After a few years, Roaring Kitty is back which caused GameStop to jump in price from around 10 to a high of 64.83 on Wednesday. The jump in price caused rising Implied Volatility of options on GameStop, which doubled in just a few days.

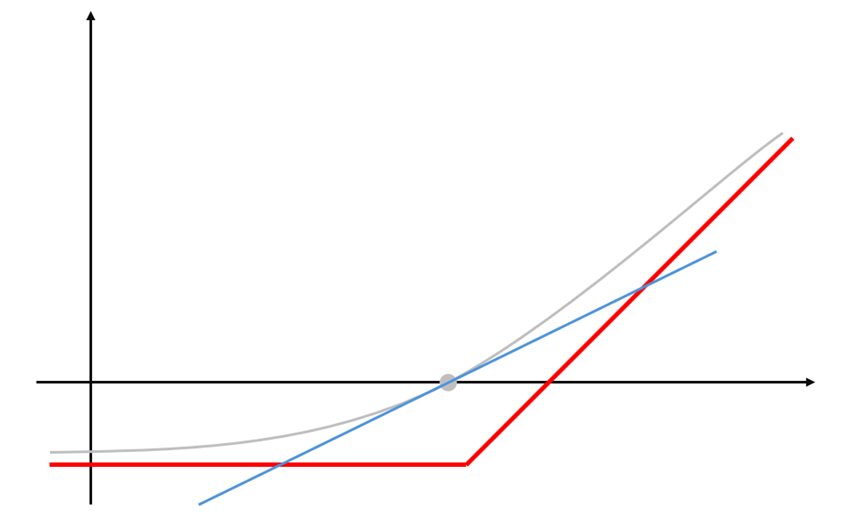

Let’s look at what implication this move in price has on option prices. Standard call pricing is given on the next PnL graph where the red line shows the value of a call option at maturity and the grey line shows the current pricing of a call.

The blue straight line is the tangent on the grey line, so the angle of the blue line represents the Delta of a call with the strike in the grey dot.

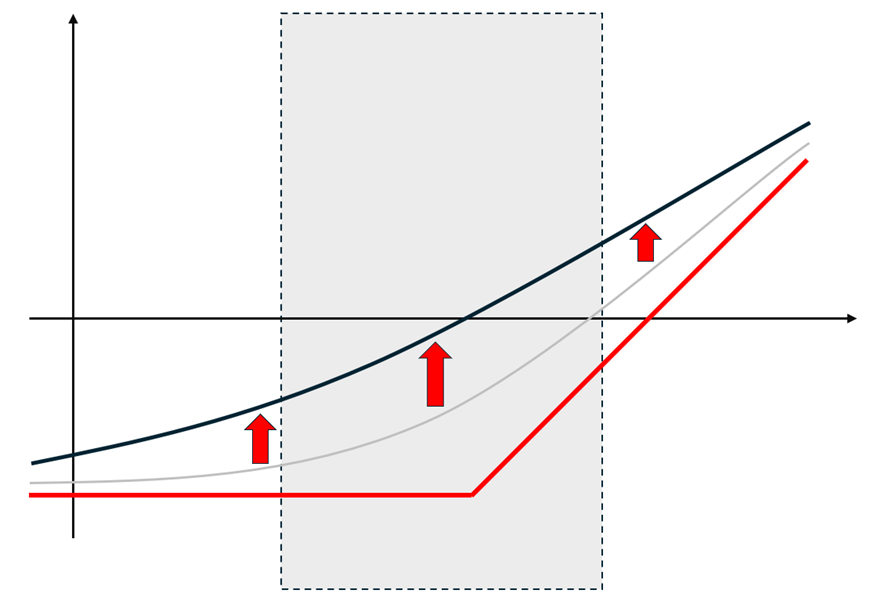

Growing Implied Volatility puts pressure on the center part of the curve that represents current call pricing. Tails still need to converge toward the maturity pricing so they don’t receive equal growth as strikes near the spot price. The next PnL graph shows the curve that represents price of a call after major growth in Implied Volatility.

The black curve represents the current pricing of a call after large growth in Implied Volatility. Because the black curve is much closer to the straight line, the delta (angle of a tangent on the black line) changes much more slowly on both sides. That is the reason why calls on strikes in the grey rectangle have a similar delta that is close to 0.50 what we have seen these days in options on GameStop.

The gamma is the second derivative of an option price line, so it is the first derivative of the curve that represents the delta. Because the change in the Delta is getting smaller, as we argued above, that means that gamma is also moving towards zero. This phenomenon is known as the gamma squeeze.

Initially, strong bull movement in the price is now forcing option sellers to delta hedge shorted calls so they are forced to buy even more of an underlying asset that consequently puts even more pressure on an initial bull movement so that the price of an underlying asset keeps growing. Because the price is at then even higher, option sellers are again forced to buy an underlying asset which creates an infinite loop that forces gamma toward zero. This infinite loop is a convergent series that stops after all positions are hedged but in the process, it derives large movement in price.

GameStop prices last week showed large volatility that produced a gamma squeeze but seems like the initial move is starting to reduce.

In the next few days, we will see if the GameStop price has the strength to produce another gamma squeeze like we saw in 2021.

As explained above, a similar phenomenon can happen after the strong bear movement when option sellers (here we are talking about puts now) need to sell even more of an underlying asset to delta hedge their position which consequently puts even more downward pressure on an underlying asset price. Although the process is similar, the biggest difference is that there is a limit on the downside (the lowest price is zero), which we don’t have on the upside because the price can converge toward infinity.