Currently, governments are doing everything they can to contain the spread of Covid-19, as well as the economic fallout of pandemics. FOMC slashed short term interest rates by 50bps in one cut, other central banks are getting ready to intervene as well, while China, US and other fiscal powers are ready to apply deficit spending to secure GDP growth from getting into red. What are fixed income investors doing? Find out in this brief research piece.

If you are working a s a fixed income portfolio manager, chances are that last few days were quite busy. First of all, last week’s primary market left many a bit tight on cash because with the yield curve historically as low as it gets, one of the few remaining ways to achieve total return is to go long on duration. And soon after the allocations started coming in your mailbox, equity markets in the US dipped, Croatian eurobond risk premia widened and many were left in doubt whether extending duration was the right thing to do.

Data about the recent Croatian primary markets gives plenty of the information if you read it the right way. First of all, pension funds posted a strong bid (as always) and bought some 7.43b HRK worth of new bonds. The average modified duration of the paper bought by the pension funds was 15.44 years (a more detailed list breaks down into 550m CROATE 0.25 03/03/2025, 2.32b HRK CROATE 1.00 11/27/2034 and 4.56b HRK of CROATE 1.25 03/03/2040). Most of this paper went on obligatory pension funds’ ledger, and since there was 75.9b HRK of government debt already on the books, we can estimate that the modified duration of an average pension fund was extended by 1.5 years. This comes just three months after the pension funds extended the duration by 0.76 years on average with double-tranche, meaning that it’s quite likely that right now they’re just where they want to be in terms of duration.

Here’s one more thing you need to know about the pension funds – they seem to be betting on bull flattening on ultra long part of the local curve. Last November, the B funds („big boys“) bought a total of 3.6b HRK of CROATE 1.00 11/27/2034 (85.7% of the total amount allocated to the pension funds) and most of this is out of „amortized cost“ valuation – 2.53b HRK is distributed in FVOCI/FVPL (according to IFRS 9), while only the remaining 1.07b HRK went into AC (amortized cost). Pension funds feel both the pain and the gain of yield curve shifting, debunking the old myth about them being pure „hold to collect“, coupon-clipping investors. Applying mark-to-market valuation to ultra-long bonds can give a lot of oomph to the overall portfolio, especially if the ultra long segment of the curve appears to be underpriced.

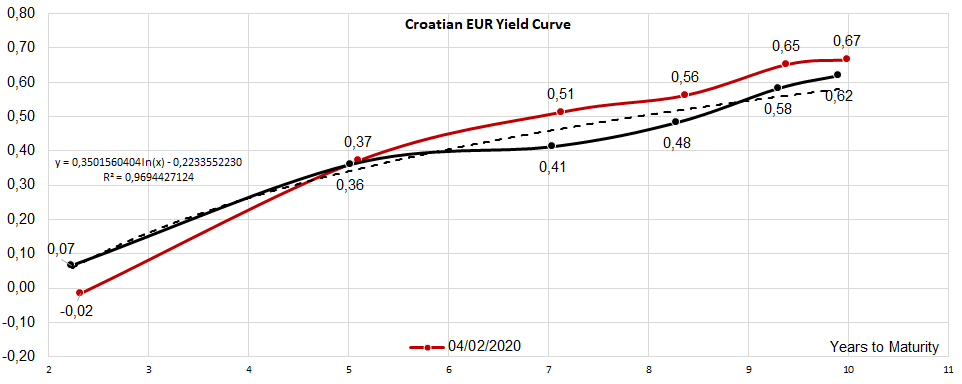

Is it really underpriced? A glance at the chart above the paragraph reveals the log function we used to extrapolate yields on CROATE 1.00 11/27/34 and CROATE 1.25 03/03/2040 if these were international bonds instead of local paper. The equation has a pretty solid explanatory power on the eurobond curve (R-squared in size of 97%; note that x of the equation is modified duration, while y is the plain vanilla YTM) and computes yields to maturity of 0.69% for CROATE 1.00 11/27/34 (modified duration of 13.62 years) and 0.78% for CROATE 1.25 03/03/2040 (modified duration of 17.62 years). Of course, this is just the mathematical model and real life has a tendency to be intransigent to valuations. The two ultra long bonds are local and should be discounted by a certain amount to reflect a relative lack of liquidity compared to eurobonds. If you’ve been around the front offices lately, you’re probably feeling a sense of revolt because of this inference – “What lack of liquidity? I had to sell a couple of millions of CROATIs in the Street a couple of days ago and couldn’t find no bids at all” (meaning that CROATI is as illiquid as CROATE).

Well that’s true, but last couple of days weren’t really what you would call ordinary market conditions. Once the dust settles, eurobonds are generally more liquid investment vehicles and it shouldn’t be surprising that they trade more expensive in relation to local bonds. It’s not really plausible to expect that you’ll be able to sell CROATEs as if they were valued straight on the CROATI curve – unless someone becomes really desperate to invest cash. Last week banks took only 320m HRK of CROATE 1.00 11/27/2034 and 360m HRK of CROATE 1.25 03/03/2040, meaning that the supply might be tight, especially around summer when those good old big coupons get paid. Nevertheless, in the coming days the supply of the ultra long paper might be considerable since speculators betting on swift rise of the price on the secondary market weren’t offered a way out and if the prices dip, they might get scared and dump it on the market at whatever price the dealer pays. The trouble is that the dealers don’t have much legroom for such a long paper, while the big money (pension funds and UCITSs) is over invested as it is. Nevertheless, if the inflation remains a relic of the ancient times and markets get hooked on monetary and fiscal stimulus, it’s quite likely that the YTMs on these paper will eventually start emigrating to the South.