CROBEX has long been known for its broadness which somewhat affected the index’s ability to accurately portray the situation on the market. Therefore, we decided to examine the index’s movement more closely by reviewing the individual contribution of each component in a period spanning from 2013 up until today.

Market indices are supposed to serve as proxies for investors which would allow them to easily follow the direction in which the observed market is moving. However, in order to function properly, the index must be comprised out of shares that attract enough turnover to actually represent the current market movement and not be exposed to frequent price fluctuations. Meanwhile, CROBEX is currently not that type of index as it consists of a large number of shares which many fund managers would not even include in their investment universe (due to extremely low liquidity, poor corporate governance, going in and out of pre-bankruptcy procedures, etc).

The value of the CROBEX index increased by 17.8% in the observed period (Mar 2013- Mar 2022), which might lead some investors to believe that the Croatian market has either missed most of the bull market or that the coronavirus was able to erase almost an entire decade of gains. Fortunately, none of that is true.

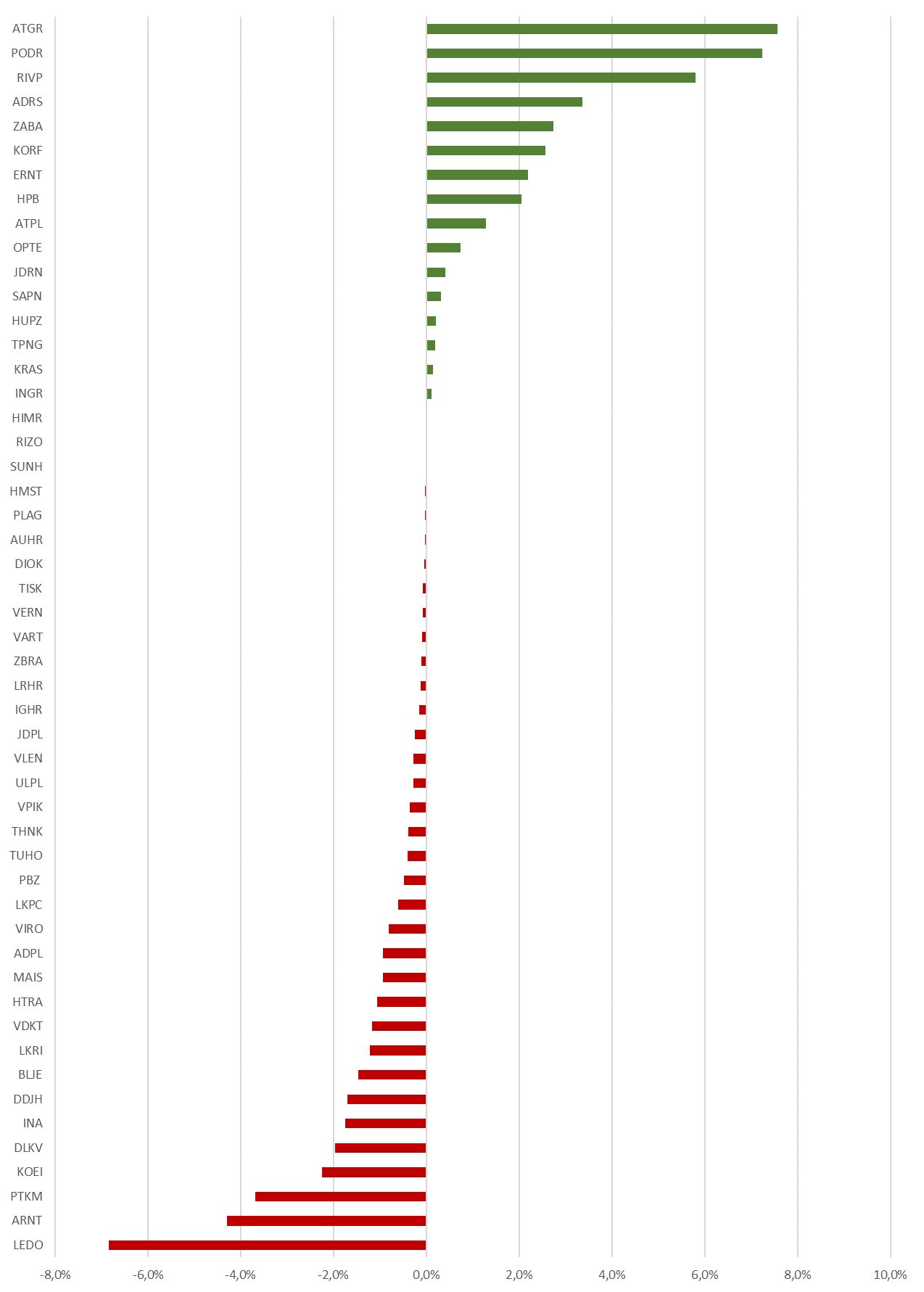

Individual Impact of Shares on CROBEX Movement in the Observed Period (in %)

As one can notice, shares such as Atlantic Grupa, Valamar, Podravka and Adris all had a positive impact on the index’s performance. Atlantic Grupa managed to increase its share price by 2.5x in the observed period due to the successful acquisition and integration of Slovenian Droge Kolineske, successful portfolio management and sell-off its non-core assets. Considering that these shares are among the most popular shares for investors, the decrease stated previously seems a bit misleading. On the flip side, the shares which dragged the index down were mostly poor performing companies from the industrial sector which are prone to share price fluctuations due to their low liquidity and poor corporate governance which puts off many institutional investors from buying those shares. Furthermore, the index was hit hard by the Agrokor crisis with Ledo accounting for a 7% decrease in value. An exception from this group would clearly be Koncar and Arena Hospitality who, despite the strong interest from investors, were some of the leading contributors to CROBEX’s negative performance. Končar’s negative contribution to the Index happened mostly as a result of the whole market reporting bullish sentiment in those periods. We should mention that Končar’s share price reported a high increase in price during the time Končar was not in the index, overestimating its negative performance in the observed period, even if it did negatively impact the Crobex value.

To conclude, the Croatian market has certainly been through a rough patch over the past couple of years. However, we believe that the performance of the main market index is slightly exaggerated as its broad size led to the inclusion of shares which unjustifiably dragged it further down. Therefore, we believe that despite the negative performance of the index, the Croatian market still offers some gems hidden in the pile.

Furthermore, the Index Committee has concluded a regular revision of the ZSE indices. It was carried out after the close of trading in Friday, March 18th. The new composition will effectively start as of today, March 21st.