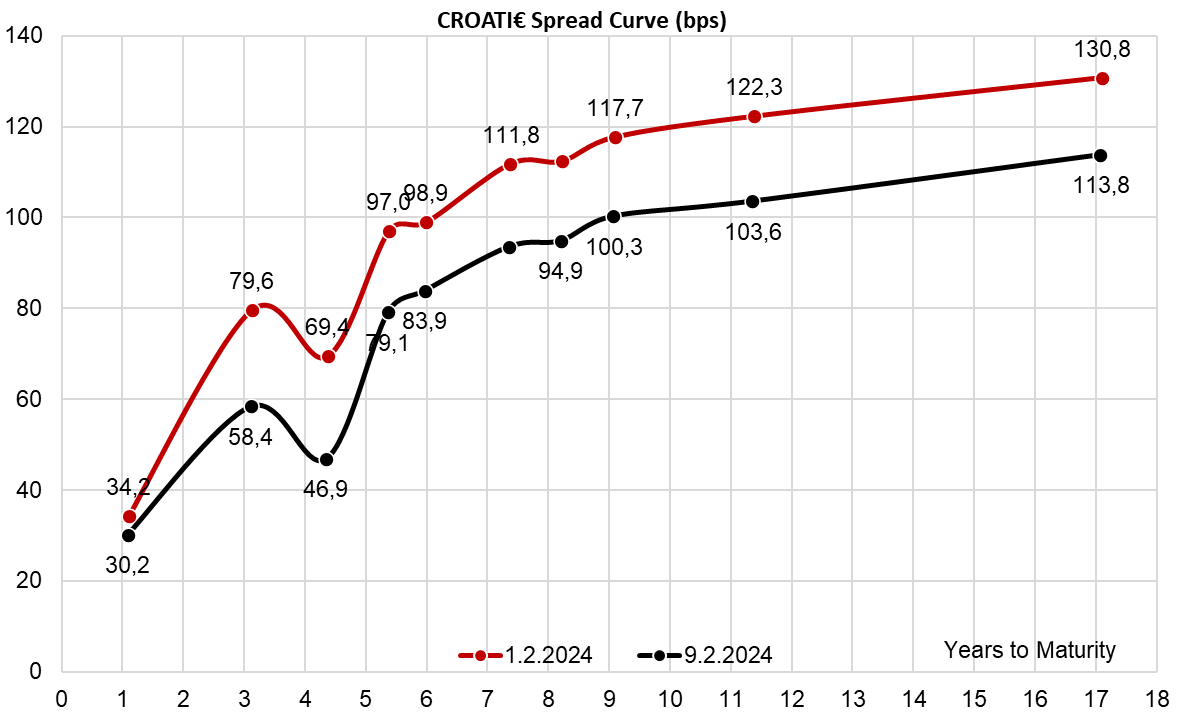

Both the FED and ECB are forcing the markets to switch into a slower lane regarding rate cuts this year. Markets got the rate cut narrative wrong from the very beginning because history was not a proper guide this time: the fastest pace of rate hikes did not cause a deflationary recession regime that would become fixed income Eldorado and a true purgatory for equities. Actually, it was the other way around. What happens next and now that CROATI 4 06/14/2035€ is traded at B+103.6bps we ask ourselves: how low can it go?

In a deluge of central bank interviews and statements, we would like to draw your attention to the speech delivered by Philip Lane yesterday at the Hutchinson Center on Fiscal and Monetary Policy (a part of the Brookings Institution).

Lane explained the current stance of ECB staff regarding medium-term inflation forecasts, which are critical factors in determining the direction of monetary policy in the euro area. Two years ago, most of the euro area inflation came from food and energy, so for instance, in October 2022, energy inflation reached +41.5% YoY. Just a reminder that this was eight months after the Russian invasion of Ukraine and EU countries scrambled for LNG, pushing TTF natural gas prices to an all-time high of 340 EUR/MWh. Since then, energy inflation turned the corner and is now negative: in January 2024 it stood at -6.3% YoY. Food is the main source of disinflation, and energy is the only source of deflation, however, services remain sticky. Service inflation stands out from the pack at +4.0% YoY (January 2024) after peaking at +5.6% YoY in July 2023.

So far half of the decline in headline inflation rate peak to trough reflects a decline in energy inflation, while monetary policy tightening had an effect of anchoring inflation expectations and putting a lid on EUR weakness.

So why isn’t the ECB cutting rates already? Because energy deflation is coming to an end as prices are rising from low base levels. Furthermore, wage growth could dampen service sector disinflation, supporting the staff view that HICP inflation could decrease to +2.7% in 2024 and +1.9% in 2025. Upside risks come from geopolitical choke points and that’s the reason why GC members are carefully observing the development of the situation in the Red Sea that so far seems to be contained. That’s probably also the reason why hawks underline the possibility that there might be no cuts at all this year should the Middle East tensions escalate. So far this is not anybody’s headline scenario.

Oh, then there’s one more thing called EONIA curves that have already priced as much as 4.7 rate cuts by December, meaning that financial markets are easing way before the central banks. A splash of sovereign and corporate issuers have taken advantage of these expectations to lock in lower rates, to the dismay of buyers under the assumption that long positions were added unhedged.

Source: Bloomberg, InterCapital

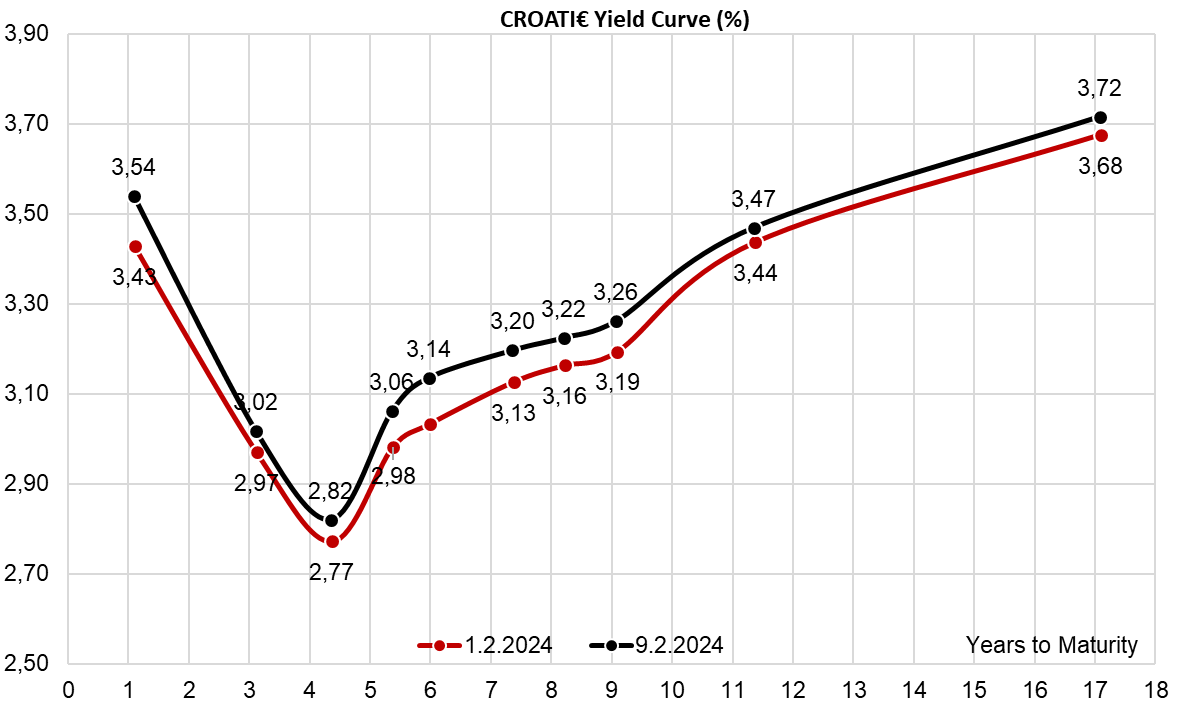

Croatia was one of the countries that skipped international bond placement and decided to tap the deep pool of domestic savings in the third retail instrument. There are repercussions for the CROATI€ curve stemming from this decision to skip the foreign market and tap the local – namely the splash of cash from CROATI 4 01/26/2024$ got swapped into EUR and reinvested into CROATI€, mostly longer part. Street dealers were lifted in big sizes of CROATI 4 06/14/2035€ and consequently, the bid couldn’t move lower when FGBL tanked. In turn, the spreads tightened and thanks to sound fundamentals and a potential rating upgrade this year, it’s quite likely that CROATI€ aficionados are not going away. Yes, the G-spread on CROATI 4 06/14/2035€ is at B+103.6bps. And yes. It’s probably getting tighter still.

Source: Bloomberg, InterCapital