Last week ECB caught some market participants by surprise and announced TLTRO III, pushing its inaugural rate hike deeper into 2020. Furthermore, the bank decreased expectations on both euro area GDP growth and inflation rate with an emphasis that risks are still tilted to the downside. There’s now more and more economists and analysts saying that Eurozone could face a Japanese scenario of sluggish growth accompanied by even weaker inflation. In this week’s blog read on the market consequences and what to expect.

After equity and real estate markets crashed in mid-90s, central bank of Japan started its three-decade long struggle versus deflation and slow economic growth. First it slashed its monetary policy rates towards zero and after that it kicked off an asset buying spree: bonds, asset-backed securities, corporate bonds and stocks. In the end of 2018, BoJ held around 50% of all JGBs while according to Bloomberg’s article from mid-2016, BoJ was among top ten shareholders of more than 90% Nikkei 225 companies. From today’s perspective when inflation is still struggling to stay above 1.0%, one could ask what would have happened in case BoJ didn’t use all of the unconventional monetary policy tools or if bank wasn’t behind the curve for some time in the early 2000s. Well, that question and its answers are far beyond today’s article, but it is just interesting to see monetary policies that were first implemented in Japan and then cross the globe are “failing” to deliver. In the meantime, more and more economists are saying that we should prepare for the same scenario in Eurozone as inflation is once again falling from the beloved “close but below 2%” and ECB once again postponed bringing its reference rates towards its “neutral” levels or at least at or above zero.

On its last monetary policy meeting a week ago, Mr Draghi said that rates are to stay at the present levels at least through the end of 2019 or as long as necessary to ensure the continued sustained convergence of inflation to levels that are below but close to 2%. Moreover, ECB now expects GDP to increase by 1.1% in 2019 (versus 1.70% in December 2018) and 1.60% in 2020 (1.70% December 2018) while it decreased inflation forecast by 40bps to 1.20% for 2019 and by 20bps to 1.50% for 2020. Several analysts stated that ECB seems to be too optimistic when decreasing GDP growth by only 20bps for 2020 but Draghi clearly stated risks are still tilted to the downside. The third main point regarding their last meeting was that ECB introduced its third round of bank financing which should help banks in their liquidity challenges until 2023, two years later compared to TLTRO II. Regarding macroeconomic indicators, meanwhile we received high frequency data on industrial production in Germany and its sentiment for the first months of 2019 that are not showing any signs of relief although some relief came from the other core countries. Here, one could ask whether eurozone’s governments should start easing their fiscal policies to help growth and ECB in his never-ending fights. Meanwhile, Brexit saga seems to be prolonged as UK parliament voted against new May’s deal meaning that extension of Article 50 is the most probable outcome right now. Economists expect first phase of Brexit story to end before June when EU elections are due although considering the past, one shouldn’t be surprised in case Brexit stays with us for a “while”.

With all that dovishness and bearishness, one doesn’t have to look at the markets to know what’s happening with rates and euro. Namely, bund is only few basis points above zero and it looks like a matter of time when we’ll see it at zero or even in negative territory. Here you should also bear in mind that we didn’t have any significant risk-off events in the last two months which tend to push safe assets’ prices up. EURUSD rate is also fighting with its multi-year lows which is in most due to eurozone’s sentiment rather than strength of USD.

So, what should we expect in the rest of the year?

Looking from today’s perspective, yields in

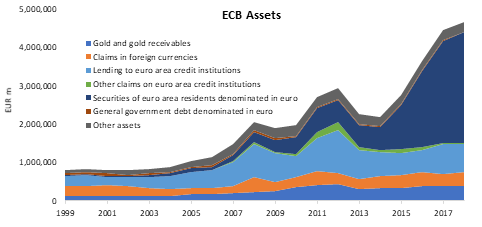

Source: ECB, InterCapital