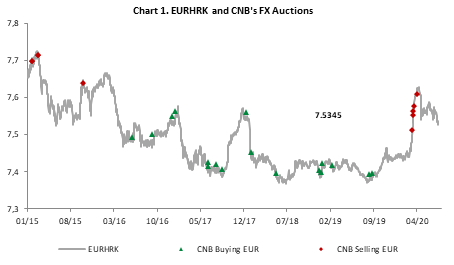

Last Friday, ECB announced that Croatia and Bulgaria are entering ERM II process. That means that at earliest in January 2023, Croatia and Bulgaria could be 20th and 21st country that adopted euro. Central exchange rate for HRK was set at 7.5345 which was in line with market rate at the time. In more details on ERM II and what are the consequences read in this brief article.

“The exchange Rate Mechanism (ERM II) was set up on 1 January 1999 as a successor to ERM to ensure that exchange rate fluctuations between the euro and other EU currencies do not disrupt economic stability within the single market, and to help non euro-area countries prepare themselves for participation in the euro area.” In other words, exchange rate of entering country can fluctuate by ± 15% of central exchange rate, i.e. 7.5343 for Croatian kuna and 1.95583 for Bulgarian lev.

As Croatia is one step closer to enter eurozone, it is worth our while to look at past performance of Croatian kuna. Well, in the last 20 years Croatian kuna was one of the most stable currencies in the region as Croatian central bank succeeded in keeping it in the range 7.0-7.7, meaning that Croatian kuna is in the allowed fluctuation range since the exception of single currency. Looking at the last several years, Croatian kuna has seen appreciation pressures due to large increase of tourism revenues which resulted in surplus of current account. Namely, after achieving its first CA surplus in 2014 of 0.2% of GDP, Croatia was posting CA surplus of 2.0-3.0% of GDP which was also supported by Croatia entering EU which increased net exports of service sectors. However, in 2020 Croatia will most likely witness CA deficit due to lower tourism revenues although one should keep an eye on imports as tourism in Croatia drives larger imports of both goods and services.

Appreciation pressures were mostly curbed by CNB which draw the line at 7.40. Namely, since September 2015 when CNB had to sell single currency due to CHF crisis, CNB bought EUR 4.7bn, stabilizing exchange rate and increasing its foreign reserves which in the beginning of 2020 stood above 30% of GDP. However, the trend reversed with corona crisis as CNB had to defend Croatian kuna from over depreciation, so it maintained 5 FX auctions in which CNB sold some EUR 2.2bn. At the moment market EURHRK stands at 7.530-7.535 which is only 1.5% above the level seen before corona crisis.

Worth mentioning is that exchange rate for entering eurozone could still be changed in case of larger moves and exact rate will be known 6 months before adopting the euro. Looking at peers that were last entering eurozone, most of them adopted euro at the same rate at which they entered ERM II except Slovakia which currency was revalued by 17.65%. Namely, Slovak koruna began participating in ERM II on November 2005 with initial central rate of 38.455 for euro but due to strong macroeconomic developments did appreciate strongly, trading at the lower bound of targeted ±15% and at the request of Slovak authorities central rate was changed to 30.122 in May 2008 (new range is then targeted according to new central rate). With new central rate Slovakia did adopt euro in January 2009.

Looking at the markets one could not say that Croatia was affirmed entering ERM II as Croatian Eurobonds were already pricing this development. Croatian newest and longest EUR denominated Eurobond, CROATI 2031 is standing at 102.00 (bid, 1.30% YTM) for the last two weeks and seems like fixed income volatility subsided due to summer vacations and will most likely stay that way for the next couple of weeks. Nevertheless, almost every summer we have witnessed some events that woke up markets and with corona virus and Trump-China challenges being here and US presidential elections being close, we do not need any new events to keep us on our feet.

Source: Bloomberg, CNB, InterCapital