Global economic slowdown and convergence to Hungary have been the narratives explaining the recent trends on CROATI curves. How plausible these narratives are and are there any undervalued bonds, find out in this brief analysis.

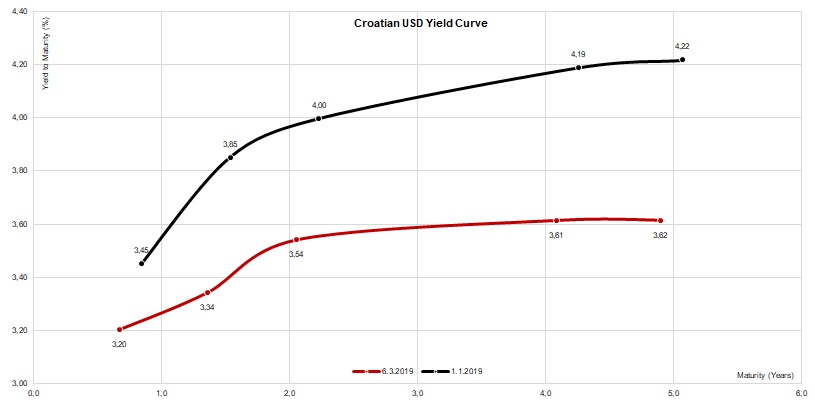

The beginning of the year was so far characterized by yield suppression and spread contraction across the board as central banks became sensitive to the indicators showing weakness in the global economy. The recent macroeconomic backdrop has been supportive for bull flattening of the Croatian USD yield curve, as the chart below clearly demonstrates – notice just how the curve became flat in the last two months. Currently, there’s barely any term premium on the longer end (CROATI 2023 USD @ 3.61% YTM and CROATI 2024 USD @ 3.62% YTM versus CROATI 2021 USD @ 3.54% YTM) and from the chart it’s quite clear that the greatest yield suppression was reported on CROATI 2024 USD.

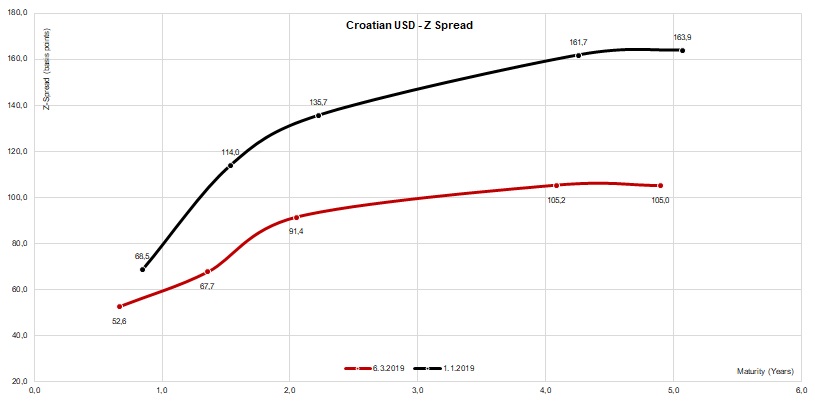

According to the Z-spread curve, the bull flattening did leave some term premium left between CROATI 2021 USD and CROATI 2023 USD, but what’s interesting in particular is that CROATI 2021 USD appears to be slightly mispriced in both yield and Z-spread terms. A simple linear interpolation using 104.30 as clean price for CROATIA 2020 USD and 107.10 for CROATI 2023 USD (3.33% and 3.61% in yield terms, respectively) gives us 3.40% as the YTM where this paper should be trading. Our screen shows that the instrument might be bought @ 3.50% (105.62 clean), giving it at least 10 bps above the interpolated yield. As stated, the bond is slightly undervalued, with a focus on the word “slightly”.

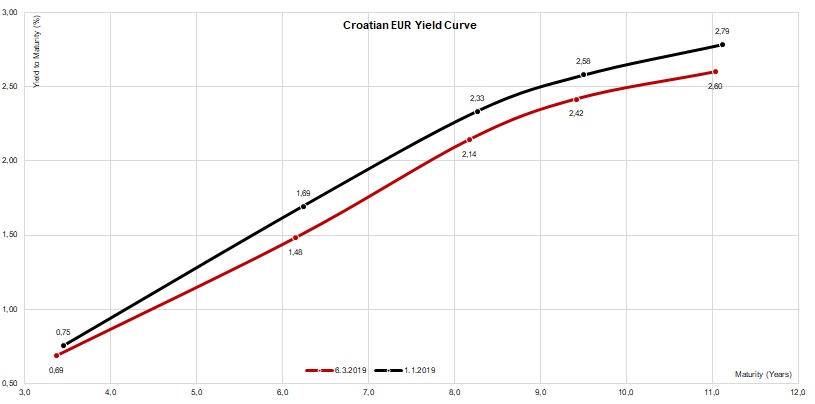

Looking at the EUR curve in the last two months, there’s an apparent move south, but without any significant loss of shape; the yields contracted almost uniformly by 19-22bps, the largest suppression going on CROATI 2025 EUR. The lack of paper is evident and anecdotal and there’s a feeling that dealers in the Street might have emptied their books, so at least some of them have their offers quoted uncovered – meaning that if a buyer lifts these offers, the dealer ends up naked short. Of course, most of the dealers aren’t willing to end up short in the first place, especially on the paper such as CROATI 2028 EUR, since buying it on the secondary market might be the scenario for the next movie from the “Mission Impossible” franchise; instead, the dealers prefer passing the quote, stating clearly that they’re out of inventory.

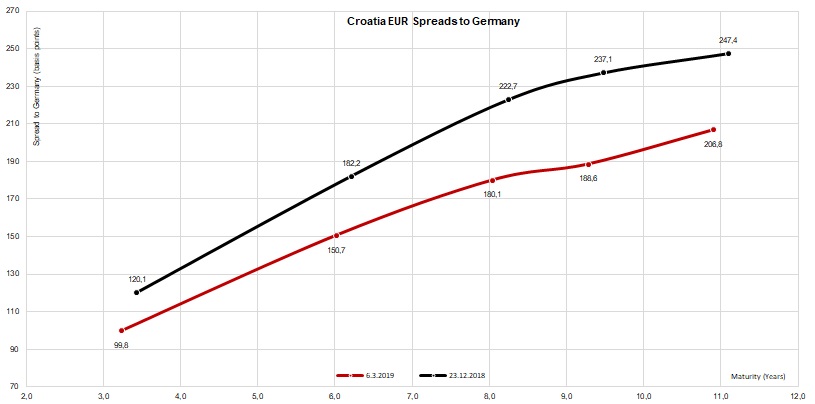

Speaking further about CROATI 2028 EUR, it’s worth mentioning that the paper was issued last June @ 121.5bps above REPHUN 1.75 10/10/28. Interestingly enough, the return on Croatian paper is poised half way between REPHUN (1.17%) and ROMANI (2.71%). By today, this spread had contracted to about 75bps, the lowest value since the paper was offered to the public. At the same time, CROATI 2025 EUR is traded some 48.7bps above the interpolated REPHUN curve (1.257% YTM for CROATI versus theoretical 0.77% for REPHUN), while CROATI 2022 EUR trades merely 23.5bps above theoretical REPHUN (0.565% versus theoretical 0.33%). In other words, the spread to REPHUN decreases as maturity of the paper gets nearer, making convergence to Hungary the plausible narrative of the current spread contraction.