Last week ECB announced new financing operations and loosened the terms of current operations. Furthermore, it opened the way for increasing its PEPP envelope so until this week seemed like ECB will save the day. However, German Constitutional Court questioned its APP and now ECB has another challenge. What happened and what we expect next read in this week’s article.

A week ago, ECB delivered once again on its monetary meeting issuing statement with six decisions. The first one and most important was cutting TLTRO III rates further (from 25bps below average rate) to 50bps below the average main refinancing rate (0.00%) from June 2020 to June 2021 but also as low as 50bps below the average deposit rate (-0.50%) for counterparties whose eligible net lending reaches the lending threshold. This means that some banks could borrow at rates as low as -1.0% resulting in solid carry opportunities. Second decision was to introduce new series of non-targeted pandemic emergency longer-term refinancing operations (PELTROs) which will consist of seven operations starting in May 2020 at rate that is 25bps below the average rate of the main refinancing operations. In the end of the statement ECB said that Governing Council is fully prepared to increase the size of the PEPP and adjust its composition by as much as necessary and for as long as needed. All in all, ECB did its job providing as much monetary stimulus it has in its toolbox.

Well, ECB’s toolbox was questioned this week as German Constitutional Court surprised market saying that ECB’s purchase programme that started in 2015 partly violated German constitution. Namely, GCC was asked few years ago whether ECB’s PSPP was compliant with EU Treaty provision on prohibition of monetary financing of member states. The verdict first said that “it is not ascertainable that the PSPP violates the constitutional identity of the Basic Law in general or the overall budgetary responsibilities of the German Bundestag in particular”. However, it said that ECB disregarded the principle of proportionality and exceeded its mandate due to volumes and time span of the programme. Moreover, it said that Bundestag should take active steps against PSPP in its current form and gave ECB three months to adopt new decisions which will demonstrate proportionality principles and prove that there weren’t any negative side effects of the programme.

We did not have to wait long for the answer from ECB. “The Governing Council remains fully committed to doing everything necessary within its mandate to ensure that inflation rises to levels consistent with its medium-term aim and that the monetary policy action taken in pursuit of the objective of maintaining price stability is transmitted to all parts of the economy and to all jurisdictions of the euro area”. To conclude, we do not expect BundesBank to start selling bonds that it bought through the programme and do not expect ECB to be stopped from its mission to increase inflation and stabilize financial sector. Most likely it will only have to show why their decision to introduce asset purchases was inevitable and justified in such manner. However, this decision shows that Euro area still has the same problems it had several years ago despite new virus which will dent the economy at such scale that was not seen since GFC and maybe even longer. Ms Lagarde and the company in Frankfurt are still looking like the only ones pushing to the limit while state governments are pulling in their own way with days passing by and we are waiting for the next meeting of the Euro group to see whether we could have united and proper answer for the crisis.

Market reaction on GCC decision was quite interesting but most likely that was due to different interpretations of decision among traders. Namely, bund first futures first fell by almost 100pps and then in the end of Europe hours bounced back above 174.0 level translated into -0.56% in YTM. On the other side periphery spreads moved in the opposite direction with Italian spread once again widening to 240bps.

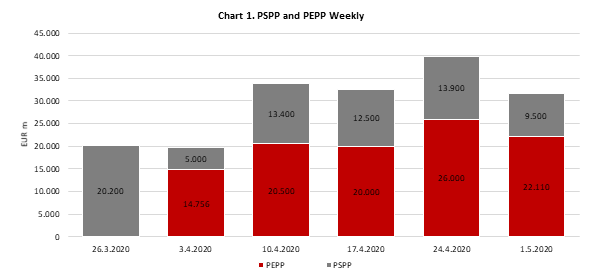

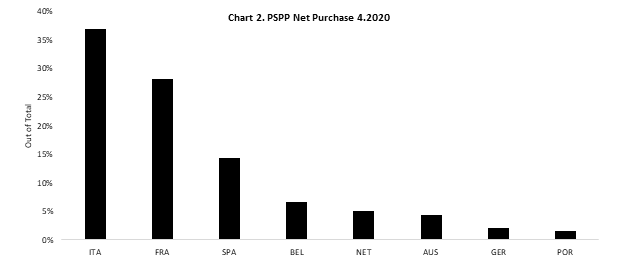

Talking about periphery, ECB published its April APP data once again showing that Italy and France were the biggest beneficiaries of the programme as 36.8% of total April PSPP was aimed to Italy while another 28.1% were French papers. Furthermore, in the end of last week (May 1st) ECB posted that it bought EUR 118.81bn in total under PEPP meaning that it bought EUR 22.21bn last week. As ECB does not provide detailed data on PEPP we could only assume that under PEPP periphery was also main target. Nevertheless, spreads are widening once again, and we expect them to continue so at least until we see some firm decision from the finance ministers; or until ECB announces it will start to control the yield curves.

Source: ECB, InterCapital