As inflation came back to the spotlight in the last three years after almost a decade of below-target inflation, bond yields moved up accordingly as the inflation outlook for the decade looks gloomy. Geopolitical uncertainty, extreme tightness of the labor market, and resilient consumer demand pushed inflation expectations higher thus pushing bond yields up. For now, it seems higher bond yields are here to stay, but that might change swiftly in case of cracks in the economic conditions.

In 2021, inflation both in Europe and the US has been rising as the demand for both goods and services skyrocketed in post-Covid recovery while countries were strongly supporting the economy with expansionary fiscal policies. Central banks were reluctant to hike rates at the beginning, but the change of their approach to the restrictive policy was correct as inflation proved not to be as transitory as it was initially thought. In 2022, the war in Ukraine drove oil prices higher and pushed inflation even higher than previously expected. To this day, both positive demand and supply effects for inflation are here with even more uncertainties regarding the war in Israel with potential regional escalation.

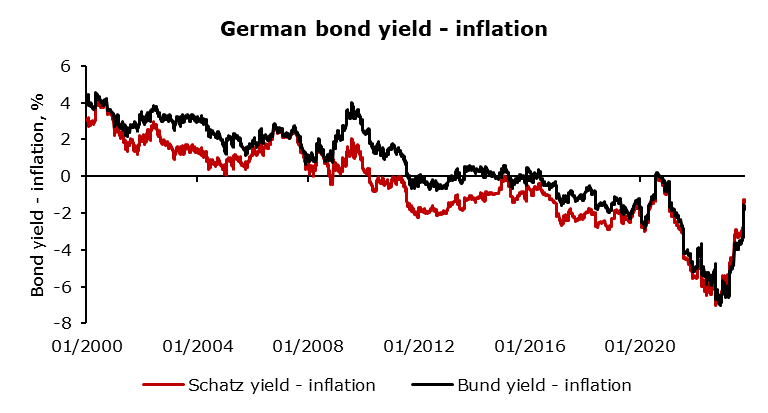

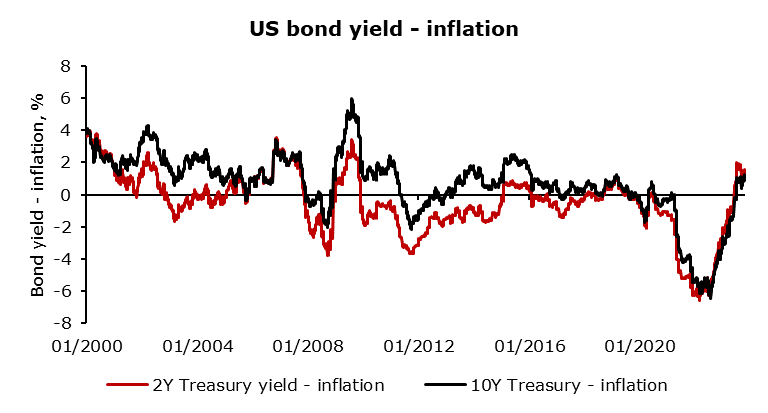

Historically, yields are closely connected to the inflation rate and inflation expectations with current real yields positive until 2010 in Europe both on 2-year and 10-year German bonds. 2010s were extreme in terms of monetary policy with approaching zero bound and yields even below 0% as the growth in Germany and Europe as a whole was sluggish. With yields still much lower than inflation, but converging, we might reach positive real yields if the economic growth blossoms in this decade. Currently, inflation in Germany is at 4.5%, Bund and Schatz at 2.94% and 3.21%, respectively. The economic outlook for the US is much brighter thus the situation of positive current real yields is much more likely to stay in the US, especially if the central banks realize that the ultra-expansionary policy has a problem of its own and didn’t provide satisfying results in the previous decade. Also, Quantitative easing is an easy concept to implement, but much harder to reverse with quantitative tightening in the future (which is the current problem), as the central banks are cautious with it and leave it in passive mode. Active QT with central banks selling bonds on the market may endanger the financial sector, so the central banks are not considering it yet. In the US, the history of the current real yields is a bit different than in Europe. Real yields were strongly positive until 2008 with a short period of negative current real yields between 2002 and 2004. After 2007, current real yields have become negative until 2023 when the positive current real yield is back both on the short and long end of the yield curve. Inflation is at 3.7% in the US, 10-year Treasury yields almost 5%, and 2-year Treasury yields 5.25% which implies positive current real yields are back. The current economic outlook may imply that negative current real yields are here to stay in Germany as opposed to the US due to divergence in economic prosperity which would imply lower EURUSD in the future or at least staying at these levels without the ability for the EURUSD move back to 1.20 or higher.

In the past three years, inflation made a strong comeback after a decade of sluggishness, leading to an increase in bond yields. This resurgence was driven by factors such as geopolitical uncertainty, a tight labor market, and robust consumer demand. In 2021, post-Covid recovery and expansionary fiscal policies resulted in a surge in inflation in both Europe and across the Atlantic. While central banks initially hesitated to raise interest rates, they eventually shifted to a restrictive policy as inflation proved to be more persistent than expected. The 2022 Ukraine conflict further fueled inflation. This historical context highlights the close connection between bond yields and inflation, with the possibility of current real yields becoming positive if economic growth prospers. Currently, Germany faces negative current real yields, while the US enjoys positive current real yields, reflecting varying economic prospects.

Source: Bloomberg, InterCapital

Source: Bloomberg, InterCapital