Croatian Ministry of Finance decided to tap two bonds on local market this Tuesday and received HRK 6bn in total. Namely, they decided to issue third tranche of RHMF-O-26CA at 0.85% and second tranche of RHMF-O-282A at 0.94%. Meanwhile Croatian central bank maintained its 4th and 5th bond buying action. In this brief article you can read about recent actions on Croatian local market and what to expect next.

Last Friday Croatian central bank announced another bond buying action with almost all HRK papers (excluding RHMF-O-26CA and RHMF-O-282A) being eligible for banks’ buying and in the beginning of this week the bank bought HRK 4,068bn worth of Croatian HRK papers (in notional terms). Looking at the excel tables provided by CNB, it already bought HRK 17.885bn worth of papers to stabilize prices and provide liquidity on Croatian bond markets. Mentioned amount accounts of close to 4.5% of Croatian GDP (2019).

Talking about local bonds, two weeks ago, Mr Maric said that government will seek to enter local market one more time before parliamentary elections that are due this Sunday. It was mentioned that the Government will issue around HRK 5bn worth of papers probably in two tranches. Two days ago, 5 banks informed investors that Ministry of finance will tap two local papers and book is to be closed in early afternoon. In the end, Croatia issued third tranche of RHMF-O-26CA in amount of HRK 2.46bn at YTM of 0.85% and clean price of 121.307. Mentioned paper (excluding CROATI 2031) has the biggest notional among Croatian papers as in three tranches its notional amounts of HRK 12,46bn (EUR 1.65bn). Another bond that was tapped on Tuesday was RHMF-O-282A, in amount of HRK 2.59bn, YTM of 0.94% and clean price of 114.163.

With total amount issued being above HRK 6bn and more than EUR 1bn that will be left from latest foreign auction after CROATI 2020 is repaid, we expect government to stay on hold at least until autumn. Summing all the proceeds from bonds and loans that Croatian government already received it seems that Mr Maric’s plan to gather some HRK 65bn is now fulfilled. However, there are new sets of measures to be introduced especially in case second wave of coronavirus halts our economy once again. We doubt that scenario could happen as we see more and more economies fully opening despite rise of corona cases, but one cannot predict tourism revenues for the next two or three months that will be of crucial importance for Croatian economy. To sum it all, Croatian Ministry of Finance now secured all the funds for the summer at yields being close to the ones before corona crisis and that was made with some help of central bank that injected large amount of liquidity through several tools under its disposal.

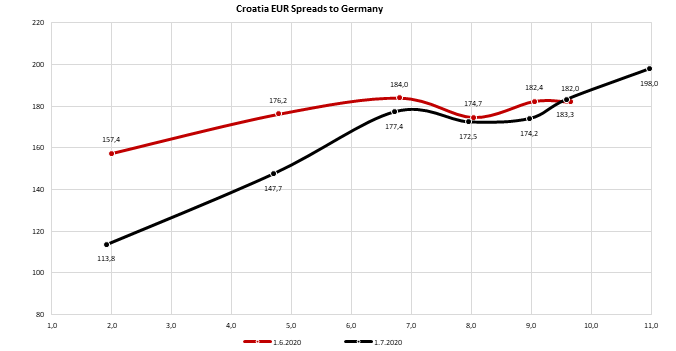

Mentioning our latest foreign issuance, its worth our while to look where does CROATI 2031 stands now. Well, in the last few days we have seen mostly buyers on the whole Croatian Eurobonds curve, both EUR and USD denominated. While USD curve seems to be carry-trade play supported by low financing costs, EUR denominated curve received bids from yield hungry investors that were also looking at some growth story due to higher duration on EUR papers. Bid on CROATI 2031 now stands above 100.00 while being issued at 98.572, reflecting total return of a bit more than 1.5% in only two weeks. In terms of benchmark, CROATI 2031 spread stands at 195bps versus above 205bps when issued, reflecting recent positive momentum on risky assets.

Source: Bloomberg, InterCapital