If Frank Sinatra was alive and well today, it would have been his 104. birthday. The author of countless evergreens that are still extremely popular in retirement homes across the globe is recognised as the author of existential anthem “My Way“, in which he states: “Regrets, I’ve had a few/ But then again, too few to mention. / I did what I had to do / And saw it through without exemption“. The last two verses could easily be applied to FOMC this year – they did what they had to do (three cuts) and saw it through without exemption. What could they do in the following two years? Find out in this brief article.

The last FOMC meeting this year went by quite unremarkably – the rates are unchanged (FED funds @ 1.50%-1.75%), the US GDP growth expectations are kept unchanged (2.2% 2019, 2.0% in 2020, 1.9% in 2021, all in real terms) and the only major tweak came in core PCE inflation where FOMC now expects 1.6% increase in 2019 versus 1.8% expected in September. Median dot in 2020 is close to the current level, implying no rate cuts next year, with next rate hike possibly in 2021.

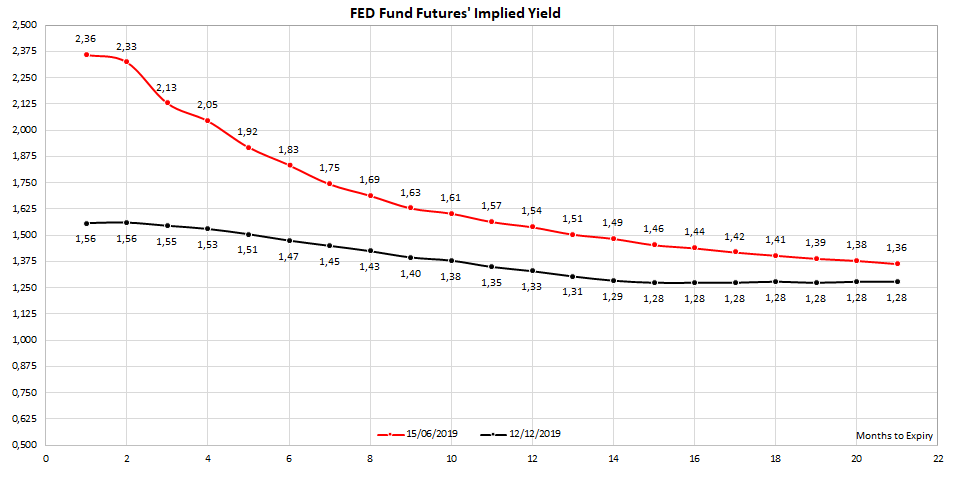

Looking at 2020, only four out of seventeen FOMC members expect a rate cut next year. Since ten out of the seventeen are eligible to vote next year, even if all four of the hawks are voting members, still there wouldn’t be enough hands for a rate hike in 2020. This means that there’s a wide consensus to keep the rates unchanged in the election year. The decision came in the aftermath of the best NFP print since January (266k jobs in November versus 312k in January). Looking at the FED fund future chart submitted below, it’s easy to spot that FED and the markets are on the same page in 2020, but diverge in 2021 since markets imply one interest rate cut in 2021 in the midst of a slowing economy.

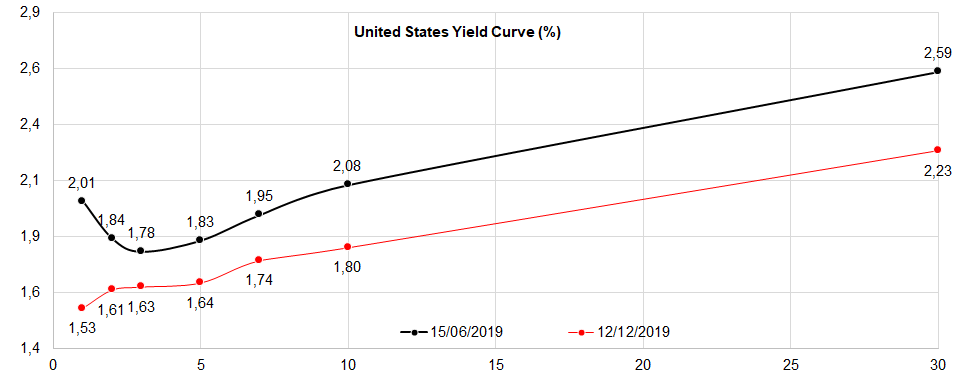

After being inverted for a couple of months, US curve is back into positive shape, with US 2Y10Y spread at 19bps (1.80% – 1.61%). The notorious recession predictor dipped into negative in the second half of August, but returned back to zero at the beginning of September and went as high as 27bps in mid-November. It’s worth noting that Federal Reserve Bank of San Francisco published a brief report stating that spread between 3 month and 10 year yield is by far the best traditional recession predictor twelve months into the future. This recession gauge inverted for a very brief period in time in March and it’s worth mentioning that it was deeply in negative between end-May and beginning October. If the indicator is right this time, recession might start sometime between March and October 2020 – with tight labor market in US and pending trade wars without a clear indication of when the tariffs might be rolled back, it could happen that the FED has to cut rates at least one more time, possibly ahead of the presidential election.

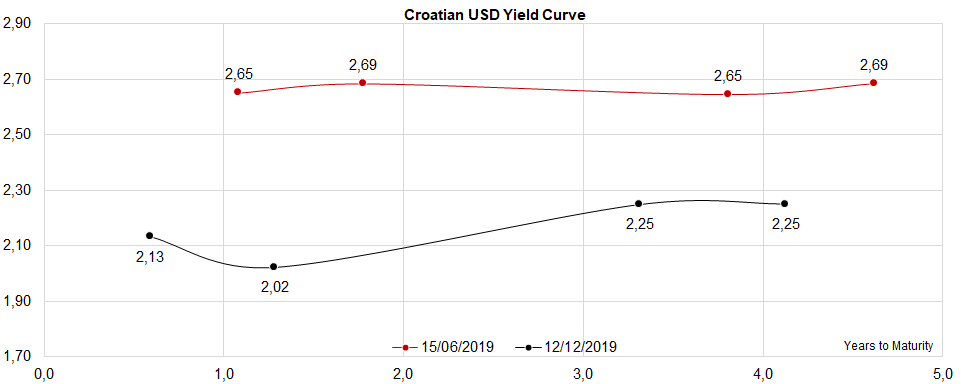

Speaking about Croatian USD yield curve, the shape has slightly changed compared to where it was six months ago. Back in June the curve was flat as a pancake, but now at least some of the term premium has emerged. Back in August, Croatian banks had a total amount of 5bio HRK (754mio USD) in greenback bonds, roughly half of it in Croatian Eurobonds (2.52bio HRK or 373mio USD). The total position in USD paper corresponds to the amount of USD deposits held by households and corporations in Croatian banks (6bio HRK, according to D8a table from the central bank). More importantly, back in August about 797mio HRK were in CROATIA 2019 USD, the Eurobond that matured in early November. It’s difficult to foretell where these proceeds in size of roughly 118mio USD went since the supply of Croatian dollar bonds is rather tight. The supply is only going to get tighter since mid-July next year CROATIA 2020 USD is going to mature as well, removing 678mio HRK (100mio USD) off the market. Banks will remain a net buyer of dollar assets because of the FX structure of deposits they carry on the liability side of their B/S – the only question is, which assets?