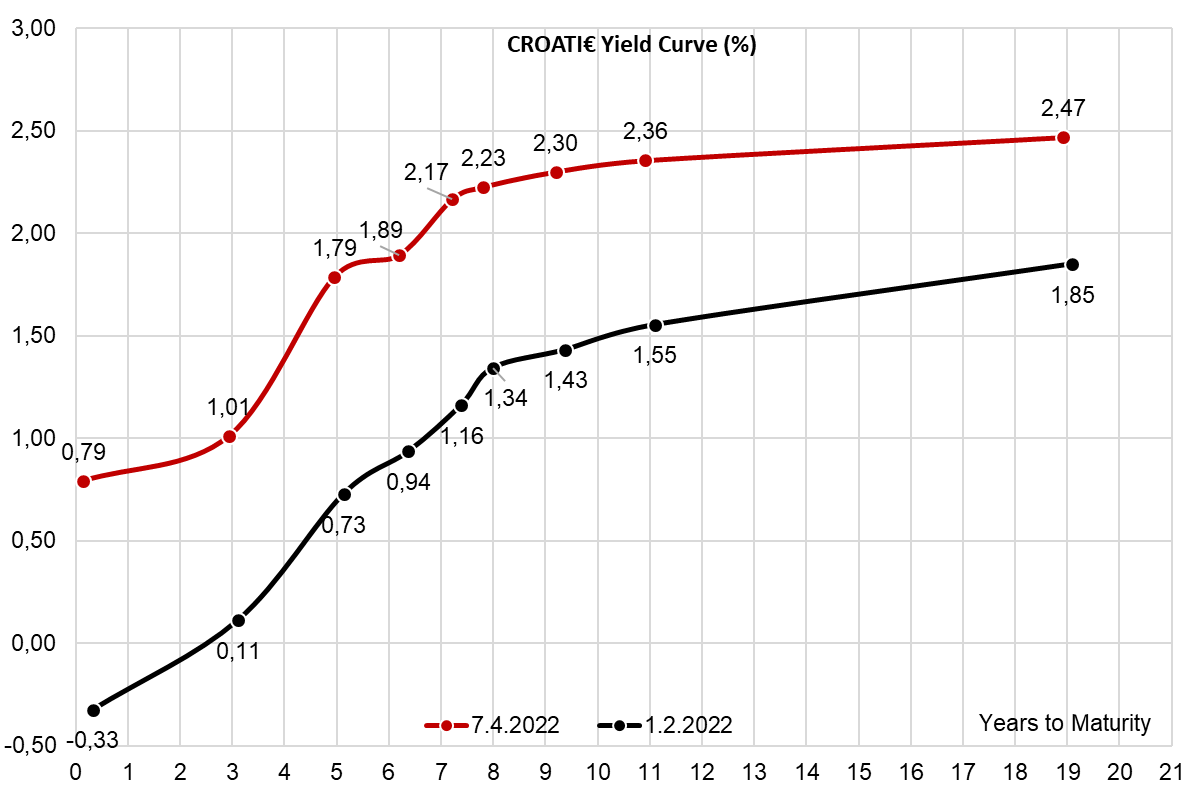

Which finally brings us to the possibility of Croatia placing new 10Y paper as soon as in the coming days while ECB’s APP is still on. We have constructed CROATI€ I-spread curve (basically spread to the swap curve) and calculated that hypothetical new CROATI 04/2032€ could be fairly priced at MS+108.4bps. Add some 15bps of NIP (because ECB is not buying CROATIs, a distinguishing feature compared to Portugal) and take into calculation a 10Y IRS @ 1.324% and finally you will arrive at 2.56% YTM (255.8bps = 108.4bps+15bps+132.4bps). Maybe it seems high at first, but if you take a look at the chart supplied below, you will see that this is quite a realistic pricing for a non-EA country placing some 1.5bn EUR to 2.0bn EUR in an age of market turbulence. It’s also worth bearing in mind that 1.25bn EUR would be used to finance the maturing CROATI 3.875 05/30/2022€.