After China announced new set of retaliation measures and Powell did not deliver what market/Trump expected, president of the USA tweeted that they will be increasing set of tariffs that are to be implemented soon while stating that FED did nothing, reflecting his stance that FED has to cut rates by 100bps and to include new set of QE. Although markets are widely getting used to Trump’s rhetoric, equity markets fell sharply while safe havens soared, and yield curves inverted.

A month ago, after FOMC’s meeting it was stated that labor market remains strong and that economic activity has been rising at a moderate rate. Nevertheless, they decided to cut reference rate by 25bps and to conclude the reduction of its assets, as stated, two months earlier than previously indicated with two voting members being against cutting rates. In its press conference after the meeting, Mr. Powell said that rate cut does not represent new easing cycle but rather it was mid-cycle adjustment to policy that should provide support in his mandate of full employment and stable prices. Only two days after, Trump announced further tariffs over Chinese goods which pushed investors into bonds, resulting in increased expectations of September cut. Two weeks later, all eyes were on Jay Powell at Jackson Hole who repeated his words from the July’s meeting, meaning that he did not announce any monetary stimulus beside already known to markets.

Looking at the macroeconomic data, one could obviously say that US economy is decelerating but still rising at a solid pace, while unemployment being at the multi-decade lows. Despite it fell somewhat since its peak, inflation accelerated in July with PCE being at 1.6% YoY. Nevertheless, FED decided to cut rates and is now expected to cut them twice more in 2019, with first test coming already in couple of weeks.

On the other side of the world, Chinese officials stated that they will implement tariffs on USD 75bn of US goods which was retaliated by further measures by Trump and USTR (United States of Trade Representative). In the beginning of the week Trump said that he is ready to make a deal with China as soon as China proposes a fair one which we assume is not going to happen any time soon.

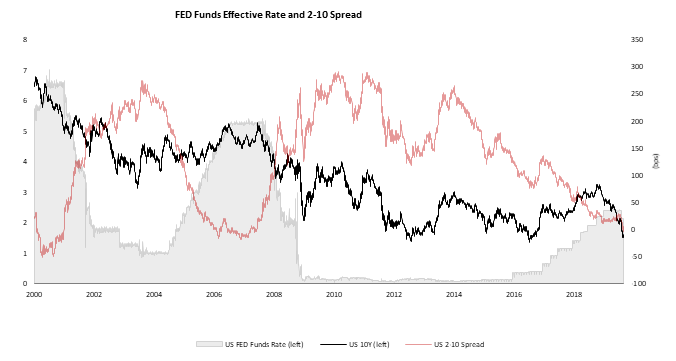

Knowing only these two stories, you shouldn’t be surprised when you look at yield curves. Namely, US 10Y being below 1.50% with 2-10s being inverted for a few days now and bund being stuck at negative 70bps. With the recent fear of recession and investors’ fears that rates could be cut further one should have a hard time finding a guy who would bet on yields going up.

Oil seems to trade sideways and wages did rise at above average pace; however inflation does not look like it could jump instantaneously. Nevertheless, one should think about supply shocks due to trade wars and world becoming less and less globalized. Environment could change very fast, with only few factors to surprise, central bankers could once again become scared of rising inflation which would catch many investors on the wrong foot as it seems like all the whole world is in hunt for yield and duration. Mr. Powell changed its stance in just one-month period in October-November 2018 period when he went from “long way from neutral” to “close to neutral” and then to cutting rates. Is the opposite impossible scenario? „He’s strong, he’s committed, he’s smart “. These were Trumps’ words back in November 2017 when he decided to pick Mr. Jerome Powell to be the next Fed’s governor. Now, Mr. Powell seems to be public enemy (Trump’s) number 1, or maybe two, after Mr. Xi.

Source: Bloomberg, InterCapital