About six months ago a good way to build up EGB position was to wait for primary market, place a bid, get allocation and collect the new issuance premium in size of 15bps-40bps. If you were trading less liquid sovereign paper, this premium could have exceeded 50bps. So on the start you were a couple of big figures in plus, depending upon the duration of paper. What a way to start the day! Well, eventually all good things come to and end. Take a look how this premium evaporated on the most recent Slovenian bond placement.

Yes, they did it again. And for the fourth time this year. Slovenian Treasury Directorate reported on Tuesday that they successfully ended 30Y bond placement worth 1bn EUR at 0.493% YTM (MS+50bps). The placement itself was followed by a tender offer to buy back January 2021 and April 2021 paper and Slovenian Treasury Directorate accepted about 173mm EUR of offers (netting some 827mm EUR of proceeds).

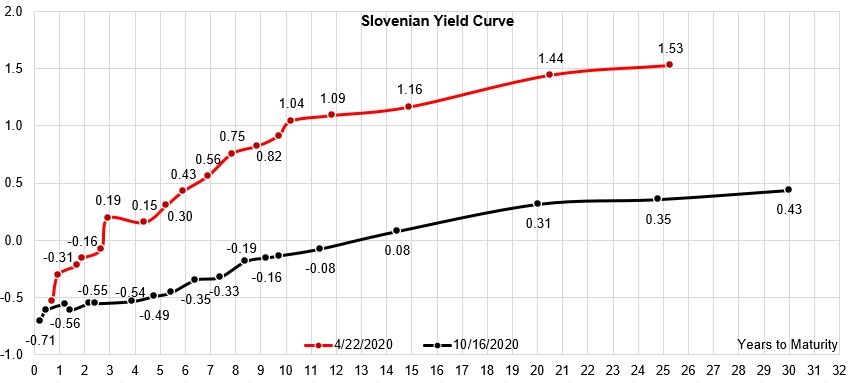

The placement of currently the longest Slovenian paper (maturing in October 2050) began with IPTs of MS+65bps, which was considered quite generous at a time. As the orderbook swelled, the spread was gradually getting tighter and in hindsight it seems that a substantial amount of orders was placed at MS+55bps. With revised guidance at exactly that level (MS+55bps) the orderbook reached its maximum seize of 7.5bn EUR, meaning that tightening even further would imply a decreasing orderbook size. With book as big as it was, nobody really cared, so the arrangers tightened the premium by further 5bps to MS+50bps, which trimmed about 2.3bn EUR of orders and ended the orderbook at 5.2bn EUR. The final spread actually meant that new SLOREP 0.4875 10/20/2050 was placed inside the existing yield curve, which caused a bit of consternation among some of the investors. By glancing at chart submitted below, one can see that this doesn’t leave much of the term premium on the ultra-long end, however investors such as life insurances are quite satisfied to add this duration to their balance sheets.

It’s worth mentioning that MS+50bps valuation implied a negative value of the so-called new issuance premium (NIP) in size of some -10bps. Seasoned traders with a good memory would remember that on the bond placement in March, when Slovenia placed a dual 3Y/10Y tranche, the NIP was as generous as 35bps/15bps, respectively. It was similar just two weeks later when inconclusiveness over EU aid motivated Slovenian fiscal authorities to place a triple tranche on the market, handing over NIPs in size of +16bps/+5bps/+12bps (3Y/10Y/25Y paper, respectively). But those were different times and although the ECB announced that it will not let markets collapse/spreads explode, the investors were still worried about a potential disbalance of bond supply and central bank demand. This could explain the premiums required in order for the placement to go on smoothly. We’re obviously in a different environment now and with all that ECB support it’s no wonder that investors are now prepared to put EGB bonds on their B/S that are already issued below the outstanding yield curve. This means that if you were expecting to make a quick buck on flipping the newly issued EGBs before the settlement date on the upcoming primary markets, be mindful that the bonds you buy are already too expensive and only a positive momentum on the benchmark instruments can save you from incurring losses. It seems that money cannot simply be picked up from the Street the way it was just six months ago.

But more on Slovenia. As we mentioned before, this is the fourth bond placement conducted by Slovenia in 2020 and with these corporate events Slovenian Treasury Department managed to collect 5.85bn EUR of gross proceeds, a minority of which was used to refinance the pre-existing debt, while the lion’s share went on to support the dwindling economy.

Speaking about the Slovenian economy, in it’s October update the IMF ameliorated Slovenian GDP drop this year, which is now expected at -6.7% YoY (versus -8.0% YoY expected in April). At the same time a rebound is expected in size of +5.2% YoY in 2021 and this forecast hasn’t been trimmed down significantly compared to the April figure. When you think about Slovenian economy, don’t forget the fact that the Alpine country has a gross domestic product heavily oriented towards manufacturing, which is the economic activity most likely to go through a V-shaped recovery. As a matter of fact, added value of manufacturing in Slovenia made up 23.2% of overall GDP figure and by this metric the Alpine country is trailing only Ireland (33.5% GDP) and Czech Republic (24.8% GDP) in EU-27 class. Out of the total 8.9bn EUR of added value in 2019 delivered by Slovenian manufacturing, chemicals (2.2bn EUR) and machine manufacturing (1.7bn EUR) contributed with a significant share. This reliance on manufacturing is an additional insurance that when EU economies start to recover, Slovenian economy might be a bellwether. And this perspective makes Slovenian bonds even more attractive.