On its yesterday’s monetary policy meeting, Fed decided to increase its reference rate by 75bps as expected while its projections for rates increased significantly since their last release in June. Is this the moment we can finally say that we have seen the peak of hawkishness? We are trying to find the answer in this brief article.

We always start with the facts after the events like this one but this time I wanted to present you market reaction to see how much Mr Jerome Powell and his company were hawkish or dovish. Well, both short- and long-term rates went up to decade highs right after the decision and projections were released while EURUSD came close to the 0.98 level. However, after the algorithmic trade was done and analysts digested the projections coupled with Mr Powell’s speech long-term treasury market went to flat for the day while UST 2y overjumped 4.0% and was up by a ‘modest’ 7bps. This could mean that Mr Powell delivered the exact amount of hawkishness that was being already calculated into the markets and that we will have to see Fed stepping up their game even more to see rates continue creeping higher.

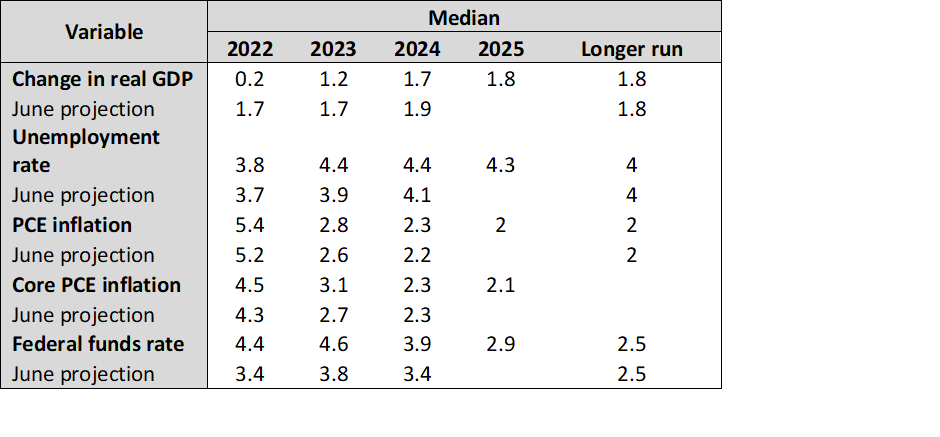

Back to the decision, as expected, Fed raised its rates to 3.0%-3.25%, resulting in rates being 3.0% higher compared to the start of the year (25bps, 50bps, 75bps, 75bps, 75bps) and their projections showed that there is still a lot of hikes in front of us. Namely, median Federal funds rate projection went to 4.4% for 2022, 4.6% in 2023, 3.9% in 2024, 2.9% in 2025 and 2.5% in the longer run vs June’s projections of 3.4%, 3.8%, 3.4%, and 2.5% respectively. This shows that Fed’s officials believe there will be more rate hikes needed while they see Fed’s pivot only in 2024. This year we could see another 75bps hike followed by a smaller one of 50bps, at least that is what is calculated right now. GDP projections were lowered as expected, and the unemployment rate projection was lifted to 4.4% in both 2023 and 2024 from today’s 3.7% which should imply a significant deceleration of economic growth and according to Governor Powell should ensure fall of inflation rates. Looking at the core PCE inflation projection, the median was set to 2.1% for 2025 meaning that the median Fed’s official does not see core PCE falling below 2.0% for the next three years.

Summary of Economic Projections, September 21st, 2022

Source: Fed – FOMC September 2022 Projections, InterCapital

Listening to Q&A session, we did not hear much news as the Governor said that inflation rates and especially core inflation is way too high and that they will have to increase rates into restrictive territory until something ‘breaks’. Mr Powell mentioned commodities that according to him have seen their highs while supply chains seem to improve which should drive inflation lower but said that Fed does not know when we will see the point to stop lifting rates or at least pause tightening for a while. Fed projections are showing cutting rates in 2024 while the market thinks that the peak of rates will be in H1 2023. All in all, Fed’s officials are still strongly determined to stop inflation with their tools and the market currently believes them. Until the next mini cycle in which the market mantra will be recession once again. With Mr. Putin in full mobilization, the mantra could be just around the corner and then we will once again read and listen that we have seen the peak of the yields in this cycle. In any case, with each day we are closer to the mentioned peak.