In their last monetary policy meeting, board of Czech central bank decided to increase its reference rate (2-week repo rate) by 25bps to 2.25% which surprised markets. Although it seems rate hike was one-off, CNB confirmed its image as one of the most hawkish central banks in the world. In this short article read about their rationale, consequences on markets and what to expect further.

In the end of last year and the beginning of 2020 it seemed like global economy could turn a corner and start accelerating again, but coronavirus could be a major headwind as Hong Kong’s leading epidemiologist told that epidemic could spread to two thirds of the world’s population if it cannot be controlled while there are some news that that there were patients that didn’t even visit China. Epidemic threat was already acknowledged by both ECB and FED which are both looking neutral or slightly dovish. Banks in the CEE region are following major ones as they hope elevated inflation will be only transitory and do not want to be an obstacle to the above average growth. Nevertheless, there is one central bank that is willing to react on inflation pressures and is not scared to react again in the opposite way in case situation dramatically changes.

As we said in the beginning, CNB decided to lift is repo rate to 2.25% as a result of rising inflation. The decision wasn’t unanimous as 4 members voted for hike versus 3 members being against. Now let’s see what the banks’ rationale was to lift rates. In December 2019 inflation jumped to 7 year high (3.2% YoY) and board expects it to increase further in 2020 before coming towards their target band of 2.0% ± 1.0% in the second half of the current year.Headline inflation will peak in April at 3.7% YoY according to the CNB due to base effect in food prices and effects of indirect tax changes. On the other hand, owing to appreciation of the koruna in the beginning of 2020 CNB expects core import prices to have modest anti-inflationary effect in the first half of 2020 but due to stable koruna afterwards that effect will turn positive also driven by renewed growth in foreign prices. CNB also expects euro area’s GDP to gradually accelerate during this year which will be reflected in gradual increase in foreign producer price inflation. Furthermore, after several years of fiscal surpluses, in 2021 government will post negative result due to minimum wage hikes and its intention to boost further household consumption. Just to put things into perspective, wages are expected to rise above 5.0% YoY in both 2020 and 2021. All in all, CNB’s board assessed the balance of risks to the inflation forecasts as being broadly balanced stating “consistent with the forecast is a rise in domestic market interest rates initially, followed by a decline in the second half of this year” meaning that they plan to cut rates back in the second part of the year.

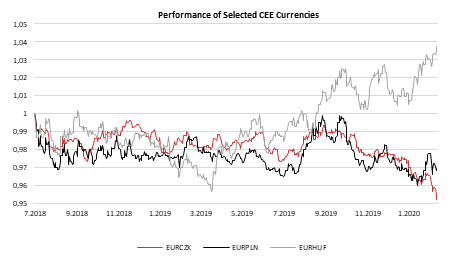

All the analysts polled by Bloomberg expected rates to stay unchanged as most of the investors, resulting in significant appreciation of Czech koruna against euro immediately after the announcement and reaching 7-year low of 24.88. However, after the statement was published it depreciated back above 25.0 due to global risk-off sentiment that afternoon but also due to the fact that hike was one-off rather than start of another hiking cycle that we witnessed in past years.

Day after the meeting, CNB published their quarterly inflation forecast which was basis for their decision to lift rates. In their new inflation forecast, CNB admits that inflation outlook is higher now due to stronger domestic price pressures, faster growth in administered prices and new tax changes in 2021. However, the most interesting part of the new forecast is their EURCZK projection. After they forecasted EURCZK to reach 24.7 in 2020 (inflation report II/2019 published in May 2019), now they expect it to reach 25.3 in the end of Q1 2020 and to decrease only modestly to 25.1 towards the end of the year. Unfortunately, they didn’t provide any argument why CZK should depreciate from today’s levels as they didn’t put more details on their forecasts. One of the main drivers of koruna’s depreciation could be reborn risk-off sentiment and at the moment that could be driven by corona virus but that wasn’t under much scrutiny by the central bank.

To sum it all, CNB confirmed its status as one of the most hawkish central banks lifting its reference rate to 2.25%, now being only 25bps below NBR’s reference rate that was fighting with much higher inflation. However, CNB is prone to cut rates in case inflation drops significantly in the following months or in case economy decelerates due to any foreign or domestic reasons. Czech economy is still rising at above average rates while it runs balanced budgets and its current account seems to be under control. As CZK is included in all major EM indices, any risk-off event should drive CZK lower due to non-selective sell of risky assets but even in case of some disruption on global markets which would drive further drop of yields, CZK could be a winner due to solid carry so we do not expect any significant depreciation in the following period.

Source: Bloomberg, InterCapital