If You missed yesterday’s FOMC press conference because You were at the pub watching the Chelsea-Dinamo match, then good news – we have compiled a research piece tracking all the highlights. The football match started as if Dinamo was going to turn a corner and record a victory against Chelsea, similar to FOMC’s statement looking as if a dovish turn (i.e. FED pivot) might actually take place. However, as time moved on it became clear that Chelsea was not going to let Dinamo get away with one early goal, eventually evening out the result at 1:1. Same with the FOMC press conference – it basically offset the initial dovish tilt stemming from the statement published earlier, strengthening the core message that the struggle to get inflation figures down is still underway.

Financial markets entered yesterday’s FOMC press conference with a significant dovish bias, although there was almost no hard data evidence to substantiate expectations of a FED pivot any time soon. Core inflation was not easing, economic activity was not slowing down, unemployment was not increasing and wage dynamics were still upbeat. Fintweets and dealer chat rooms were full of charts depicting deteriorating US government securities liquidity, such as this one:

GVLQUSD Index measures average yield error across the universe of US Treasury notes and bonds with a remaining maturity 1-year or greater. In this context 3.5bps is the highest level in about 12 years, excluding the pandemic-induced illiquidity of March 2020 (a clear outlier). However, FOMC Chairman Jerome Powell seemed unintimidated by declining liquidity in the US Treasury market and instead focused on what really falls within the limits of the FED’s dual mandate: consumer prices and unemployment. He almost ritually acknowledged the resilience of the US labor market and stated that the resilient wage growth might be one of the reasons why he seriously doubts the FED’s job is over. He also reiterated the notion that in these circumstances it’s better to overtighten and then provide relief to the overall economy by using the instruments inaugurated during the pandemic, instead of being too cautious and letting inflation expectations de-anchor.

Once FED’s Powell said that the main question on the table is not when will the interest rate plateau come, but rather how high will it be and how long will it last. Notice that when we talk about the end of monetary tightening, we’re no longer talking about the peak, but rather about a plateau – implying that higher interest rates might stay with us for a while. Critics of the FED have already pointed out that the FOMC is behind the curve since the median dot tends to follow the core PCE YoY; currently, core PCI YoY is at +5.1% YoY, while the median dot is at +4.4%. Nevertheless, if the PCE stays above +5.0%, you can bet the median dot moving closer to +5.0%. Actually, markets have already figured it out and currently price the beginning of the plateau in May at 5.138%:

We believe the FED fund plateau instead of the FED fund pivot is the main takeaway from yesterday’s FOMC press conference. To substantiate this, compare the upper (November 03rd) WIRP US snip with the snip taken just six days before (October 27th):

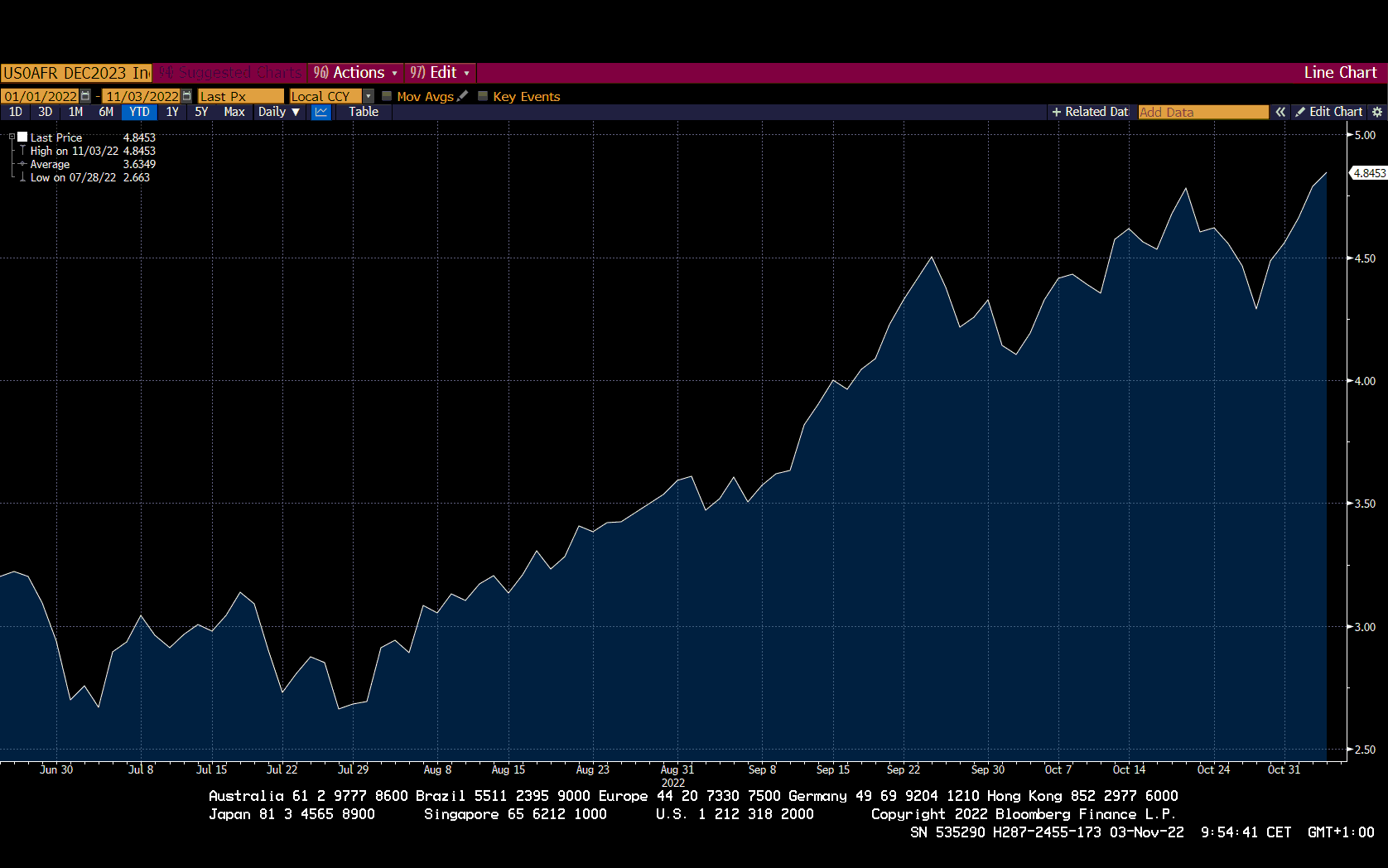

Now compare the expectations for December 2023 meeting: these have gone from 4.29% to the current value of 4.83%. Actually, you can see the whole time series by typing US0AFR DEC2023 Index in Your Bloomberg terminal, but if You’re too lazy to do it, we’ll do it for You:

This is actually the underlying reason why bond markets fell apart yesterday, taking with them global equities and causing depreciation of all the majors against the greenback. Three large dealers sent us their morning notes arguing for USD long positions, however, we remain slightly skeptical since it’s clear that the FED plateau is already baked into the prices of currencies and bonds.

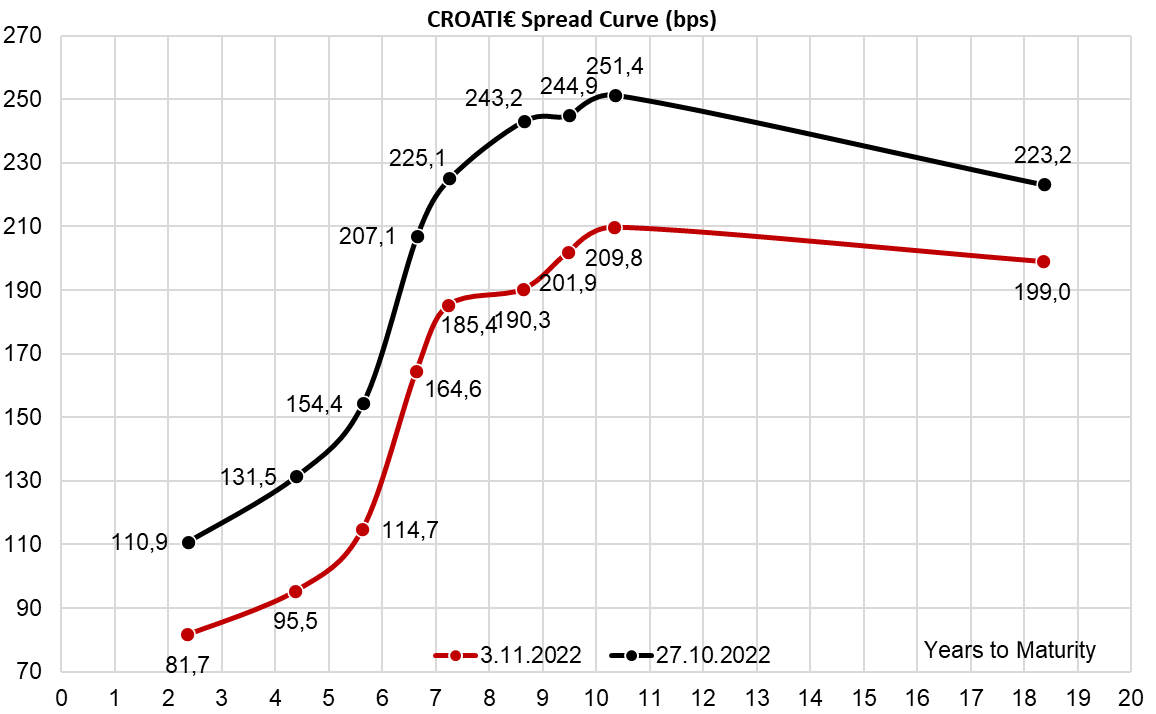

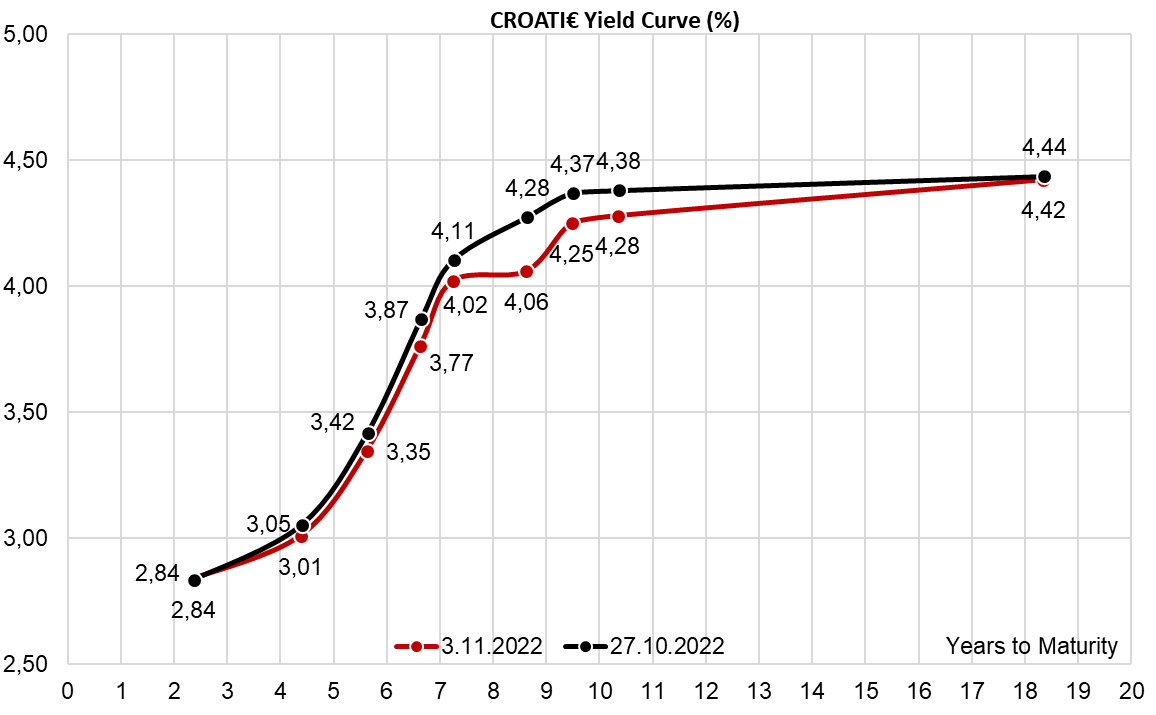

How are Croatian bonds going through this change of heart? The spreads were contained at first and this morning staged another bout of tightening. This morning bigger sizes of CROATI 2.875 03/04/2032€ could be bought around 89.60 (4.23% YTM, B+200bps), signaling that CROATI€ is still well supported by real money bids, both domestic and offshore.