Next week is a blockbuster one, with the last monetary policy meetings in 2022 for Fed and ECB coupled with the US CPI release. The market expects both central banks to slow the pace of hikes to 50bps and to stop hiking in Q1 2023. Of course, the policy will be data-dependent rather than forward guidance based, which means one should be prepared for large swings in markets for at least several more quarters. In this article, we are briefly looking at 2022 and sharing our thoughts on recent market moves.

Thirteen months ago, Fed’s governor Jerome Powell appeared before the Senate banking, housing, and urban affairs committee on which he said that inflation should not be called transitory anymore and that „it is appropriate in my view to consider wrapping up the taper of our asset purchases, which we actually announced at out November meeting, perhaps a few months sooner “. Back then, CPI in the US stood at 4.4% (September 2021, YoY), the lower bound of Fed fund rates was still at 0.00% and Fed was still increasing its balance sheet. On the other side of the Atlantic, ECB was still in very loose mode, and Ms Lagarde in December stated that it is very unlikely that ECB will increase its reference rates in 2022. Two months after that, Russia started aggression on Ukraine and soon was clear that inflation will skyrocket even more driven by higher prices of commodities and difficulties in supply chains. Inflation reached almost double digits in the US and exceeded them in the euro area. Central bankers reacted promptly to the inflation to curb inflation expectations which they succeeded as inflation expectations surprisingly did not increase in that last year (according to 5y5y inflation swaps and breakeven data). Au contraire, 10Y breakeven in US stands at 2.3% compared to 2.40% a year earlier.

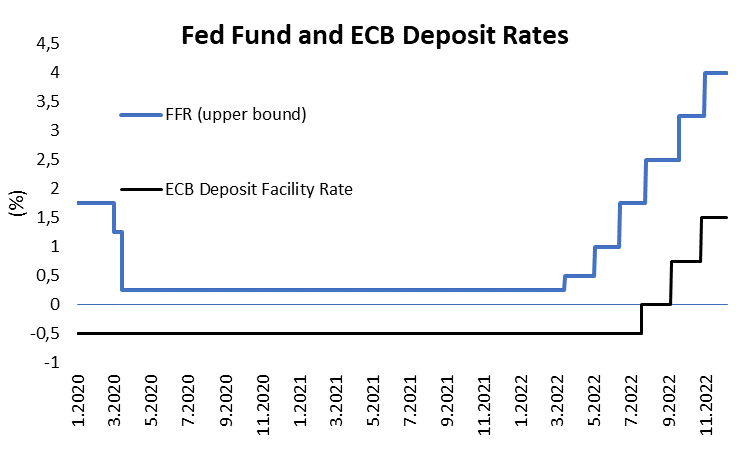

A year ago, an interesting survey was made by the biggest German bank in which they asked their clients (institutional investors and corporates) on rates and inflation for 2022. Out of 750 respondents, only 2% of them thought that CPI could be above 7.0% in 2022 while only 4 (!) of them thought that US10Y could end the year at or above 3.50% (we are today a bit below the level but have been above for the last two months and high was at 4.30%). Today Fed fund rates are at 3.75%-4.0% and are expected to be lifted to 4.5% (upper bound) meaning that the Fed will most likely lift its rates by 4.25% in one year while ECB increased rates by 2.0% by now and is expected to lift them by 50bps further next week, resulting in a total of 2.50% hikes in one year.

Talking about hiking, next week we have the last monetary policy meetings for the year in both the US and euro area on Wednesday and Thursday, respectively. Fed’s governor already stated last week that the time for moderating the pace of rate increases may come as soon as the December meeting and that statement cemented market expectations that Fed will step down from 75bps hikes that it repeated in the last four monetary policy meetings. Furthermore, yield curves are deeply inverted meaning that investors expect Fed to pause soon and then start cutting (maybe already in 2023 according to Fed Fund Futures). October’s CPI came below expectations and most of the investors think that peak inflation is behind us, while the last NFP data showed that the labor market is still tight and wage prices inched higher so Fed could turn its focus depending on the message they want to send. All in all, we expect that Fed will be eager to deliver a smaller hike of 50bps but the message from the governor could be hawkish due to the strong labor market, eased financial conditions in the last two months and also to send the message to the market that Fed would rather risk under delivery versus tightening too much.

On the other side, the labor market also seems to be historically tight while CPI in the euro area could still see its peak. In November core inflation stood at 5.0% YoY (same as in October) while headline inflation dipped to 10.0% versus 10.6% in October as energy prices dipped. However, ECB has lifted its rates by ‘only’ 2.0% this year and its short real rate is significantly lower compared with the one in the US so one could make a case for ECB to continue lifting rates by 75bps. However, we expect ECB also to lift by 50bps but to include QT talk and to start with the program in Q1 2023 which will inevitably increase the net supply of EGBs next year. Some analyses show that EGBs’ net supply next year could reach EUR 500bn versus slightly below EUR 200bn this year. Ceteris paribus, investors will have to buy EUR 300bn more bonds than they did this year. To sum up, we would give more probability for the ECB (at least 30%) to lift rates by 75bps compared to Fed, while futures show very small probability for both Fed and ECB (0.523% implied and 0.550% implied move by futures).

Not to forget, next week we will also know the rate of inflation in US for November and BBG consensus currently stands at 7.3% YoY (7.7% in October) for headline number and 6.0% for core data (6.3% in October). Since October’s data which surprised the investors on the downside, the market once again started to price in recession and Fed’s pivot (at least pause by Fed). This meant both equity and fixed income skyrocketing, with equity indices already erasing some 10% of the lows while yields on longer bonds fell by almost 1.0%.

So, what to expect from the markets next week? Well, we think that markets went ahead of themselves as they did several times this year. Markets now price slower inflation and slower growth ahead meaning that the Fed will pause or reverse its rhetoric. Today, the 1Y breakeven rate stands at only 2.17%, which means that investors currently price that next December YoY headline inflation will stand at 2.17%. We somehow doubt that inflation will come back to 2.0% or below in such an ordinary fashion but there are still 12 months for that to be seen. In any case, we think that markets could be surprised on the downside i.e., if inflation comes higher than expected due to any reason, we could see a sea of red once again. In case inflation surprises on the upside and one of the central banks hikes by 75bps, it would be the perfect storm for both equity and bonds, the Santa rally that we deserve, not the one that we want.

Source: Bloomberg, InterCapital