We know you’re busy, so let’s make the long story short. Croatia places the new 10Y paper today, we expect a 1.5bn EUR placement at MS+82.5bps or 3.52% YTM. The orderbook is likely going to exceed 3bn EUR and it’s going to be tough to get meaningful allocation, unless you are a large institutional investor. If you’re not, it’s likely you will have to buy after it’s FTT. How to trade it on the secondary market? Well, you’ll just have to go through this brief research piece to find out.

Ahead of a pretty busy week in terms of central bank meetings (ECB GC on Thursday, 07th March) and economic data (JOLTS, ADP and NFP in the coming days) Croatia is placing a new 10Y international bond that is very likely to price today. With the benefit of hindsight, we can claim that eurozone and Schengen entry propped up demand for Croatian paper. The last international placement took place in June last year and back then the sovereign placed CROATI 4 06/14/2035€ at MS+100bps (back then it was 4.047% YTM). Last summer the 1.5bn EUR placement (benchmark) was met with “exceptionally high demand” reaching 6.4bn EUR (4.27x bid-to-cover) and this time around we can expect a threat for paper of similar magnitude.

What else can we expect today? Some clarity can be claimed from most recent CEE placements such as Lithuanian 10Y on February 06th (LITHUN 3.5 02/13/2034€, 1.5bn EUR at MS+90bps) and Slovak Republic 10Y on February 27th (SLOVGB 3.375 03/06/2034€, 3bn EUR at MS+100bps). Although yields were marching higher throughout February as markets were splashed by cold water in the form of FED’s reluctance to confirm aggressive rate cuts, orderbooks were reflecting strong demand and in both cases exceeded 2.0x (3.5bn EUR for Lithuania and above 6.0bn EUR for Slovakia). Notice that both countries had their share of geopolitical turbulence spilling over, but nevertheless, this was not reflected in the size of demand. Moreover, experienced traders remember that both countries priced at the tighter end of the range and floated without much NIP to satisfy the investors. Speaking about Slovakia, the pricing began with IPTs at about MS+115bps, but as the orderbook increased the final pricing reflected a total of 15bps of tightening. Notice that this is the most recent Slovakian placement that settles tomorrow, but from what we see on the screen the I-spread is still roughly the same as the one recorded on the pricing date – the paper is traded at 3.70% YTM, some 100bps above the swap curve. It’s no cigar, but at least the spread is not volatile at all.

So what does all of this tell us about Croatian placement? Well, first of all, don’t be surprised if the pricing happens significantly below the CROATI€ curve and the paper still does well on the secondary market. In other words, if the orderbook exceeds 3bn EUR (which likely it will), we can expect a 1.5bn EUR placement with pricing at or below the curve of existing paper.

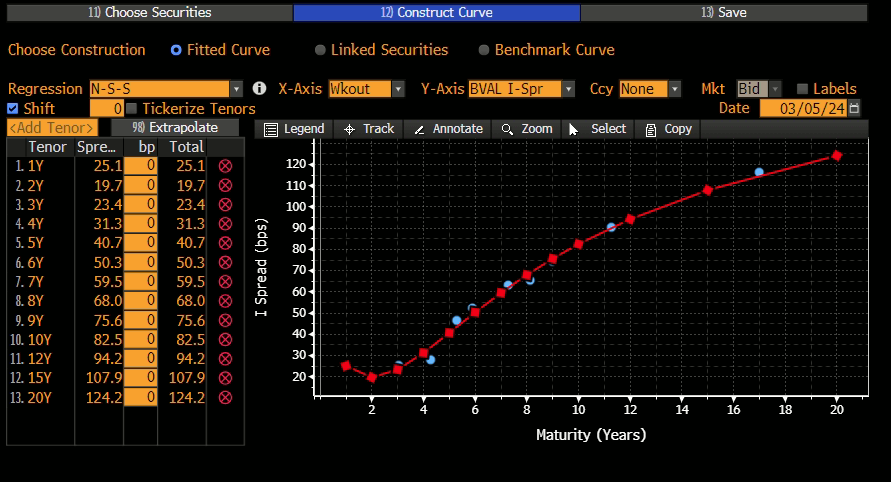

But where exactly is the CROATI€ I-spread curve? According to Bloomberg, the fair value of new placement should be at MS+82.5bps or 3.52% YTM. IPTs are likely going to start from MS+100bps and work their way down as orderbook gets more robust. Large institutional investors would still be satisfied with the pricing slightly below the curve because this is the only way they can get significant exposure to Croatian paper at bid levels and a couple of basis points higher or lower won’t make much of a difference. With a 1.5bn EUR international placement the Ministry of Finance would reach roughly half of this year’s funding needs: the 1.07bn EUR T bill placement (970mm EUR for the people + 100mm EUR for institutional investors) last month took us only so far that it covered slightly less than 20% of gross funding needs. After the international placement the attention would probably shift back to the local market with a brand new 4Y retail bond, expected to be placed by the end of the current month. An educated guess of 1bn EUR in new 4Y retail bond would mean that roughly two thirds of gross funding needs would be covered (65% = 1.07bn EUR in retail T bill + 1.5bn EUR international bond + 1.0bn EUR retail 4Y bond / 5.5bn EUR 2024 gross funding needs). In other words, the current government can now turn to what is really important and that’s winning the upcoming general election.

Ona last thing investors need to consider before submitting their bids. Croatia is well positioned to receive that one last credit rating upgrade that would position it’s sovereign paper into HQLA class. The first date when such an event can happen is March 15th when S&P revises Croatian credit rating (BBB+ with a positive outlook). We think it’s a bit too soon that Croatia joins the A- family in mid-March, but by summer this becomes more and more likely. Still, March 15th is definitely a date to put on your calendar.