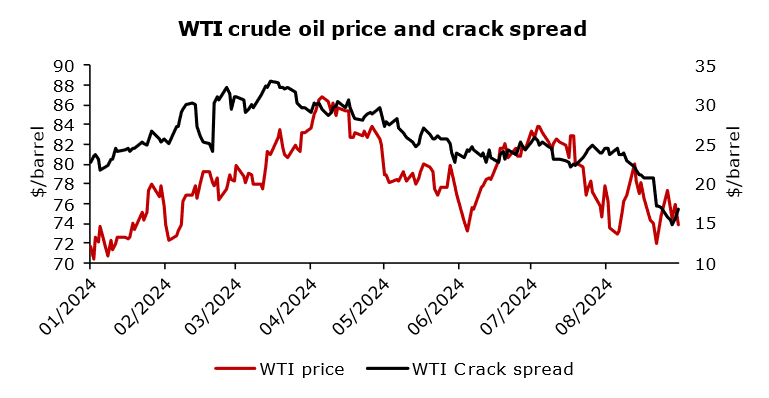

Since the beginning of summer, oil prices (West Texas Intermediate) have made a roundtrip back to the low 70$ as demand concerns and geopolitics keep the prices subdued.

Over the past three months, WTI has been trading between 72$ per barrel and 84$ per barrel. In June prices skyrocketed to 84$ per barrel and since then have reached lower highs with multiple bounces of 72$ low. Various events have led to the described price action. Firstly, demand concerns have been strengthening as the Federal Reserve in their July meeting indicated that the first rate cut is on the horizon due to the weakening labor market and the overall economy, as well as confirmation of the cut in September in the Jackson Hole meeting in August. Secondly, crack spreads that determine the value of petroleum products that refineries produce have dropped significantly and fell back to levels seen in pre-pandemic years. Thirdly, Libya which produces about 1 million barrels per day is going to dramatically reduce production due to their internal political conflicts as the separate government of Eastern Libya declared force majeure and plans to stop oil production and exports. On Friday, OPEC+ decided to proceed with plans to increase production which they had announced earlier this year, and will bring back barrels to the market in October of 2024. All of the above leads to downward price pressure of crude oil leading to instability in oil markets even though the Israeli-Hamas conflict might lead to escalation of conflict with Iran. However, the market’s reaction to occasional escalations of the Isreali-Hamas conflict is often subdued due to the usual rapid de-escalation after the mentioned events.

Crack spreads have been in free fall over the past year as they represent the income that refiners make processing crude to make distillate fuel which has been in decline due to inventory levels, slow rebalancing on the oil market after a significant amount of time has passed after the start of the war in Ukraine and demand concerns as the interest rates are kept high and might cause mild or even severe recession in the near future. According to Bloomberg’s calculation of WTI Cushing crude oil 321 crack spread, the crack spread has fallen from 23$ per barrel to 16.75$ per barrel which is a 26% drop since the start of the year. The biggest move has happened since the start of August during which it fell from 24.5$ to 16.75$ over the course of the months.

Unrelated to WTI, significant news for European countries came on Friday the 30th of August, Ukraine decided to halt Russian oil transit in addition to gas via the Druzhba pipeline starting January 1st, 2025 causing problems for Slovakia, Czechia, and Hungary that have been receiving Russian oil through this Druzhba pipeline. However, Ukraine officials mentioned that they are ready to provide transit of gas from other suppliers through their pipelines. The recent fluctuations in WTI crude oil prices highlight the impact of various factors, including demand concerns driven by potential Federal Reserve rate cuts, declining crack spreads, and geopolitical tensions. The reduction in Libya’s oil production and OPEC+’s decision to increase supply have added downward pressure on prices. Despite occasional spikes due to geopolitical events like the Israeli-Hamas conflict, market responses have been tempered by swift de-escalations. The ongoing decline in crack spreads signals a broader concern for the oil market, with potential economic slowdowns and changes in supply dynamics expected to shape future price trends.

Source: Bloomberg, InterCapital