Everybody’s doing it – Iceland, Ireland, Italy, Slovenia (twice already this year!), Spain… Even the EU? Yes, for SURE! The € bond placements are all over the place, all over chat rooms and all over RFQs. But, the game is different and concessions for the new paper are down to zero. However, countries outside of the euro area are a bit cautious before they tap the international bond markets because nobody wants to be the first one to dip his toe in the sea to check how warm are the waters. What can you expect from Croatian placement any time soon? Well, you’ll have to click on the link below to find out.

Looking back at beginning January, the year kicked off with Italy, Ireland and Slovenia placing new bonds. What captivated our attention this morning in all three cases are NIPs (new issuance premiums), i.e. the spreads to the existing yield curve given to buyers in order to facilitate the deal. In case of Italy, the BTPS 0.95 03/01/2037 was placed at no more than 0bps NIP. In other words, the arrangers placed the paper right on the yield curve and the buyers still managed to build up a 105bn EUR orderbook with more than 520 account involved. The auction ended up at 99.44 reoffer price, 0.992% reoffer yield and 10.5x bid to cover since 10bn EUR was placed. Ireland even managed to squeeze out a negative NIP in size of -5bps (5.5bn EUR placed against an orderbook of 40bn EUR @ -0.257% reoffer yield for a 10Y duration). The accounts involved had a feeling that the times of lofty NIPs and prices skyrocketing the day after the placement might have been over and what happened in mid-January confirmed their instinct was correct.

A bit of a history lesson – in April last year things looked much different than they do now. True, the ECB implicitly promised to keep the periphery spreads under control because it couldn’t have done it explicitly since that might clash with sections of TEU prohibiting direct financing of governments by the central bank. The institutional investors were baffled by the size of expected placements of so-called corona bonds and these were needed to fund the rescue packages. So in April 2020 Spain placed a 10-year bond some 12bps above the curve (i.e. 12bps NIP was included) and the orderbook reached 100bn EUR for a 15bn EUR placement. Wow! You got the point – it was all about the possibility of buying it well below what investors regarded as fair value.

Well, this year it’s different. In mid-January 2021 Spain came back to the markets, this time with SPGB 0.1 04/30/2031 indicating some +5bps of NIP. OK, so it wasn’t 12bps like last time, but still quite lofty. This promise of a concession managed to round up some 130bn EUR of orders, a record-breaking amount in Spanish history. Seeing this, director general of the Spanish treasury Pablo de Ramon-Laca decided that it’s time for the investors to pay for liquidity and cut the NIP all the way to 0bps (i.e. the bond was priced right at the curve, similar to earlier Italian placement). The orderbook collapsed from 130bn EUR to merely 55bn EUR – a 75bn EUR contraction was another record breaker. What’s even more interesting is that although Italian government collapsed the same evening and price movements between BTPs and SPGBs tend to rhyme, the grey market price hasn’t dipped below the reoffer by a meaningful amount. It was basically still traded in a tight 20 cent range around the reoffer the following day. The yield hungry investors have their pockets full of cash – and all they want is exposure to high yielding assets.

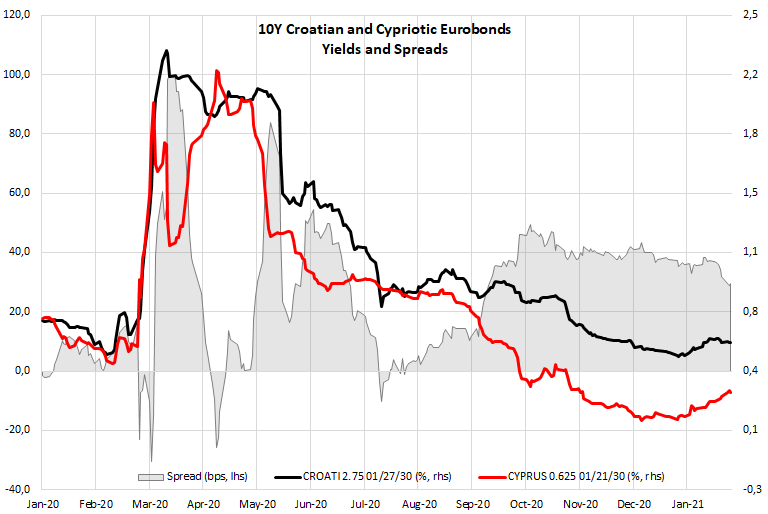

This works if you are Italy, Spain, Slovenia, Ireland etc. and you have ECB guarding your back with implicit Lagarde put. But what if you’re not? Financial markets were on watch for the first large placement by a sovereign outside the euro area (Armenia and Iceland are not really considered cases in a point) and that still hasn’t happened. Well that might change in the coming weeks because on March 24th Croatia has 1.5bn USD CROATI 6.375 03/24/2021 maturing and it’s quite likely that refinancing would be done before the maturity date. So what can we expect from the placement?

The size is likely to reach 2bn EUR (benchmark) or even exceed it – Croatian government could put the extra funding to good use because the economy still needs plenty of stimulus to make the ends meet. On the other hand, even with slightly lower ECB PEPP purchases in January, investors are still overflown with liquidity and Croatia has a good story behind it. Namely, Bulgaria and Croatia are in the same ship called “euro area membership” which is expected to dock in five years tops, meaning that ECB support might be around the corner.

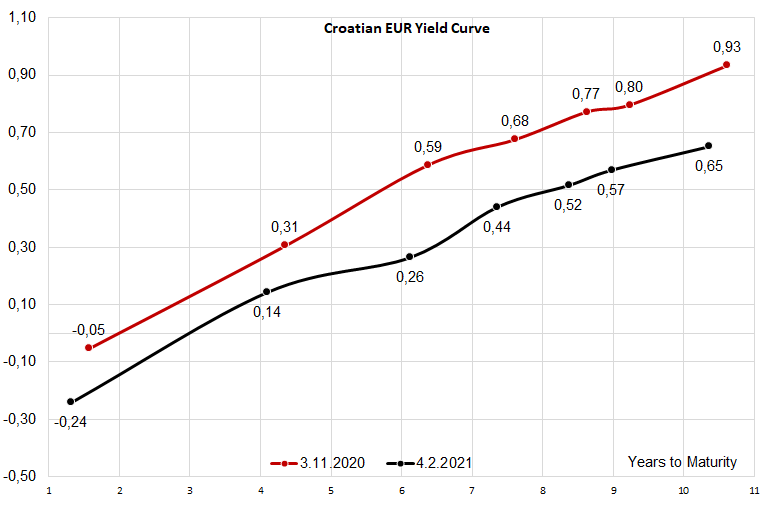

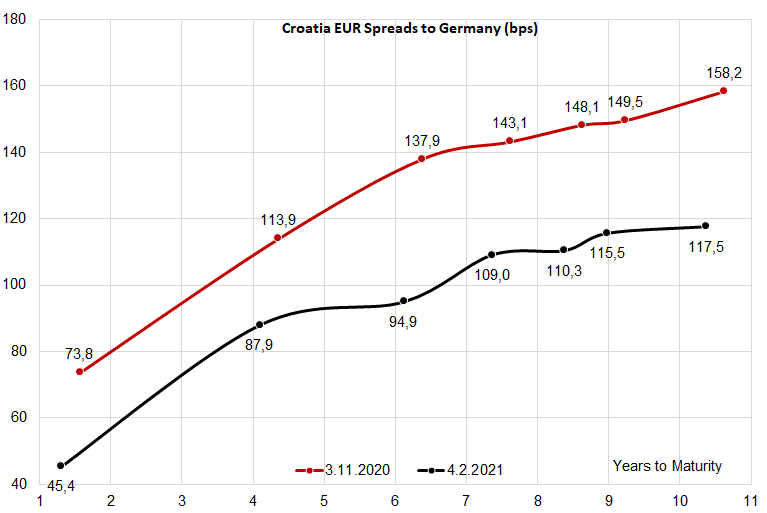

OK, but what about the yield? On the last placement in mid-June 2020 the investor base was heavily skewed towards the 10Y maturity because a lot of clients from Germany and Austria had special capital requirements for the paper exceeding the 10Y maturity and issued by a country outside EA. This time around we can expect the Croatian government to place between 10Y and 15Y paper (2031-2036 maturity) between 0.62% YTM (10Y) and 0.85% (15Y) – the yields derived by extrapolating the Bloomberg BVAL bids as of this morning. Add some 5bps of NIP and we get to the range of 0.67% (10Y) – 0.90% (15Y). If you skipped reading the previous paragraphs about Italy and Spain, the point was that don’t count that much on concessions since NIPs are close to zero latelay; moreover, in June 2020 the NIP on CROATI 1.5 06/17/2031 was contested – some leads said it was 5bps, the other that it was non existing (you can randomly pick your side of the argument).

Where is that compared to the rest of the CEE/SEE space? Well, REPHUN 1.75 06/05/2035 is traded in 1.0%-0.95% range (bid YTM-ask YTM) and we’re talking about a country rated Baa3/BBB-/BBB- (similar to Croatia), but faring much better according to macroeconomic parameters such as public debt. There is a catch – REPHUNs are becoming scarcer, less liquid and tougher to price since the Hungarian government tends to focus more on local investor base and keep only a token presence on international markets. In other words: don’t forget us, but don’t count on us either. On the other hand, Croatia was steadily building it’s CROATI€ curve, adding a new spot on the curve every year and now it’s easier to price CROATI than REPHUN. Our baseline scenario for Croatian placement is basically a long 10Y (CROATI 2032 sounds good) at some 0.75%, implying a 2bps NIP to make the markets purr. This would make all the participants happy: it’s an all time low in reoffer yield (government is OK with that), slightly above 10Y duration (banks are OK with that) and yield is decent (in times like these, if you’re not happy with 0.75% YTM or B+126bps feel free to try your luck elsewhere).

So what happens next? It’s a question really which country takes the first shot and reveals how thirsty are the markets for this sort of paper – will it be Croatia or Romania. The latter has been through a tough government forming process and is still struggling with the 2021 budget, so if you’re choosing a horse to bet on, Croatia looks like a better pick. So be on guard because if you want long CROATI€ in your portfolio, you can count on only one eurobond placement this year.