Croatian public debt has been steadily decreasing on a relative basis, but rating agencies have so far been dormant to these improvements. This might change today – Fitch is set to review Croatian rating today (April 14th, 2023). Might be a non event, might be something to write about next week. What to expect? Well, You’ll just have to read the full article to find out.

If You missed the latest string of Eurostat press releases concerning EU public debt (link), here are the main takeaways. By the third quarter of 2022 three EU countries managed to bring the public debt down significantly on a relative basis: Greece (by 24.7% GDP points, from 202.9% GDP to 178.2% GDP), Cyprus (by 14.9% GDP, from 106.5% GDP to 91.6% GDP) and – Croatia (by 11.1% GDP, from 81.5% GDP to 70.4% GDP). The story about Greece returning back into investment grade has been all over the news lately (note to the readers – this hasn’t happened yet!), but what about Croatia? In the third quarter of 2022 Croatian public debt dropped below Slovenian reported value (70.4% GDP vs. 72.3% GDP, respectively), although Slovenia has a sovereign credit rating at least two notches higher than Croatia (AA-/A versus BBB+/BBB+). Could this fact be corrected today late in the afternoon when Fitch is scheduled to review the Croatian sovereign rating?

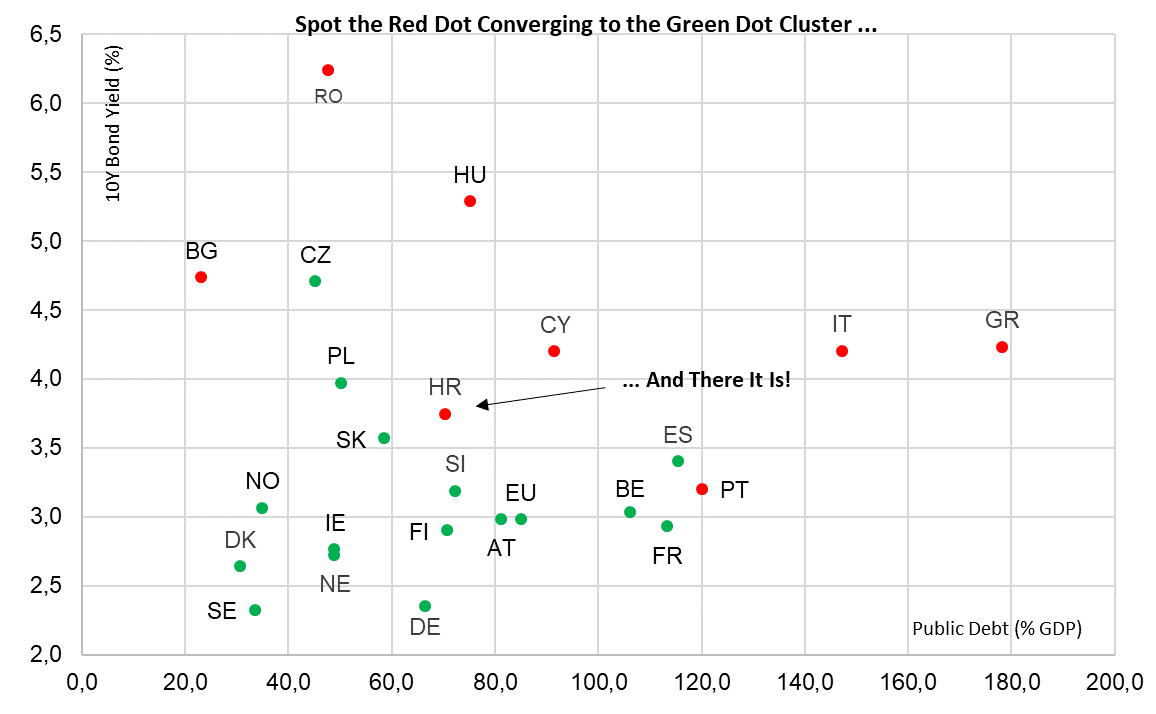

To provide an answer to this question, let’s take a look at the first bubble chart with public debt and 10Y bond yield on the horizontal and vertical axis, respectively (Eurostat and Bloomberg are used as sources). To make the matter more straightforward, we painted the BBB-rated countries red, and A-rated countries green. Notice Croatian public debt/10Y yield gradually converging to the green cluster, although the Croatian dot appears on the outer limit of the cluster. There is one more catch – Croatian prime minister Andrej Plenkovic recently came forward with central bank data about Croatian public debt dropping as low as 68.4% of GDP at the end of 2022. This would put the Croatian dot deeper into the green cluster (A-rated countries, or better). Before proceeding, bear in mind that the mentioned reduction in public debt happened primarily on a relative basis, i. e. in relation to nominal GDP. In absolute terms, public debt reduction is barely visible: from 45.86bn EUR (2Q2021) to 45.69bn EUR (3Q2022). If You are too tired to do the math on Friday morning, that’s 170mm EUR (0.37%). But on the other hand, Greek absolute reduction was close to non-existent, while Cyprus managed to bring the debt down from 24.8bn EUR (3Q2021) to 24.0bn EUR (3Q2022). That’s 800mm EUR (3.2%) for the lazy ones!

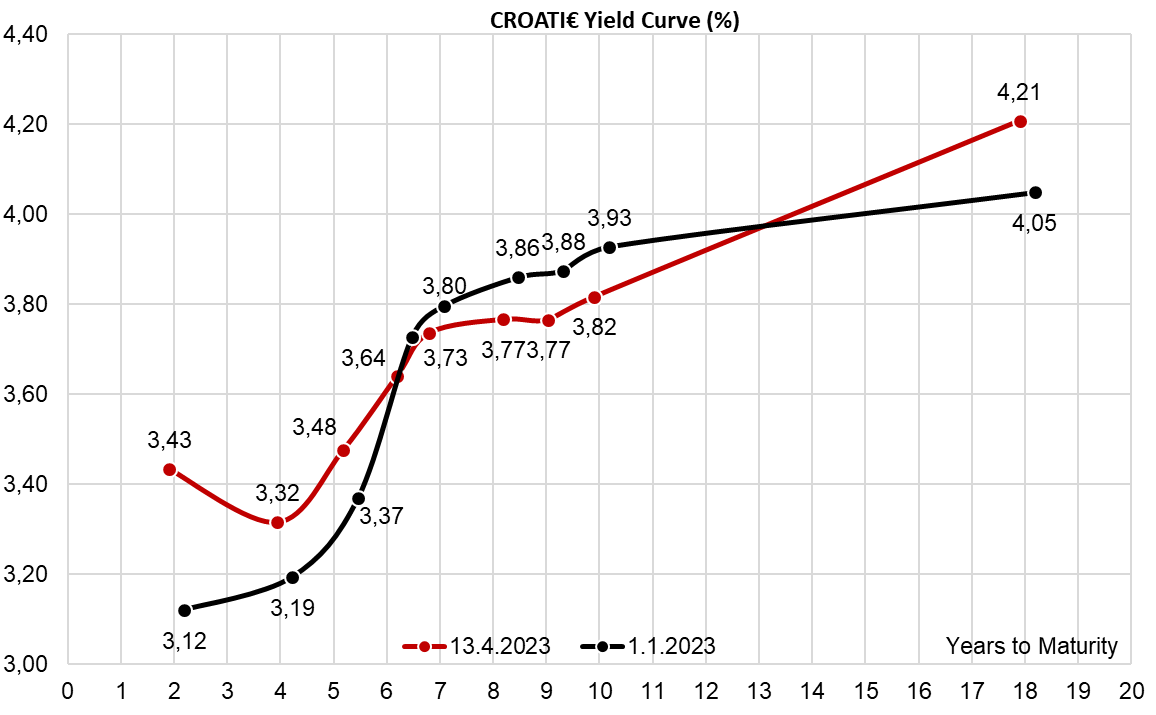

So why aren’t the Croatian 10Y yields closer to the green cluster? Doesn’t the bond market already price such trends? We stick to the opinion that the expectation of a 1.5bn EUR-heavy Croatian international bond in the second quarter of the current year might have played a part here. Institutional investors are keeping their cash on the sideline in order to enter new positions on the primary market, hopefully collecting some 10bps-15bps NIP and getting the paper at bid levels.

To provide more clarity on Fitch’s decision today, it’s worth bearing in mind that the rating agency currently keeps the Croatian outlook stable. With the current macroeconomic framework, we believe the rating agency might raise the Croatian outlook to positive today, before moving the rating deeper into IG. It’s quite likely that the agency will wait until the end of summer to have better visibility of the tourist season and EU fund withdrawal.

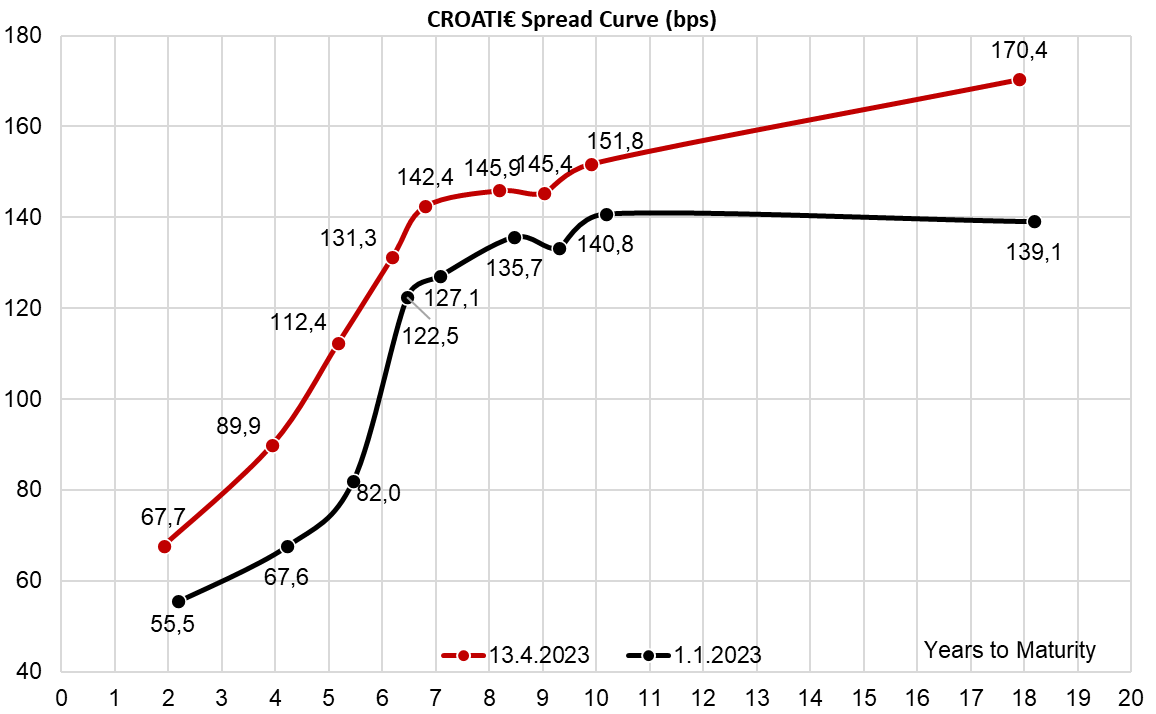

How is the Croatian bond market digesting the possibility of the imminent sovereign rating upgrade? Well, the “retail” bond (CROATE 3.65 03/08/2025, link) is still offered at 100.60 levels, or at 3.30% YTM levels. This is some 30bps above the Spanish (A/A-) yield of equivalent duration. Should the Fitch really play out according to our playbook (outlook improvement from stable to positive, the rating remains unchanged at BBB+), it’s going to be really interesting on Monday to see how are investors calculating in this news. Moreover, there are some Croatian international bonds this morning, such as CROATI 1.500 06/17/2031€ @ 3.74% YTM, B+141.5bps and CROATI 1.125 03/04/2033€ @ 3.79% YTM, B+146.4bps. Notice that for instance SPGB 3.15 04/30/2033€ is currently traded at 3.42% YTM, so there are some 30bps of tightening to unwind should Croatia get that rating upgrade by the end of the year. It’s also worth remembering that the next rating reviews are scheduled for September 15th (S&P) and October 06th (Fitch).