Yes, it’s been 29 years since the world first heard of Noel Gallagher’s Oasis with his debut album Definitely Maybe. And yes, it’s been 22 days since the world heard “rates kept unchanged” for the first time since March 2022. What do FED minutes tell us about the course of US rates in the coming half a year? We can’t escape the conclusion that Jerome Powell managed to build consensus around skipping one rate hike (in June) in order to get more time to assess the impact of rate hikes without historical precedent in terms of speed and magnitude. Are we nearing the end of the hiking cycle? Definitely maybe. But read more in the article below.

Yesterday’s FOMC minutes revealed a broad consensus to keep the FED fund target band unchanged at the last FOMC meeting, but the consensus was built upon a widely accepted premise that further tightening is to be applied, albeit at a moderate pace. FED staff now expects a mild recession starting in the fourth quarter of this year and ending in the first quarter of the next, but on the other hand, a soft landing scenario is equally possible as a brief technical recession. The likelihood of a technical recession scenario is supported by declining PMIs, nevertheless, hard data such as core PCE, unemployment, and non-farm payrolls point to the sustained resilience of the economy. Needless to say, should the economy prove more resilient than expected, then next year FOMC would have to make a difficult choice of either hiking rates further, or keeping them higher for longer. The complexity of the decision is further aggravated by the prospects of presidential elections in November, but at least non-US assets are getting a relief from weaker greenback.

So what do we make of the FED minutes in general? In essence, the wording reaffirmed the July 26th 25bps hike, which is now taken for granted with an 87.6% probability (take a look at the screenshot above). But even before the statement, the SOFR-implied probability was about 84%, so not much change coming from there. We can’t just say that FOMC minutes had the same effect on the SOFR curve as Lagarde’s Sintra speech had on the €STR curve. The good thing is that FED minutes didn’t steal the show from what really matters, which is hard economic data in the form of this Friday’s NFP (225k expected versus 339k in June, 4.2% YoY in average hourly earnings versus 4.3% YoY the previous month).

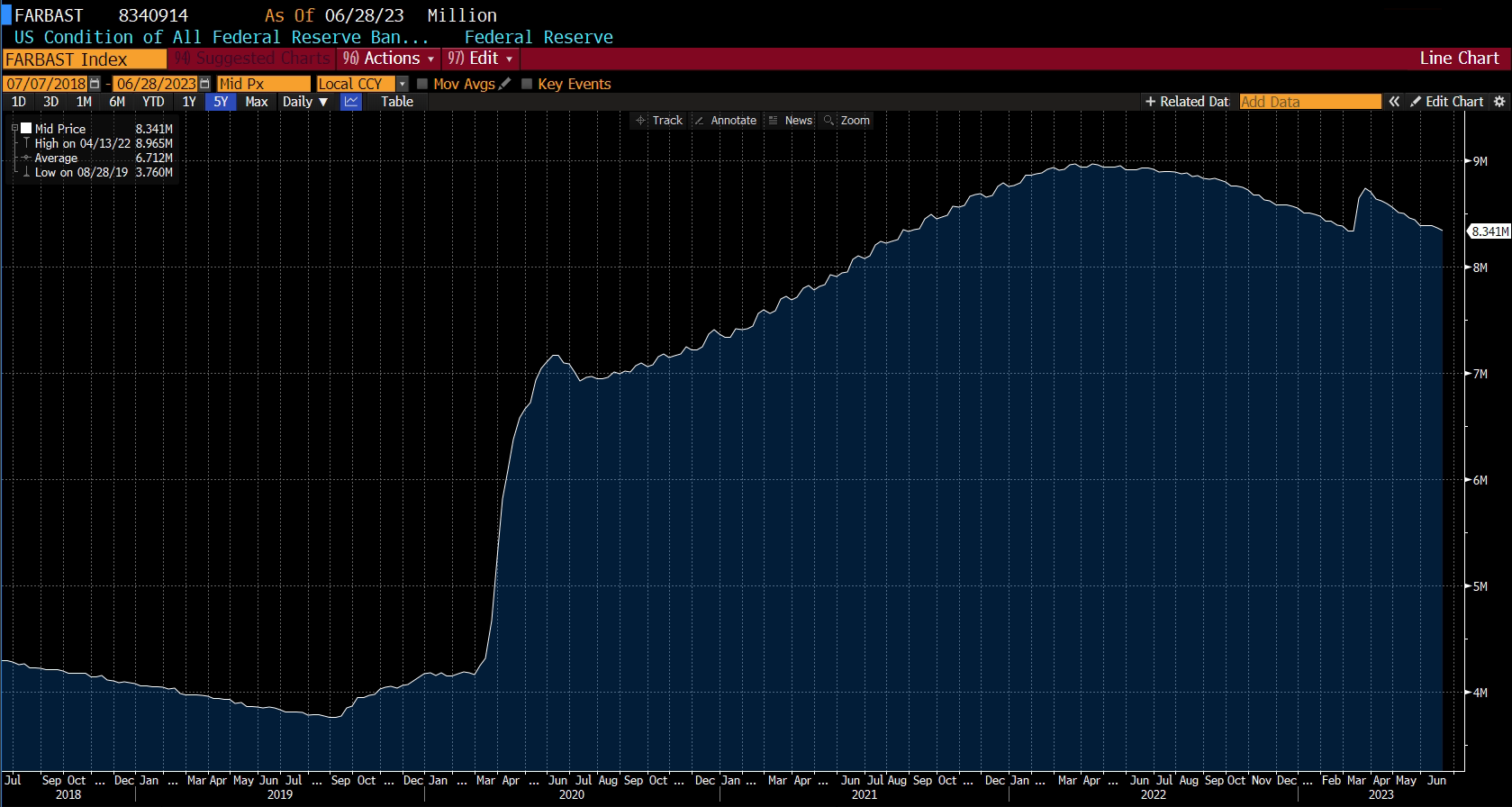

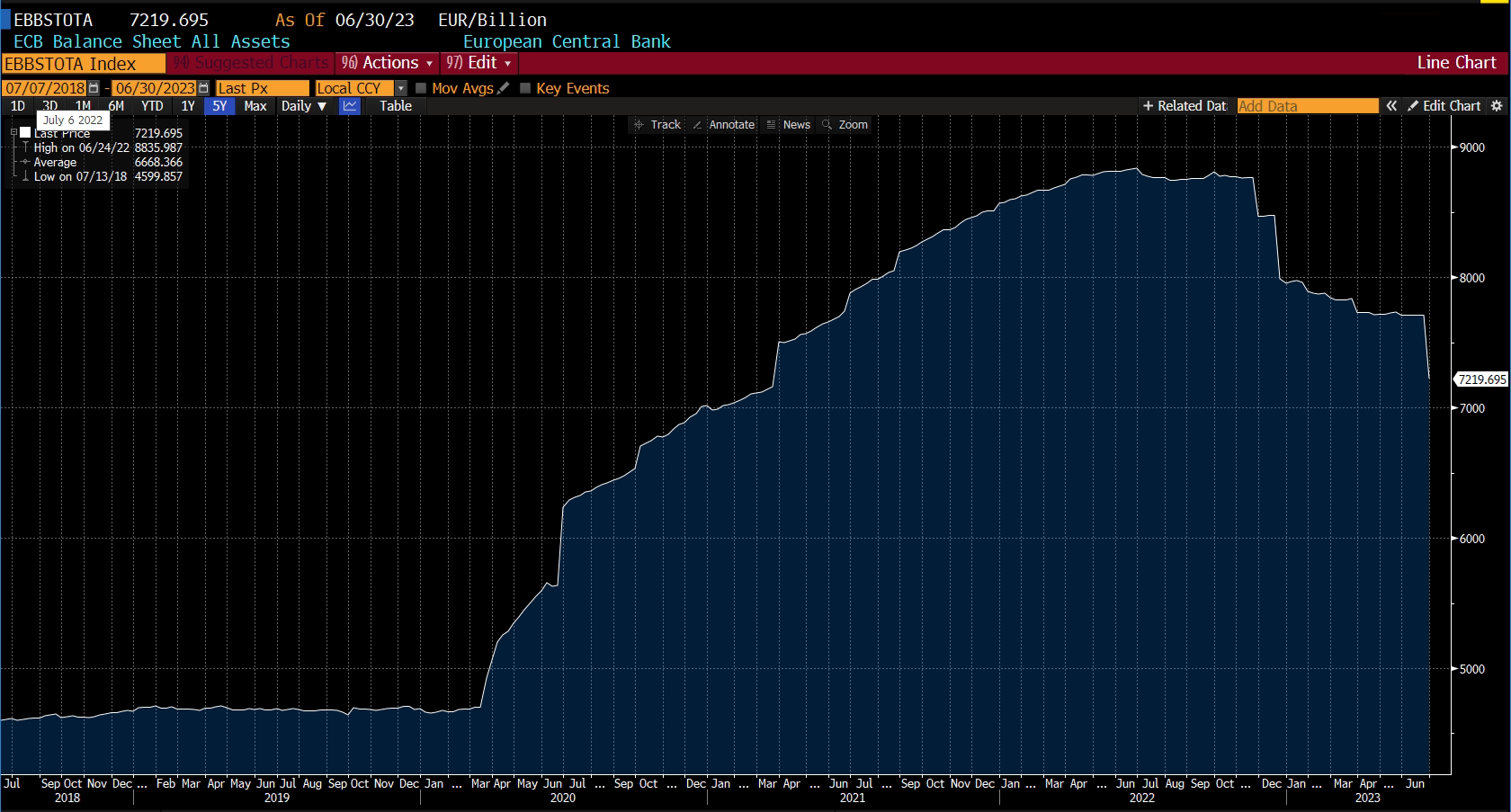

For further clarity, we remind our readers that after a brief excursion to save mid-sized US banks, the FED balance sheet is again on a decreasing path, erasing the gains from what was essentially an asset purchase (take a look at the chart above). There’s more… ECB’s balance sheet was significantly reduced in the past week thanks to TLTRO repayments. At 7.2tn EUR, the size corresponds to March 2021 and just to put things in perspective – from March 2020 (bottom) to June 2022 (top) ECB’s balance sheet has increased from 4.7tn EUR to 8.8tn EUR (+4.1tn EUR). With the current size at 7.2tn EUR, the total reduction so far has been equal to 1.6tn EUR, equivalent to about 40% of weight gained during the pandemic fight against recession. And with all of this, the spread of BTPs is at the lowest levels in at least a year and a half. If you want a picture of beautiful deleveraging, then here it is.

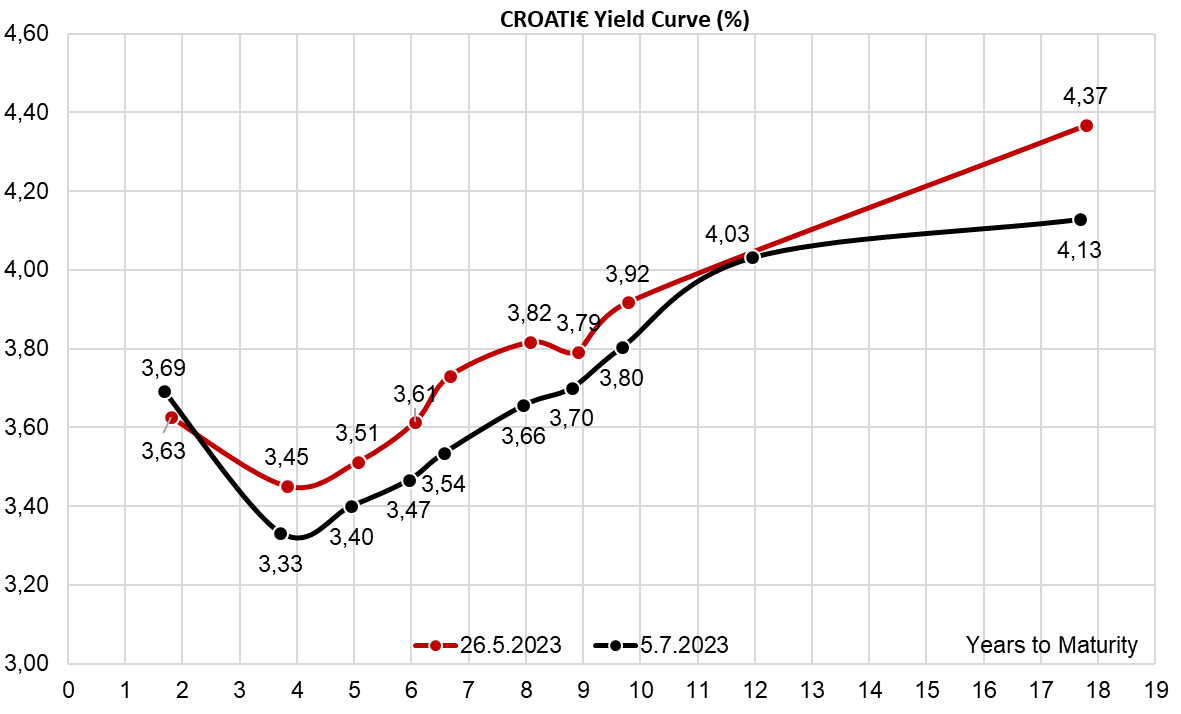

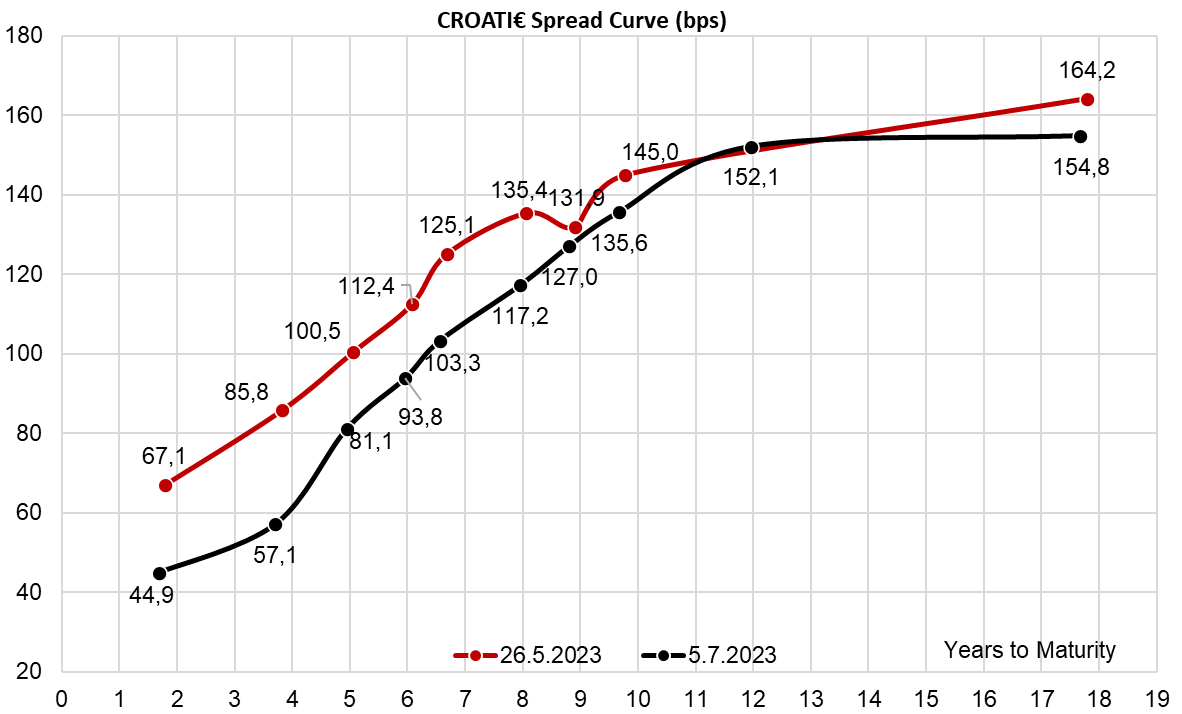

Regarding Croatian international bonds, the spreads have managed to contract in recent bouts of rising core rates. Our impression of the market on CROATI€ is that dealers are out of inventory, some of them already have short positions on longer CROATI€ bonds, sparking their reluctance to offer any. Hence yields and prices on the screen are on autopilot and for at least a month and a half CROATI 1.125 03/04/2033€ and SLOREP 3.625 03/11/2033€ have almost always traded with a 50bps spread (this morning they are 78.50, 3.83% YTM and 102.57, 3.31% YTM, respectively). The same is with the entire CEE complex. Nevertheless, our clients shifted their focus to two new interesting sets of financial instruments. The first ones are MREL bonds, the +1.000 strong universe of liquid bonds with belly of the curve yields ranging from 4.00% to 6.50%. The second focus of interest is local CEE bonds, namely Hungarian HGBs, in anticipation that since European EMs were the first ones to hike rates, they would also be the first ones to cut them. With Hungarian retail sales dropping by -12.3% YoY (versus -11.0% YoY consensus), these investors might be right in front running the recession in CEE space – the only question remaining would the bid be strong enough to let them offload their positions with gains once it becomes clear they were right about the timing of Hungarian rate cuts.