Abraham Lincoln once said: “The house divided cannot stand“. It’s Mario Draghi’s last monetary policy meeting and his legacy is that a divided house (the euro area) still stands. On the other side of Atlantic the FED is preparing for possibly it’s last rate cut in this cycle. Markets are betting on a reflation trade next year, although it’s much too soon to forecast what 2020 has in store for us. Instead, let’s take a look at what can we expect before the turn of the year.

Although it’s Mario Draghi’s last monetary policy meeting, his statement @ 14.30 CET would not get the attention it usually deserves. The head of ECB would probably use this opportunity to once again try to sway heads of European governments to put aside their biased austerity policies and introduce more fiscal support for the dwindling GDP growth. It was just last week that Gita Gopinath from IMF downgraded 2019 EA growth forecast to merely 1.2% YoY (down 10bps compared to April), with German forecast being knocked down the most – by as much as 30bps versus April figures. The sky has been cloudy over Berlin for quite some time – Brexit spill overs, as well as trade tensions with the US and slowing Chinese growth have all weighed on the prospects of the largest European economy. And although the policy of strictly balanced federal budget (“schwarze Null”) has been attracting criticism even from domestic economic policy institutes, the government still seems reluctant to foot the bill and give the economy a more formidable push.

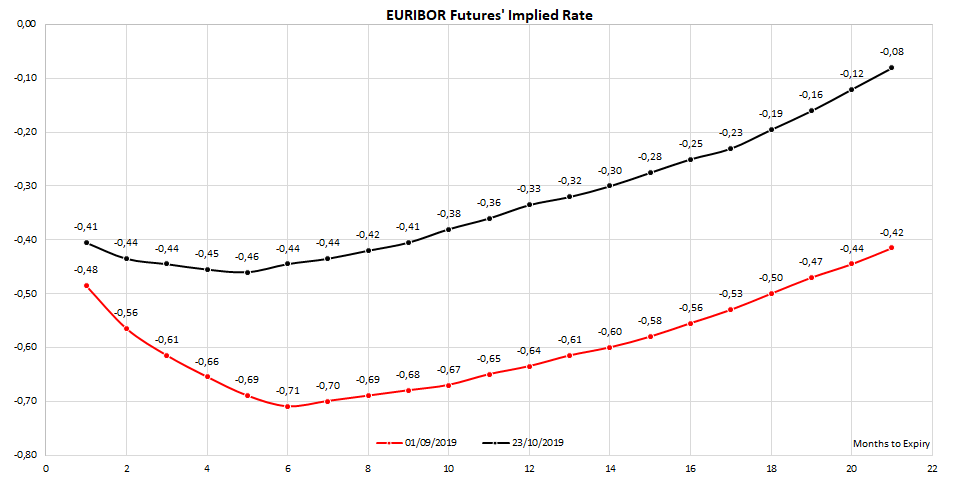

The good thing is that short term rate expectations are gradually rising, as indicated by the EURIBOR futures chart. The EURIBOR curve steepened significantly compared to beginning of the last month and currently the financial markets expect that around spring next year the EURIBOR would find itself on its lowest ebb; after that a slow, but steady growth is expected. This might be good news for European banks, but bear in mind that the banking sector would start preparing for introduction of Basel IV (expected to be put into force between 2022 and 2027). Just recently Jean Pierre Mustier, the president of European Banking Authority (and Unicredit AG as well) said that this legal overhaul would reduce CET1 ratios of large European banks by as much as 27%; in US the comparative change would equal 5% or 6%. Tough times for banks might continue in spite of the announced payroll cuts.

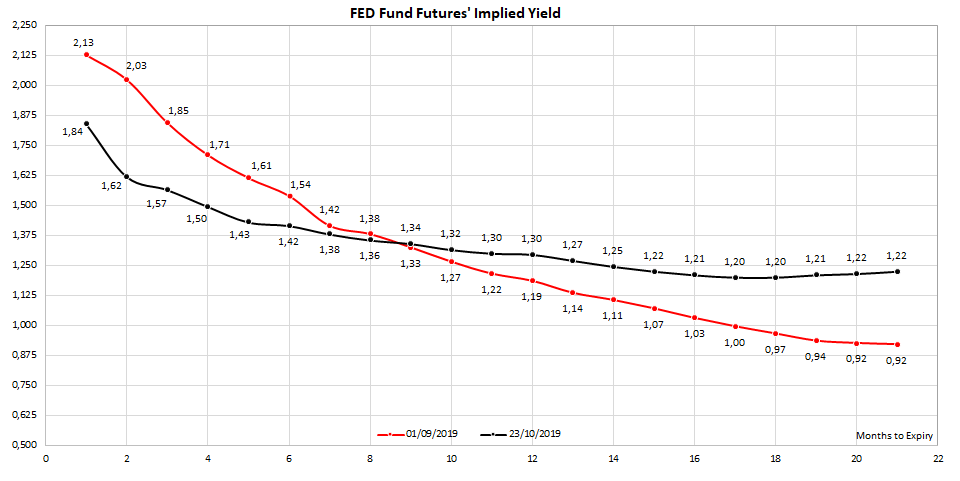

The really important event before the turn of the month would be next week’s FOMC meeting, which is expected to deliver another FED fund rate cut and lower down the target band to 1.50%-1.75%. Taking a closer look at the FED fund futures curve reveals that the front month futures contract still implies a 1.84% FED fund rate. This is because the first futures contract expires on the same day when the meeting ends (October 31st), and the new FED fund target band comes into force on the day following the meeting (November 01st). The curve also suggests one more thing relating to rate cuts: that’s all folks, at least for 2019. The January futures implies a FED fund rate in size of 1.50% (fourth dot from the left on the black curve) and the next rate cut might not come before January 29th 2020 FOMC meeting. Easing of the trade tensions helped to flatten the FED fund futures curve, now it’s up to Washington and Beijing to deliver more than just a handshake.

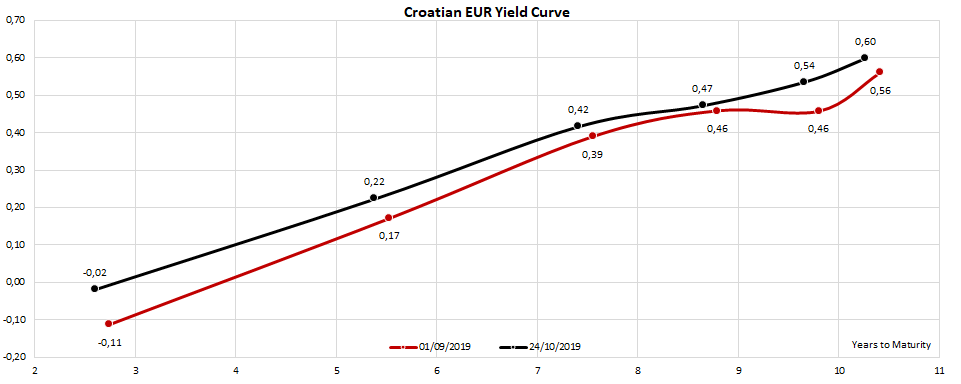

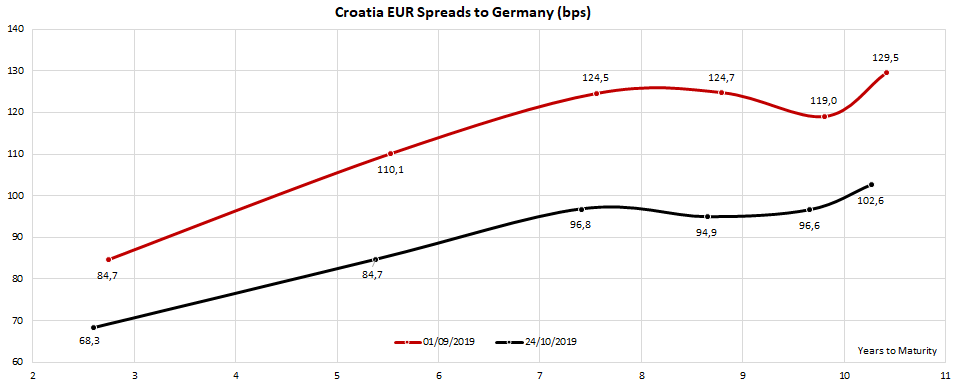

Speaking about the Croatian EUR-denominated international bonds, there’s been considerable supply pressure on the longer part of the curve, although yields haven’t moved much compared to beginning September. Since the German benchmark moved up in terms of yields, the spreads tightened and currently only CROATI 2¾ 01/27/30 trades at a risk premium higher than 100bps.

Before the turn of the year three things are worth keeping an eye on. The first one is the 2020 budget due to the promise made last week about the rise of public wage bill. The second thing are presidential elections taking place probably during the last weekend before Christmas (the run off would obviously take place after New Year). Although the role of the President is dwarfed in influence compared to Prime Minister, the elections would shed light on how could the next year’s parliamentary elections play out. And finally, Fitch rating review would take place on December 06th; a rating upgrade is difficult to expect after the agency returned Croatia back into investment grade in June, but it’s worth looking at how the outlook evolves. Even with the fiscal largesse promised last week, sound GDP growth would likely keep the public debt on a decreasing trajectory, and with ERM II just around the corner maybe the agency decides to lift the outlook from stable to positive. After all, December 06th is Saint Nicholas Day and so far public finances have been on their best behaviour this year.