As we enter the last week of February, it’s becoming clear that markets are bracing for stagflationary narrative as signs of economic contraction become apparent and higher inflation prints cause central banks to dial down interest rate cuts. How do we play this market and what can we expect going forward on Croatian domestic market – read in this brief research piece.

Since the beginning of the year price formation on core bonds market meant finding an equilibrium between two competing narratives – recession narrative (pushed by bond bulls) and inflation narrative (supported by bond bears). The bulls got several tailwinds on Friday as French PMIs reported a strong miss coming primarily from services PMI (HCOB French Services PMI at 44.5 versus 48.9 consensus estimate). The recession narrative was spoon fed with subsequent data publications reporting misses to the downside as well, such as Global PMI (S&P Global Composite PMI at 50.4 versus 53.2 consensus). We would like to remind our readers that oil price was coming down throughout Friday’s session, with WTI front month futures price sliding all the way down from 72.70 USD/bbl to 70.20 USD/bbl, mostly on supply outlook (“drill, baby, drill” might have had something to do with that). In early Monday’s session WTI basically continued to slide down with China growth concerns mounting, this time coming from prospects of USA introducing new tariffs on China, this time aimed at technology, energy and fees on commercial ships.

The elephant in the room were obviously the German snap elections which ended in line with consensus pools – SPD lost the chancellor’s office, but might return to form the government in some other form, such as junior partner to CDU/CSU. First of all, we hate to break it to you, but we think in this case voter turnout might be the real news – it was 83.5%, the highest turnout since German reunification in 1990s. Why is this important? Because huge turnout was the only way to keep extremist AfD out of the coalition talks. Still, AfD managed to secure the highest number of seats in Bundestag since the inception of the party. Here is the vote breakdown corresponding to the number of seats in Bundestag (630 in total, 616 to form the government): CDU/CSU 208, AfD 151, SPD 121, Greens 85, Die Linke 64. Notice that FDP dropped out of Bundestag failing to exceed 5% voter threshold. Notice as well that the most likely outcome of achieving 316 seats and getting a hold of ring of power is the coalition of CDU/CSU and SPD, since any other alternative (apart from AfD) fails to meet 316 threshold. Although Trump praised AfD’s success, we still remind our readers that German Bundestag is not so fragmented as French parliament, meaning that scenario that’s currently giving Mr. Macron headaches looks quite remote in the German case. What we will be looking in the coming weeks is how supranational EU defence spending plays out, since this is where bond prices might suffer.

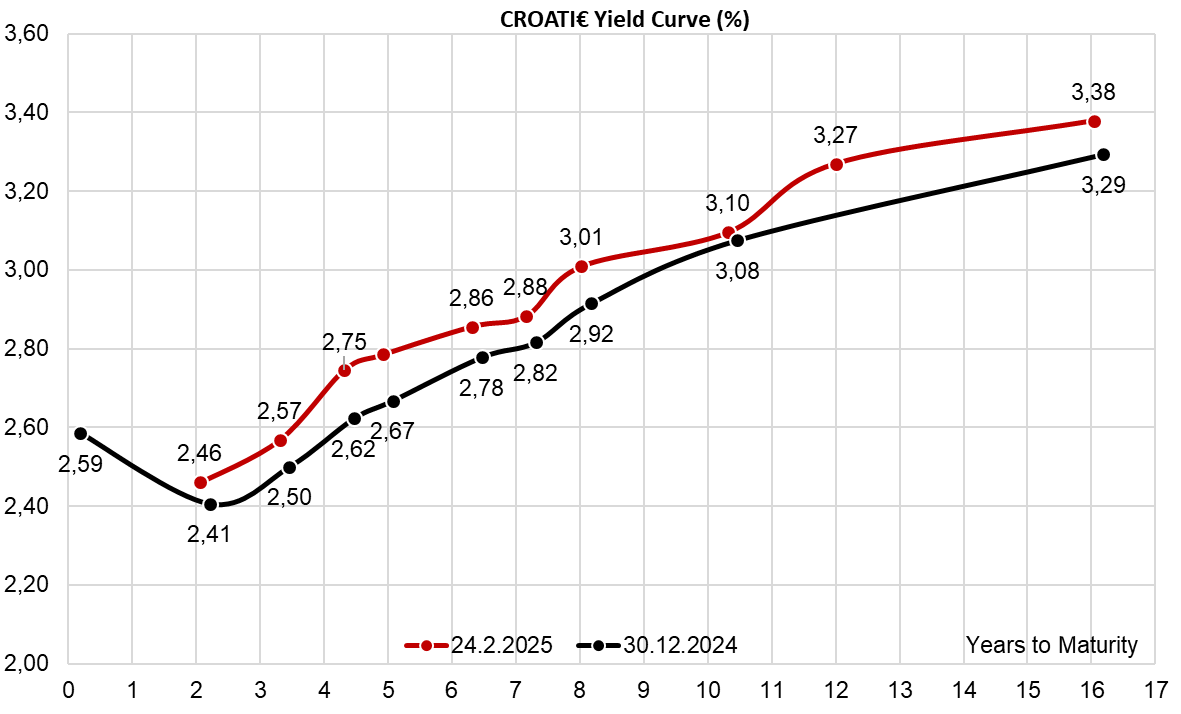

What’s going on in CEE-land? Take a look at popular Bloomberg’s GOVI function, depicting 10Y spreads within euro area. Notice that in the France column there are only four countries trading at a positive spread to France (this means their 10Y cash bond yield is above French equivalent): Greece (+8.3bps), Italy (+33.6bps), Lithuania (+13.9bps) and Slovakia (+9.9bps). If POLAND 3.625 01/16/2035€ would be added to the picture, it would report a +25bps spread to French equivalent. We commit to the outlook that by summer only Italy will report a positive spread to France, basing our view on French deficit/supply concerns, as well as Russia-Ukraine ceasefire sparking a rally on CEE assets (that might happen after April 20th). The only country excluded from the rally might be Romania due to rating cut fears in H2 2025. Speaking about new CROATI 3.25 02/11/2037€, it was placed at MS+90bps (99.745 rf, 3.27% YTM, MS+90bps) and in the recent rally managed to report spread tightening to mid-swap curve of about 3bps. This means that the supply overhang might have been eliminated and the bond will participate in future bond rallies. Don’t expect much of a bid to come from Croatia because PF’s still prefer 34s and 35s. Also, after tomorrow’s T-bill placement (we expect retail investors to get the paper at 2.60% and institutionals at roughly 2.25%), it’s quite likely the Ministry of Finance will step forward with planned local bond auctions, probably 2Y retail bond and something of longer duration (we like 2035 local maturity) for institutional investors. A lot of things going on at Crotian domestic market, so stay tuned.