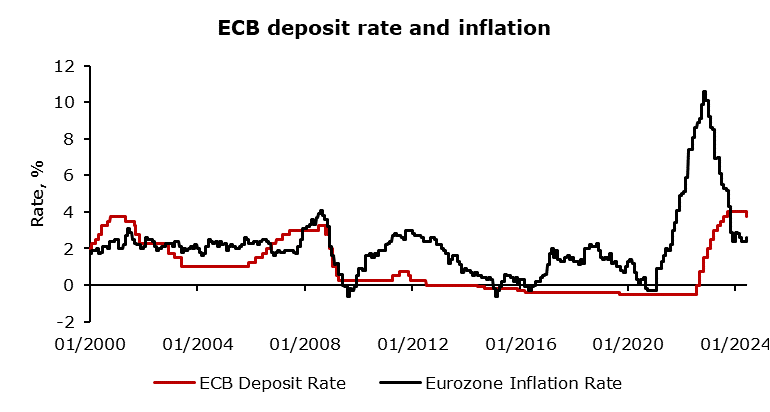

On the 6th of June, the European Central Bank decided to lower interest rates by 25 basis points which translates to a 3.75% deposit rate. According to the monetary policy statement and the speech of Christine Lagarde, they have more cuts in front of themselves to reach a neutral level regardless of the new growth and inflation outlook.

After three-quarters of the plateaued deposit rate, the ECB decided to cut the deposit rate by 25 basis points as the inflation outlook looks bright with no need to further suppress growth as much as before. The most important statement by Christine Lagarde related to the ability of cutting rates yesterday and in the future was about halving inflation in the past which was very much needed, but further halving inflation in the future would be under their two percent medium-term goal. Regardless of her dovish statements, data-dependency might change their stance especially data regarding wages which come out today. She pointed out that the main objective of the European Central Bank is taking care of price stability and the neutral rate is quite below current interest rates which translates to less restrictive monetary policy after the rate cut, not more accommodative monetary policy resulting in less headwinds for the economy, and not more tailwind. The decision to cut interest rates was made after the Governing Council gained confidence in the path ahead as they are comfortable that the inflation is under control after more than two years. Many argue that the decision and the conference should be called a „hawkish cut“, however, I would argue for calling it a „reasonable cut“ given the macroeconomic data that came since their last hike nine months ago and arguments by President Lagarde. Retaining restrictiveness, but slightly moderating is brave and something not seen before. Usually, central banks hike interest rates when inflation rises and lower them when a part of the economy is experiencing a crash, which is something that hasn’t happened yet in this tightening cycle. Also, other central banks such as the Swiss Central Bank and Riksbank have already cut interest rates with the ECB following their path.

Both the front and long end of the yield curve reacted with a fall in bond prices and rising yields. German 2-year bond yield rose by 4.5 basis points after the decision and German 10-year bond yield rose by 6 basis points. The reaction across the Atlantic was quite muted, without significant moves on the yield curve. The result is the tightening of the spread between the US Treasury 10-year yield and the German 10-year yield down to 176 basis points. In mid-April, the spread reached 220 basis points and tightened steadily since then. A year ago, in late April of 2023 the spread was at 100 basis points showing significant market expectations changes over time since then.

In conclusion, the European Central Bank’s decision on June 6th to lower the deposit rate by 25 basis points to 3.75% marks a pivotal shift in its monetary policy stance. President Christine Lagarde’s statements underscore the ECB’s confidence in having successfully curbed inflation, allowing for a transition towards a less restrictive monetary policy without fully embracing an accommodative approach. This “reasonable cut” strategy reflects a nuanced understanding of the current economic landscape, balancing the need to support growth while maintaining price stability. The market’s reaction, particularly the rise in German bond yields and the tightening of the spread between US and German 10-year yields indicates a complex interplay of global economic expectations. As the ECB navigates this delicate path, its data dependency, especially concerning wage growth, remains crucial in shaping future policy directions. The move aligns with similar actions by other central banks, suggesting a broader trend towards moderating restrictive measures amid a changing macroeconomic environment. The ECB’s approach may serve as a blueprint for other central banks, illustrating a cautious yet confident method of adjusting policy levers to sustain economic stability and growth.

Source: Bloomberg, InterCapital