2023 was a volatile and tough year for financial experts. The market narrative has changed several times over the course of the year, switching back and forth between recessionary scenario and higher for longer scenario. However, inflation has had constant downward pressure due to base effects and a significant reduction of inflationary pressures in 2023.

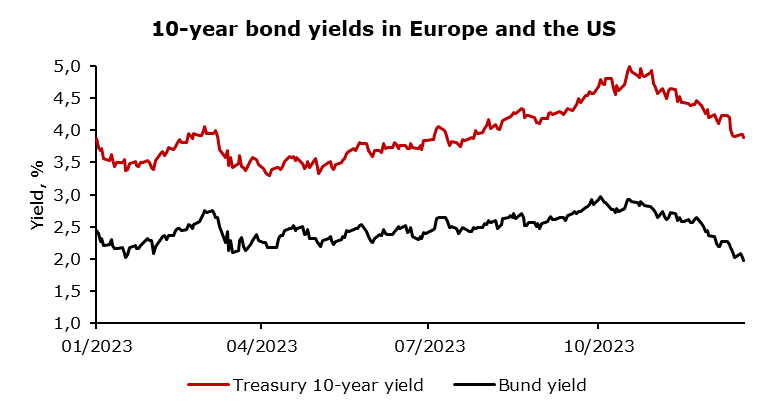

Since the start of the year, 10-year bond yields have significantly dropped, mostly in November and December as the inflation pressures seem to be contained without concerns of second-leg inflation. Also, Germany and the US have significantly reduced planned issues of debt instruments driving the Bund below yield at the start of the year and 15 bps yield above for the US Treasury. The slowing of economic activity is clearly a more prominent phenomenon in Europe.

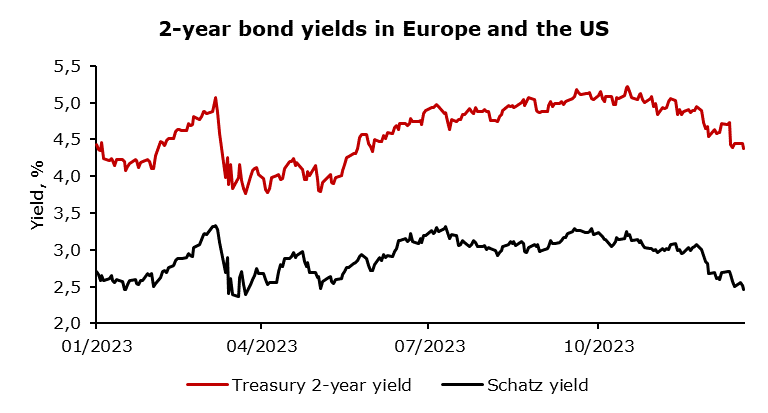

2-year bonds are highly dependent on central bank communication and policy. Since Fed Chairman Powell announced a U-Turn in Fed’s policy for 2024 and a significant portion of the data showed the deceleration of growth, 2-year yields have dropped back to the levels below the yields seen at the start of the year as the inflation is contained and Fed explicitly saying that they should focus both on maximum sustainable employment and price stability. Christine Lagarde denied the possibility of cuts in the near future, however, she highlighted the data-dependency of the ECB which might follow Fed, as it was with hiking in 2022.

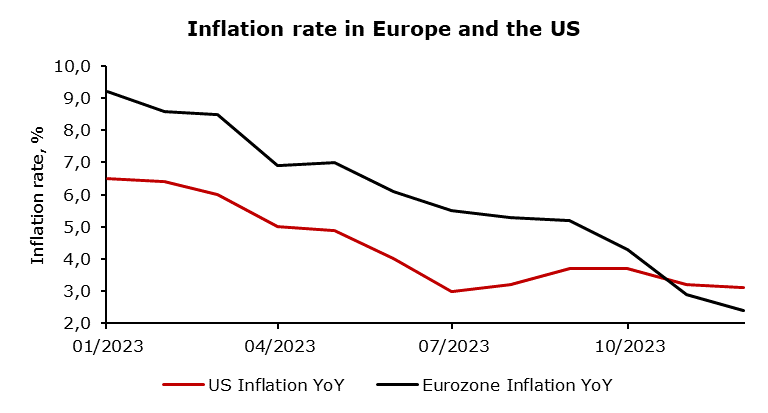

The inflation rate is sending an unequivocal message to the markets. Inflation is in a downward trend both in the eurozone and across the Atlantic with Europe below levels in the US even though it was higher in Europe the whole year. It can be attributed to the energy shock that is now resolved in Europe and sluggish economic growth in contrast to the US.

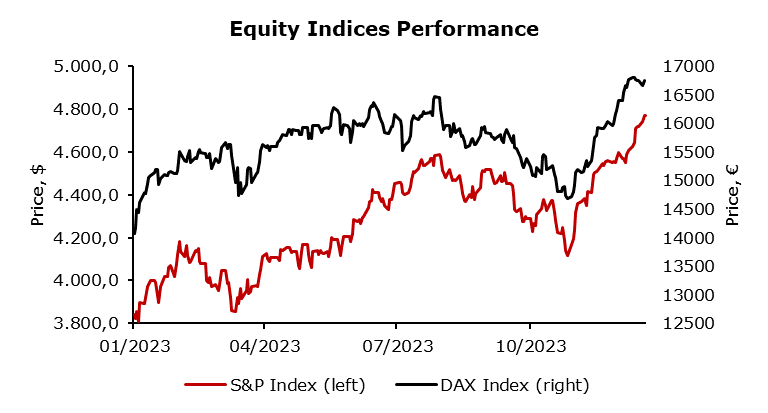

Markets had a gloomy outlook for the world economy at the end of 2022. As the economy did not collapse, the energy crisis was partially resolved and inflation dropped significantly in comparison with 2022, stellar growth of the equity indices was the end result of the equation. It is doubtlessly the best-performing asset class of 2023.

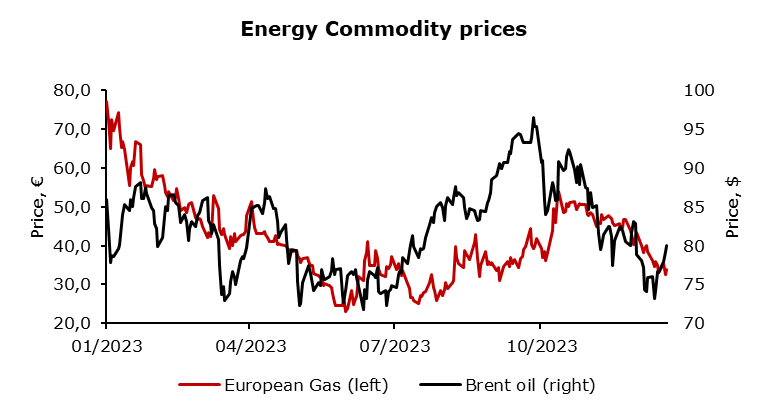

A significant contributor to the disinflation was commodity prices. Both natural gas and oil prices fell significantly, impacting producer prices which consequently led to disinflationary pressure on consumer prices. The year was full of new uncertainties (Israel – Hamas war, Guyana – Venezuela conflict, concerns over Taiwan security), however, the energy prices weren’t able to stay at the high levels seen in 2022. Downward pressure from heightened US energy production and recessionary outlook pinned them well below 2022 levels.

2023 unfolded as a year of fluctuating narratives and economic shifts. The financial landscape witnessed dramatic changes in market sentiments, oscillating between recessionary fears and a ‘higher for longer’ scenario. Notably, inflationary pressures eased across the eurozone and the US, primarily attributed to resolved energy shocks in Europe. Bond yields, influenced by central bank policies and economic data, notably decreased, especially following Fed Chairman Powell’s policy pivot and ECB’s data-dependent stance. Despite uncertainties from geopolitical tensions, the resolution of energy crises and significant drops in commodity prices led to disinflationary pressures, driving equity indices to remarkable growth. The year concluded with equity markets emerging as the top-performing asset class. While challenges persisted, the global economy navigated through uncertainties, showing resilience and adaptability amidst the evolving financial landscape.