For today, we decided to present you with a DuPont analysis of Croatian companies, a useful technique used to decompose the different drivers of ROE.

The DuPont analysis is a useful technique used to decompose the different drivers of ROE. This model allows stock analysts and investors to examine the profitability of a company using information from both the income statement as well as the balance sheet. This gives the analyst a thorough view of a company’s financial health and operating efficiency. Note that for this analysis we used (trailing 12m) H1 2020 results.

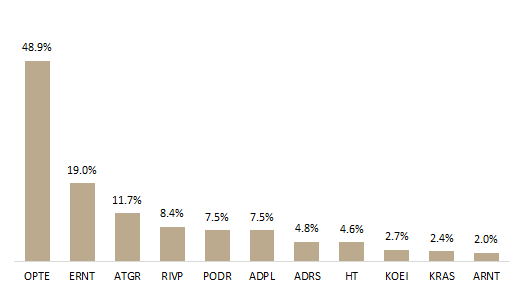

Return on Equity of Croatian Companies (%)*

*using trailing 12m net profit (H1 2020)

Speaking in broad terms the equation allows analysts to dissect a company, and to efficiently determine where the company is weak and where it is strong. This allows analysts to quickly know what areas of business to look at (inventory management, debt structure, margins) for more answers. However, the measure is still broad and is not a substitute for detailed analysis.

DuPont tells us that ROE is affected by three things:

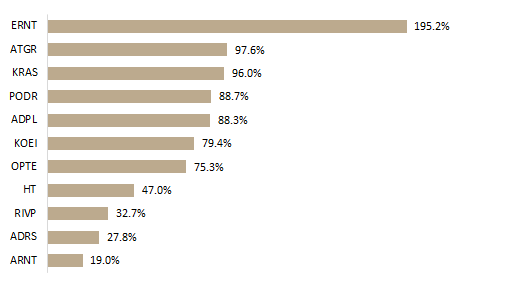

- Operating efficiency, which is measured by profit margin

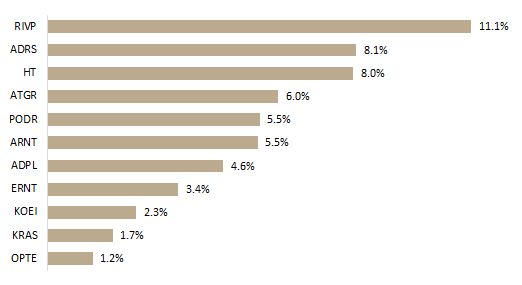

- Asset use efficiency, which is measured by total asset turnover

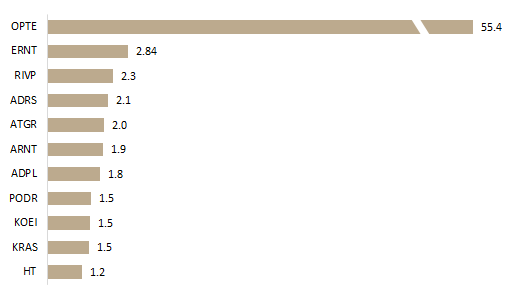

- Financial leverage, which is measured by the equity multiplier

Of the observed companies, Optima Telekom recoded the highest ROE of 48.9%, which came on the back of the financial leverage (equity multiplier) which stood at 55.37, by far the highest of all companies. The company currently operates with very low equity, as a result of recording net losses in the recent years. Ericsson NT and Atlantic Grupa follow with a ROE of 19% and 11.8%, respectively. This is especially noteworthy considering that both companies operate with very little debt.

On the flip side, Arena Hospitality Group witnessed the lowest ROE (of the observed companies which operate with a trailing 12m profit) of 2%. Note that such a ROE is currently not fully representative as it does not account for the Q3 2020 results, where the company derives most of its revenues and which are expected to be significantly different YoY due to the Covid-19 crisis.