In today’s blog, we are bringing you 8 thought-provoking graphs regarding the Slovenian Equity market.

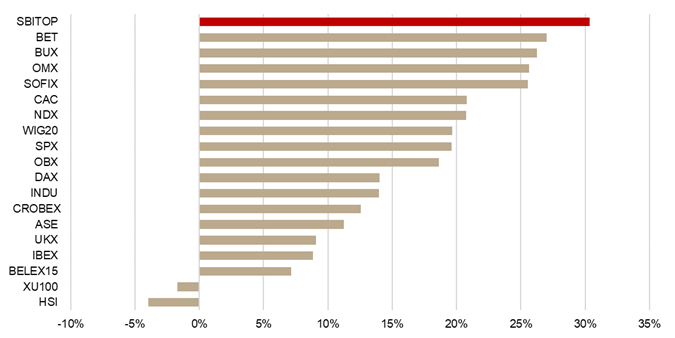

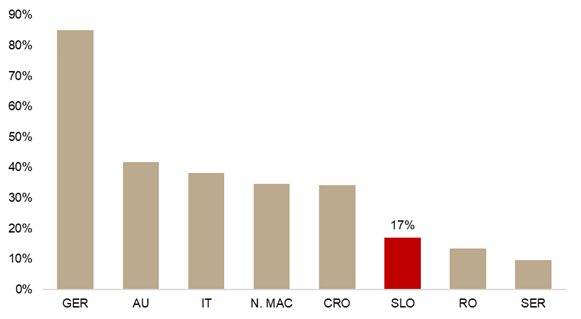

1. Slovenian SBITOP is the best performing equity index in the wider region in 2021*

*YTD share price performance of selected indices

Source: Bloomberg, InterCapital Research

If you have been holding the Slovenian equity index since the beginning of this year, you have done your portfolio a favor. The comeback of value and cyclicals definitely provided tailwind for the performance of the index which led to SBITOP witnessing a YTD increase of close to 30%. In other words, SBITOP outperformed virtually every global equity index so far in 2021. We already wrote quite a few blogs this year on this topic, which can we found on our web.

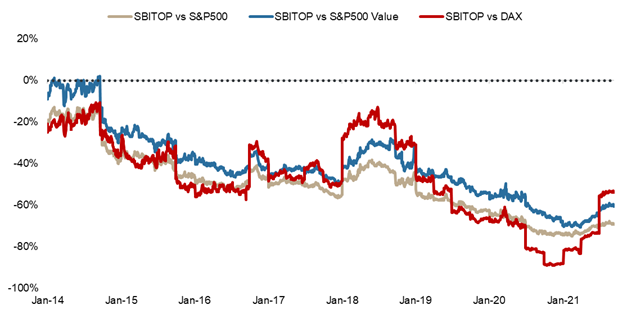

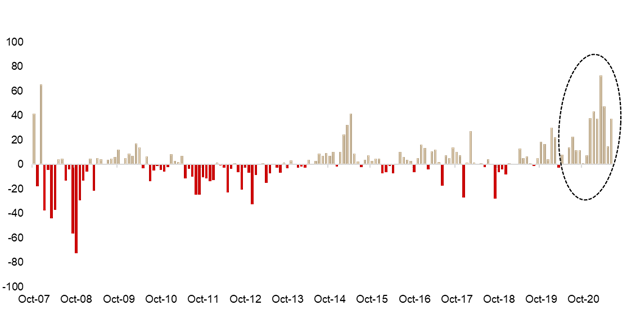

2. SBITOP is still traded at a deep discount compared to developed markets*

*P/E gap between SBITOP and developed markets (Jan 2014 – Sep 2021)

Source: Bloomberg, InterCapital Research

Slovenia, which can be considered a pure value play, is traded at a significant discount to developed markets, with SBITOP’s P/E standing at 8.2x, according to Bloomberg. Despite being one of the best performers globally so far in 2021, SBITOP’s discount to developed markets remains very large. To be specific, according to Bloomberg, SBITOP’s discount to S&P Value currently stands at 61%, which is significantly higher than the 7-year average of 41%. Taking into consideration that a certain discount is reasonable due to the specificity of the Slovenian equity market, we still deem that the market is very much fundamentally attractive. The fact that we are expecting to see quite strong 2021 results of almost all Slovenian blue chips, further backs the above-mentioned statement.

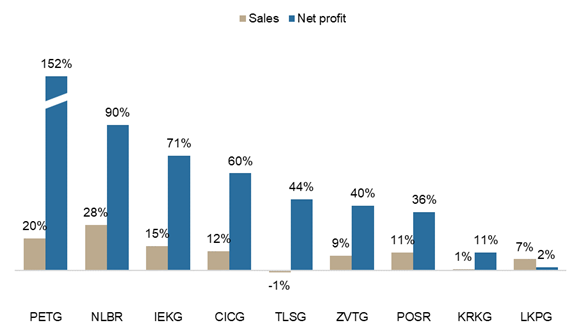

3. FY 2021 Results are expected to be very encouraging*

*H1 2021 results of Slovenian Blue Chips, YoY sales and net profit growth

H1 2021 has proved to be a very good period for Slovenian companies, with virtually all of them witnessing top-line and bottom-line growth. Such results do come as a consequence of a low base effect for most companies coupled with the relaxation of Covid-19 related measures. SBITOP’s largest constituent – Krka noted the highest H1 sales results in their history. Overall, we remain quite positive on the expected FY 2021 results of Slovenian blue chips.

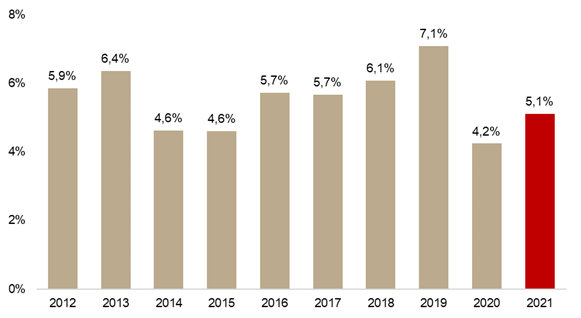

4. Slovenia has been a consistent dividend play

*dividend yield of SBITOP (2012 – 2021)

Source: InterCapital Research

Almost all Slovenian blue chips could be characterized as mature companies which are continuously paying our dividends, while offering very attractive yields. To be specific, in the 2 pandemic years, SBITOP offered very attractive dividend yields and we deem that such a trend is here to stay. One can expect that, with the stabilization of the macroeconomic situation, dividend yields would converge closer to 2018/2019 levels, especially once financials start paying out higher dividends again (cumulatively account for c.30% of the index). Moreover, we might still witness additional dividend payments in 2021. As a reminder, NLB’s management has already announced that they are eager to payout EUR 92m (or 4.6 DPS) in dividends this year.

5. Slovenia’s Market Cap / GDP is still quite low*

*market cap to GDP of selected countries

Source: Bloomberg, InterCapital Research

Slovenia’s market cap to GDP currently stands at c.17%, putting the country at the lower end of the observed countries. Such a low figure could partially be explained by the fact that frontier markets tend to have a lower ratio compared to developed markets, however the figure shows quite a lot of room for improvement. The mentioned ratio has not significantly changed in the past 10 years and has never in that period breached the 20% mark.

6. Very high net contributions to Slovenian mutual funds since the March 2020 correction*

*Net contributions to Slovenian Mutual Funds (EUR m) (Oct 2007 – Jul 2021)

Source: ATVP, InterCapital Research

In the first 7 months of 2021, Slovenian mutual funds have observed more net contributions than in any full year ever (since publicly available data, Oct 2007). According to the Securities and Market Agency (ATVP), net contributions of Slovenian mutual funds amounted to EUR 288.3m, indicating a 14th consecutive month of positive contributions to mutual funds. When looking since March 2020 correction, net contributions reach as much as EUR 401.8m. Unlike Croatian UCTIS funds, the majority of AUM of Slovenian funds (70.2%) is allocated in equities. However, one could argue that this did not significantly impact the Slovenian equity market, given that only 2.4% of the total equity holding of mutual funds are allocated in domestic equity. More specifically, this represents the lowest allocation to domestic equity ever (since publicly available data) by Slovenian mutual funds.

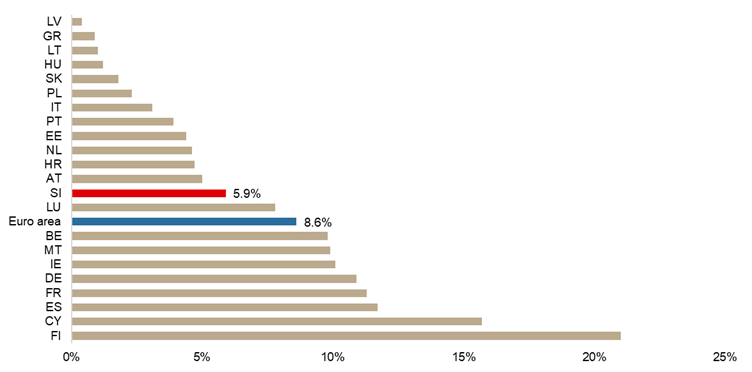

7. … However, still low participation of households in equity ownership*

*% of houslelods owning publicaly traded shares

Source: ECB, InterCapital Research

According to the Household Finance and Consumption Survey by the ECB, only 5.9% of Slovenian households own publicly traded shares which is still lower than the average of the Euro area (8.6%). However, the figures are somewhat better when looking at the 90th percentile of Slovenian’s by net wealth. To be specific, 15.4% of them own shares, compared to only 7.7% of the richest (90th percentile) Croatians. This is still significantly lower than the Euro area average of the richest Europeans (31.3% of the richest households own equities).

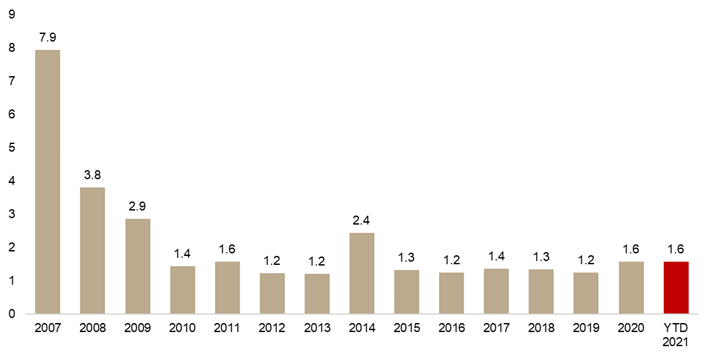

8. Liquidity on the LJSE remains a drag*

*Average daily equity turnover on the LJSE (EUR m)

Source: LJSE, InterCapital Research

Arguably the largest challenge of all regional markets is the lack of liquidity which has been flat for a decade now. As visible from the graph, 2020 showed a somewhat higher turnover on LJSE, partially due to the selloff seen in March (outbreak of the pandemic). However, with the lack of new listings it is unlikely to imagine that we will see significant increases in liquidity in the mid-term.