For today, we decided to present you with a brief article regarding increasing ESG practices in the investment community and how present is ESG in Croatia and Slovenia.

ESG could be defined as responsible investing strategy and practice which includes 3 key factors in investment decision making and active ownership. ESG is an abbreviation composed of the 3 key components:

- Environmental factors – climate change, the responsible/sustainable use of limited resources, waste, pollution etc.

- Social factors – human rights, child labor, modern slavery, working conditions etc.

- Governance factors – management remuneration, tax strategies, political lobbying and donations, corruption, diversity etc.

Do ESG Practices Lead to Higher Returns?

Although there are a number of studies which show mixed results regarding the direct relationship between higher return on investments and ESG investing, many studies show a positive correlation between disregarding these factors and higher volatility. This does not come as a surprise given that disregarding ESG factors could lead to higher amount of affairs/scandals which in turn could not only have a negative social or environmental effect but could therefore be reflected in the return on investment.

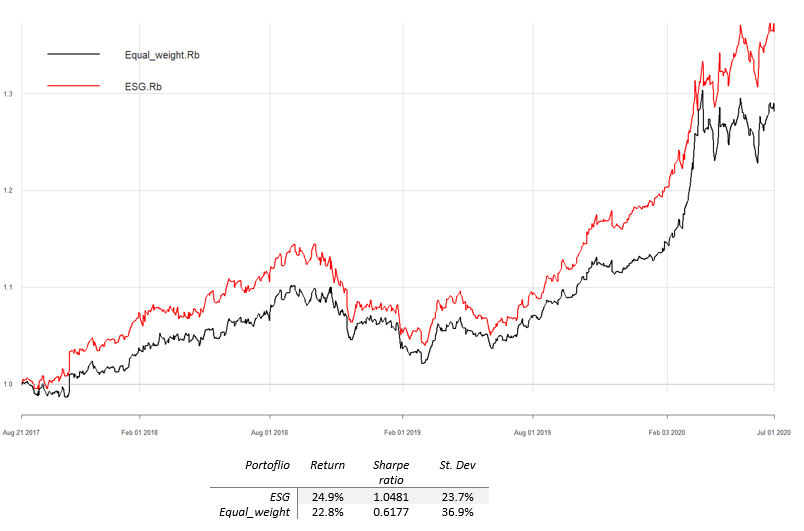

However, to further explore this idea our colleagues from the Asset Management department recently wrote a blog (Croatian only) comparing an ESG portfolio to S&P 500. For the purposes of their blog, they constructed two portfolios consisting of companies with a high ESG score (according to Sustainalytics). Both portfolios included the same stocks (such as Verizon, Amazon, Alphabet etc.), however one portfolio was an equal weight index, while the other was weighted based on the ESG score and rebalanced each year based on the new score. As visible in the graph below, in the past 3 years, both portfolios have significantly outperformed the index (S&P 500). It is important to state the we can not necessarily conclude whether such a performance came as a result of the growing awareness of the investors about sustainable investing or did the portfolio just pick “lucky” stocks.

Relative return of ESG portfolio compared to S&P 500

Source: InterCapital Asset Management

Growing Popularity of ESG Practices

Another reason why ESG is becoming more important and present in the investing world is that there is a growing number of clients who take into consideration ESG factors when deciding on which fund to invest in. According to 2016 US Trust Wealth and Worth Survey, 68% of Gen X and 93% of Millennials find ESG factors important when making investment decisions. Therefore, asset managers are becoming more transparent with their investments in regard to the implications of their investments on the environment and the society. This also applies to other institutional investors such as pension funds. The positive trend could be observed when looking at the share of assets of pension funds being managed by third parties in Europe which jumped to 40% in 2019, compared to 20% in 2015.

There is no doubt that ESG funds are becoming more popular, while their true potential is yet to be seen. Since the beginning of 2017 until October 2019, ESG funds have doubled on a global level reaching USD 683bn. Of that, the majority of funds (roughly 72%) are allocated in equities which make up for only 2.6% of the global equity funds. The low base definitely indicates that there is a lot of room for the continuation of the upward trend of ESG investing in the long term. When looking at the EU, 6.6% of assets under fund management is invested taking into account ESG practices, which is quite higher than the global level of 2.5%.

Share of ESG assets in total assets managed (by asset class) (%)

Source: Societe Generale

Share of ESG assets in total assets managed (by market) (%)

Source: Societe Generale

ESG in Croatia & Slovenia

One could argue that ESG investing is still at its early phases in Croatia and Slovenia. However, we see ESG practices definitely as the future of investing in terms of transparency of both companies and institutional investors in the region. This to some extent will come as a consequence of regulators already increasingly emphasizing that responsible investing is an integral part of asset management services.

At the EU level, asset management companies will need to start announcing how they integrate ESG factors into investment decisions (most likely sometime between 2020 and 2022). Recently, Croatia’s regulator (HANFA) announced that the International Organization of Pension Supervisors (IOPS) has adopted Supervisory Guidelines on the integration of ESG factors into investment and risk management of pension funds.

Therefore, it is interesting to see how the companies are currently standing in terms of ESG practices. One way to do so is by looking at the Bloomberg’s ESG Scorecard, which is a tool to generate custom, transparent ESG scores to understand company and portfolio ESG performance for any Equity or Corporate Bond Portfolio. Scores are calculated based on company performance on the Environmental, Social and Governance pillars and are calculated up to 100 (the higher, the better score). Note that some companies do not have an ESG score (or have a low score), which does not necessarily mean that they do not abide by ESG practices, but it is also possible that Bloomberg did not retrieve such data from the companies.

Bloomberg’s ESG Score of Croatian and Slovenian Companies

Source: Bloomberg, InterCapital Research

As visible from the graph above, HT leads the list with and ESG score of 61.97, followed by Ad Plastik with 45.76. The early adapters to ESG practices could possibly benefit from having high ESG scores as it might attract a new pool of investors who are seeking investments in companies with implemented ESG practices. We support the fact that many companies from both Croatian and Slovenian prime market are already publishing many ESG reports, such as sustainability reports and find such practices deeply important not only from an environmental and social stand point but also as a way for companies to distinguish themselves among many others.