It is not a surprise that most of the wealth of an average Croat comes from home ownership. For today we decided to look at the extent of their wealth exposed to real estate and whether they are underexposed to financial assets, particularly stocks.

For this we used the data by the European Central Bank collected in The Household Finance and Consumption Survey.

Very High Concentration of Wealth in Real Estate

Let us start with the obvious – real estate. Unsurprisingly, Croatians have traditionally preferred home ownership to renting. To be specific, 86.9% of households in Croatia have real estate wealth, which includes household’s main residence and other real estate property. This is significantly higher than the Euro area (64.7%), while for example, in Germany only 49.9% of households have real estate wealth.

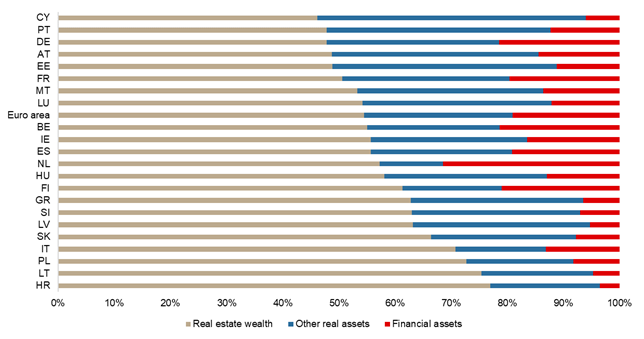

However, the fact that real assets account for 96.5% of total assets of Croatians could be seen as more startling. Of the total wealth, real estate wealth accounts for as much as 76.9%, by far the highest of 22 observed European countries. As a comparison, real estate wealth accounts for 54.5% of total assets in the Euro area.

Breakdown of Wealth by Asset Type (%)

Source: European Central Bank, InterCapital Research

Lowest % of Financial Assets Among 22 European Countries

An even more surpising fact is that Croatians have merely 3.5% of total assets in financial assets, by far the lowest of the observed countries, lower by as much as 15.6 p.p. than the Euro area. This is quite remarkable given the fact that financial assets do not only include shares, mutual funds, bonds etc. but also include sight and saving deposits, which we will touch apon further in the article.

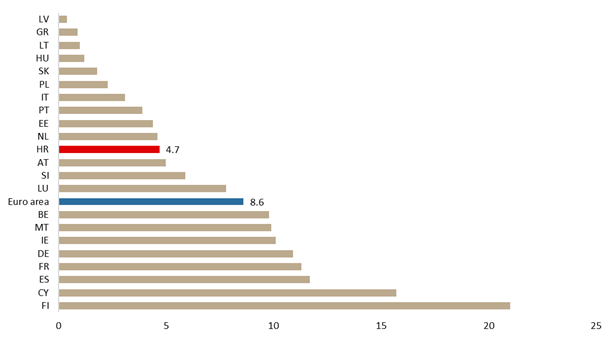

% of Households Owning Stocks

Source: European Central Bank, InterCapital Research

If we were to observe solely equities, 4.7% of total households own shares (publicly traded), which is quite lower than the Euro area (8.6%). In nominal terms, the median share ownership stands at EUR 2.1k, ahead of only Cyprus, Slovakia and Poland.

Breaking down by age groups, 6.9% of Croats between age 45 – 55 and 55 – 64 own shares, which are the highest age groups to own equities. On the flip side, only 0.2% of the youngest group (from 16 – 34) own shares.

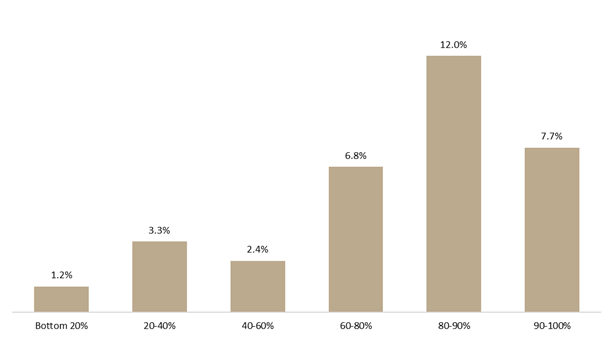

The data is not much better when looking at the wealthiest Croatians (90th percentile); 7.7% of them own shares, compared to 31.3% of the 90th percentile in Euro area. In terms of income, 8.2% of the highest earning Croats (90th percentile) own shares, compared to 25.4% in Euro area.

Turning our attention to mutual funds, only 1.4% of households are invested in mutual funds, ahead of only Cyprus and Latvia. Meanwhile, Euro area stands significantly higher at 10.2%.

% of Households Owning Stocks by Net Wealth

Source: European Central Bank, InterCapital Research

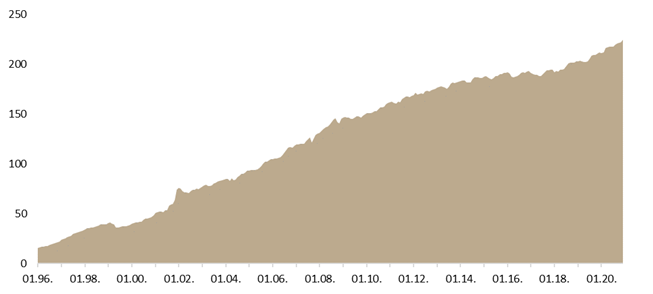

Croatians like to play it very safe – HRK 224.5bn in Deposits

According to Croatian National Bank, as of end 2020, households held HRK 224.54bn in deposits, representing an increase of 3.2% YoY and putting it on an all-time high. To put things into a perspective, this is larger than the current market cap of ZSE and LJSE combined. We note that looking at average deposits per capita would give us certainly a misleading figure, as according to ECB, top 46.6% of net wealth is concentrated among the top 10% of the wealthiest. However, the figure above indicates a relative unwillingness of the population to invest in even slightly riskier assets. Additionally, if we look at Croatian UCITS funds, their asset composition further backs the above-stated claim of Croats being quite conservative, as roughly two thirds of assets under management of all UCITS funds are related to bonds. As a comparison, in Slovenia, UCITS funds hold roughly the same percentage in equities.

Household Deposits (1996 – 2020) (HRK bn)

Source: HNB, InterCapital Research

So what does all of the above tell us? Well, it confirms quite a lot of popular beliefs, but, more importantly, it also shows the extent of untapped potential when it comes to a shift in wealth to financial assets, especially equities. With deposits and fixed income showing no yield, are Croatians going to dip their toes into equities? Time will tell.