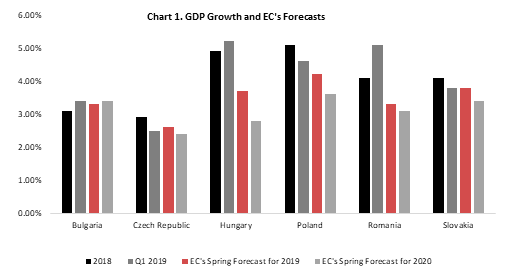

The beginning of 2019 brought lower GDP expectations across the world as dark clouds were looming. Trade war, messy Brexit, slower growth of China and narrowly avoided recession in Germany were just few to mention. However, CEE countries managed to absorb headwinds from external factors in the Q1 2019 as domestic demand showed its full strength.

Last week Eurostat published data on euro area’s GDP growth in the first quarter of 2019 which showed that GDP didn’t decelerate compared to last quarter of 2018, i.e. it grew at the same pace of 1.2% YoY. However, that represents solid slowdown compared to first three quarters of 2018 when GDP grew by above 2.0% YoY. German GDP increased by 0.7% YoY compared to 0.6% YoY in Q4 2018 but looking at the business and manufacturing surveys it seems that further acceleration isn’t most likely scenario. On the other hand, most of the CEE countries’ GDP growth accelerated compared to 2018. Although we still do not have detailed breakdown of GDP, we expect that largest contribution came from domestic demand as strong rise of wages pushed personal consumption while increased withdrawals of EU funds and public capex boosted investments.

Source: Statistical Offices, EC, InterCapital

Hungary posted the highest growth among all EU countries (that published flash estimates) of 5.2% YoY compared to 5.0% YoY in Q4 2018. Despite Hungarian exports made 80% of GDP (about which we wrote in our blog last week) and foreign demand slowed, seems like personal consumption that rose strongly in 2018 will continue this year as well but there are some signs that economy could overheat, leading to external imbalances and higher inflation. In April, HICP inflation in Hungary stood at 3.9%, which is second highest level after Romania, but Hungarian central bank is still seen as one of the dovish banks as it hiked its reference rate but introduced new asset purchase programme to further boost its economy.

Talking about high inflation, Romanian economic growth was most likely the biggest surprise as it expanded by 5.1% YoY in real terms compared to 4.1% last year. Looking at the high frequency data published by Romanian statistical office one could see that they point to another pick up in consumption. Namely, retail sales data showed that after deceleration in the last quarter of 2018, Romanians again sped up their consumption in the beginning of the year. Also, Romanian loose fiscal policy and tight labor market have driven significant rise of wages and coupled with increased employment resulted in strong increase of disposable income. Just to put things into perspective, net wages in Romania increased by 13.7% YoY in March, meaning that in real terms they were higher by 9.3% compared to last year. In March 2019, average net salary in Romania was by 32.3% higher compared to March 2017.

Going further, Poland grew by 4.6% YoY, with growth being the same as quarter before while Bulgarian economy accelerated to 3.4% YoY compared to 3.1% last year. Nevertheless, there were two countries which GDP growth was slightly lower compared to Q4 2018, Czech Republic and Slovakia. Both countries’ growth was only 0.1% slower and stood at 2.5% YoY and 3.8% YoY respectively.

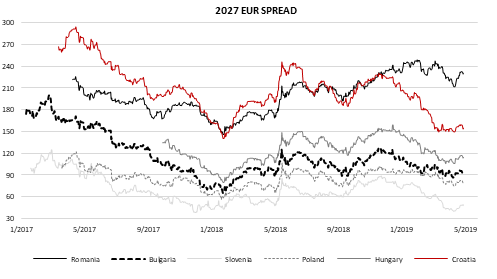

CEE countries have witnessed above EU growth for several years now which combined with fiscal balances being in green and loose monetary policy, i.e. low yield environment pushed investors into their Eurobonds. On the chart submitted below you could see how risk premia decreased in most of countries (besides Romania due to political risks). As CEE converges to core countries it wouldn’t be a huge surprise that even in case of risk-off sentiment these papers stay bid as macroeconomic indicators of these countries look better and better.

Source: Bloomberg, InterCapital