Although there were merely five full trading sessions YTD, it’s been quite a ride with with tensions developing, and then quickly debasing on the Middle East. The key question we always try to answer is – what happens next? Find out in this brief article.

The key word over the past five trading sessions has been volatility, and we’re talking about realized volatility in particular. The expression “geopolitical tensions” has been recycled over and over again as chain of events unraveled before our eyes: as protesters stormed US embassy in Baghdad on New Year’s day, US administration escalated tensions by liquidating Iranian Major General Qasim Soleimani in a drone attack on the outskirts of Iraqi capital. Middle East erupted in anger and Iranian leaders pledged retaliation. Their reaction was to lunch 15 missiles on American military bases in Iraq, but the mainstream media claims that no human casualties were afflicted in these attacks. This was the reason why President Trump advocated for de-escalation of conflict, perhaps understanding that he might have gone too far with killing Soleimani without consulting with allies first (on the other hand, if he had consulted, it’s possible that the information about possible US attack on Iranian general might have leaked and jeopardized the result of the entire operation altogether).

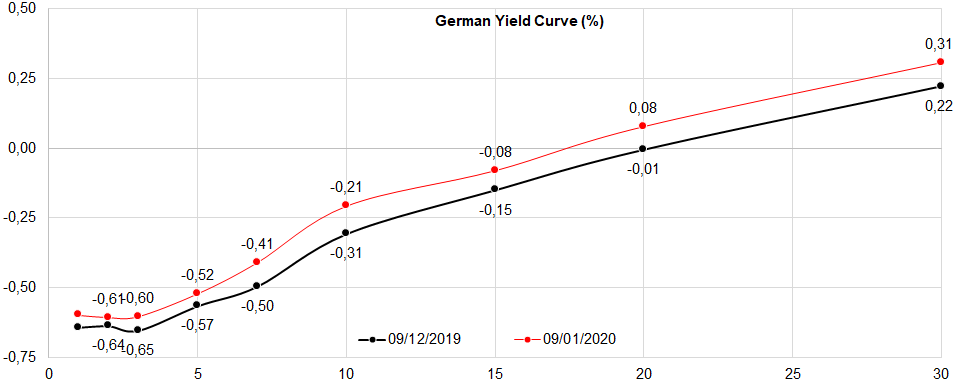

Drone attack and Iranian retaliation caused typical safe havens such as VIX, yen, Bund and gold to spike, and notable reaction was marked on WTI/Brent as well, but the key word of today is de-escalation. Following Trump’s yesterday’s address, risk on sentiment has gripped markets and currently equity indices across the board (S&P, NASDAQ, EUROSTOXX 50, DAX etc.) are recording new all-time highs, while safe havens are paring recent gains. During a brief risk off episode at the beginning of the year, Ireland, Portugal and Slovenia decided to benefit from the overall situation and become the first European countries to issue new debt this year.

Considering Slovenia, 1.5bio EUR worth of a 10Y local bond (SLOREP 0.275 01/14/2030) was issued to repay the maturing SLOREP 4.125 01/26/2020. Early Tuesday morning we received IPTs @ MS+25bps, but since the demand exceeded the amount issued by a scale of nearly eight, the paper was placed @ MS+19bps (YTM in size of 0.296%). Issued at reoffer price of 99.793, the holders were please to see the market move as high as 100.22 (bid price) in yesterday’s session, but it’s dubious to see where the paper might trade today because of the sharp rise in yields overnight as fear was out an FOMO was in. Speaking about Slovenian fundamentals, the European Commission expects public debt to drop to 63% GDP by the end of 2020, while next year it would finally return below the Maastricht figure of 60% GDP. Slovenian government keeps ample liquidity buffers at the central bank (last November these amounted to 3bio EUR and were charged 0.50% worth of parking costs) and it’s also worth remembering that Slovenian government still has quite a chunk of assets that could be privatized in order to boost cash buffers even further. Also, don’t forget that when the SLOREP 4.125 01/26/2020 matures in late January, the proceeds received by the European system of central banks would likely be reinvested into new SLOREPs, providing more support for Slovenian government bonds.

OK, so demand for Slovenian paper is solid, but what about general economic conditions and their effect on benchmarks (mid-swaps and Bund)? Well, the figure we’re all waiting for is tomorrow’s NFP. For what it’s worth, Wednesday’s ADP employment change surprised with a +202k print versus +160k expected. It’s worth noting that the initial November print reported +67k increase, which probably affected analyst consensus expectations. The November figure was subsequently revised all the way up to +124k, while in that same month NFP surprised as well with a +266k print. NFPs have been beating market expectations since summer, but this scenario might not play out in December due to seasonality of labour demand for in the US. Nevertheless, even a weak NFP print would be insufficient to derail market rally. Also, in October Powell said that he needs to see persistent rise of inflation just to consider possible interest rate hike and with interest rates as low as they are currently, the market might have more room to run.

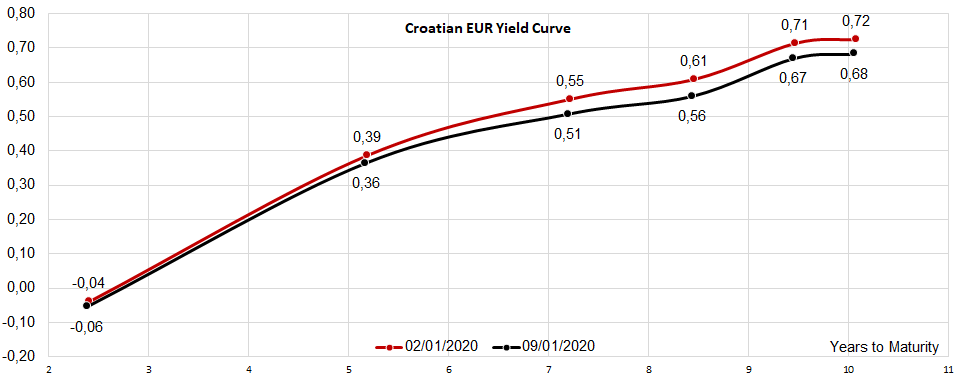

Finally, Croatian international bonds reported a muted reaction, albeit a modest drop in yields was observed across the EUR curve. At this point in time it might look as Croatian eurobonds are trading at too tight spread compared to comparable countries. Think about this, for instance: the spread between CROATI 2.7 06/15/2028 (BBB- under S&P and Fitch) and REPHUN 1.75 10/10/2027 (BBB under S&P and Fitch) is currently only 29bps; this is just an inch away from all-time low of 25bps. Exactly one year earlier the spread stood at 100bps, for instance. It’s clear that there are some fundamentals at play (such as Croatia entering ERM II in the near future, and Hungary determined to stick to it’s monetary sovereignty), but still the spread looks quite tight and possible that this might attract CROATI sellers in the coming weeks.