In yesterday’s long-awaited meeting, ECB decided to lift rates by 75bps from zero, to the highest level since February 2009. In the statement, the ECB said that it will continue lifting rates further while in the Q&A session Ms Lagarde said that QT is still not in the cards. In this brief article we are looking into more details on the decision and what could we expect in the following months.

On August 25th, some 15 minutes before Mr. Powell’s speech on Jackson Hole Symposium, Reuters published a story titled „Some ECB policymakers want 75 basis point hike discussed in Sept, sources say“ which obviously had a strong impact on the EUR rates market with forwards starting to include the possibility of 75bps rate hike. Before the story came out, there were some 20% chances of such a move. The Reuters story was confirmed by several ECB’s hawks with August’s CPI upside surprise and robust labor market being the strongest drivers for the call.

Fast forward to yesterday’s meeting, the ECB indeed decided to increase its reference rates by 75bps for the first time ever (Bundesbank did the same move in 1992 when rates were at 8.0%). Yesterday’s statement said that 75bps is a major step that frontloads the transition from a highly accommodative level and that over the several meetings it is expected that rates would be raised further to dampen demand and guard against the inflation expectations being entrenched. Furthermore, ECB decided to suspend tiering for the banks as the deposit facility is now above zero percent. APP and PEPP parts were left unchanged from July’s statement meaning that TPI is still some mythical creature that exists only in ECB’s statements, but no one still knows how it looks like, how big it is or how does it work. One of the most important things in yesterday’s statement was staff projections on inflation and growth in the following years. As you may guess, inflation projections increased compared to the latest projections while economic growth projections decreased. Namely, inflation is now expected to average 5.5% in 2023 and 2.3% in 2024 compared to June’s forecasts when ECB expected inflation to average 3.5% and 2.1% in 2023 and 2024 respectively. GDP projections for the euro area now stand at 0.9% in 2023 and 1.9% in 2024 i.e., ECB still does not see a recession in any of the years although Ms Lagarde said some strange things on the topic in her Q&A session.

In the Q&A session, Ms Lagarde sounded rather hawkish saying that ECB has to normalize its policy and that that process started in December when ECB said that it will end PEPP (as you may remember, that December Ms Lagarde also said that it is very unlikely that ECB will lift rates in 2022). When asked where the neutral or terminal rate is, Ms Lagarde said we are still not at neutral nor terminal but that she or the GC does not know where that is exactly, nor she did give any hints on that. The weakness of the single currency was also one of the hot topics, but we did not hear any news on that besides that ECB looks at the euro very carefully. The question on staff projections was the most interesting one as Ms Lagarde said that the negative scenario sees euro area’s GDP falling by 0.9% and that the negative scenario includes a full stop from Russian gas and rationing of the energy in Europe of which both cases look like a deal done now. So, we are still not sure which scenario is base and which is negative considering the facts on the energy.

To sum it all up, ECB showed willingness and strength to fight inflation at the same pace as the Fed does, despite the economic situation seems to be far worse in Europe than it is in the US. Nevertheless, inflation in Europe could rise even further and seems reasonable to frontload for the ECB at least until data do not show Europe is in recession. The ECB is really in a tough position but for the moment it has chosen to fight inflation at all costs, which we think is the right move. Also, in case ECB did not react and frontload this time, we would see EURUSD much lower than it is today which would add more pressure on prices on the old continent.

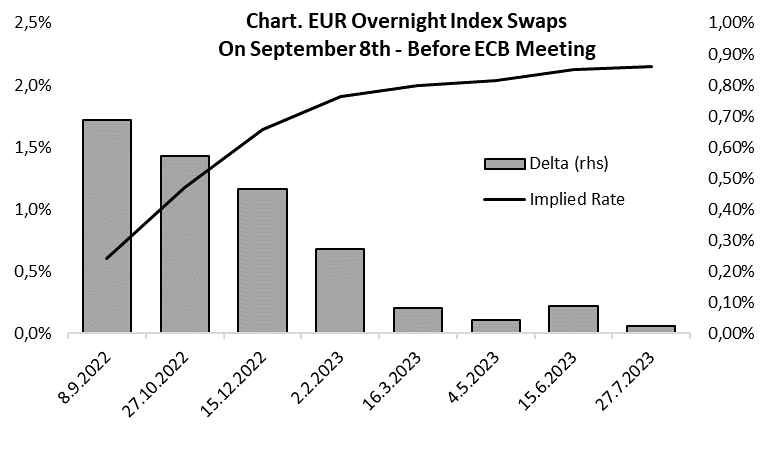

Talking about market reaction, yields showed that 75bps hike was not calculated in full as Schatz yield went from 1.12% to 1.33% (and further to 1.40% this morning) while bund yield overjumped 1.70% level. However, forward rates still show that the peak in EUR rates should be around 2.25%, somewhere in the end of H1 2023 with 50bps hikes in each of the two remaining meetings this year and then markets sees slower hiking until a peak in June 2023.

This week we have also seen Canadian central bank lifting rates by 75bps to 3.25%, and we expect Fed to deliver also. Economic data in the last several weeks showed that recession could be a few quarters away at least in US, contrary to the rhetoric that prevailed on the markets in the summer. Looking at the Fed, the move of 75bps is still not fully calculated as we have one more CPI data before the meeting that will occur on September 21st. The main question is whether we are at the peak of hawkishness with even ECB lifting by 75bps? For the last 8 months we have read or heard a lot of times that we have seen the peak of yields, the peak of forward rates and so on but central banks somehow managed to surprise us on the upside. As we still do not see an end of high inflation on the horizon, we expect yields to continue climbing but you should have one eye on the energy, as its current weakness will have a word on the matter also.

Source: Bloomberg, InterCapital